International Flavors & Fragrances Inc.

CEO : Mr. Franklin K. Clyburn Jr.

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

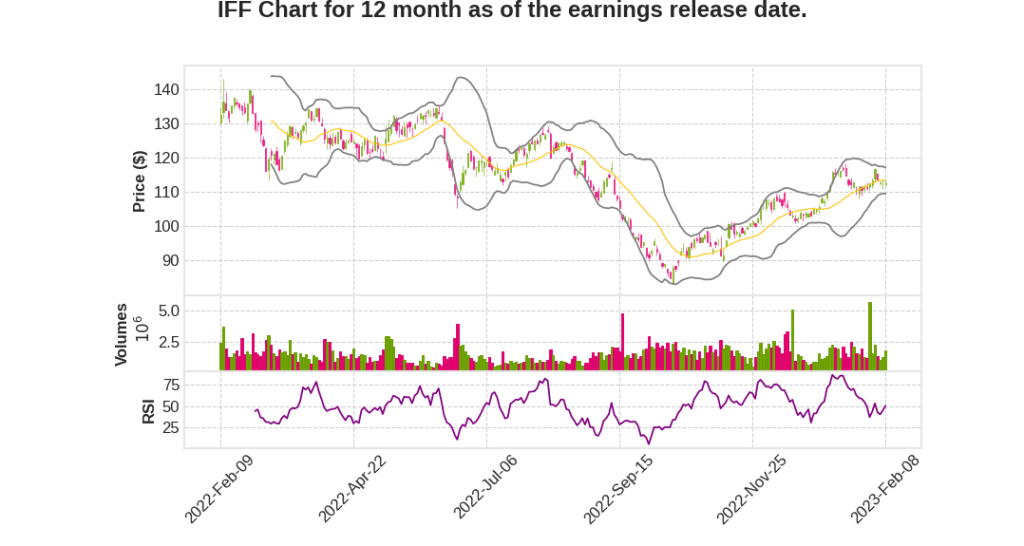

| 2022 Q4 | -6.2% YoY | -35.8% | -97.1% | 2023-02-09 |

Frank Clyburn says,

Strategic Transformation

- Unveiled the next phase of strategic transformation in December 2022

- Focus on jump-starting even stronger growth, cost reduction, and productivity initiatives

- Targeting sales growth of 4% to 6% and adjusted operating EBITDA growth of 8% to 10% on a comparable currency-neutral basis over 2024, 2025 and 2026

Financial Performance

- Delivered $12.4 billion in sales, a 9% growth over the previous year

- Recovered more than $1 billion in revenue through strategic price increases in 2022

- Delivered nearly $150 million in productivity benefits in 2022, driving profitability in the challenging operating environment

Business Segments

- Nourish achieved currency-neutral sales growth of 11% compared to the previous year, led by double-digit growth in food designs and ingredients

- Health and Bioscience delivered 4% currency-neutral sales growth in 2022, primarily driven by strong performance across all segments, particularly culture and food enzymes and animal nutrition

- Scent delivered strong 8% currency-neutral growth, led by double-digit growth in Fine Fragrance and strong single-digit increase in Ingredients and Consumer segments

Portfolio Optimization

- Successfully completed the sale of Microbial Control business and announced the sale of Savory Solutions business

- Transactions will contribute more than $2 billion in gross proceeds to strengthen the capital structure

Board Changes

- Plans to reduce the size of the board from 14 to a target of no more than 10 IFF directors and one icon capital designee director by the 2023 Annual Shareholder Meeting

- Composition of the Board prioritizing the inclusion of senior executives with relevant skills, leadership experience, and business expertise

Glenn Richter says,

Q4 2022 Financial Highlights

- IFF generated $2.8 billion in sales revenue, up 4% YoY on a currency-neutral basis

- Adjusted operating EBITDA for Q4 was $441 million, down 5% YoY on a currency-neutral basis

- Q4 EPS ex-amortization was 12% lower due to lower adjusted operating profit

- Currency headwinds had a significant impact on sales and adjusted operating EBITDA

Segment Performance

- Nourish, Scent, and Pharma Solutions saw growth in the quarter, while Health and Bioscience experienced a decline

- Comparable currency-neutral adjusted operating EBITDA decreased by 11% across Nourish and Health & Bioscience due to lower volumes

- Scent division delivered 6% YoY sales growth and 25% growth in comparable currency-neutral adjusted operating EBITDA due to a favorable product mix, pricing, and productivity gains

Free Cash Flow and Deleveraging Targets

- Free cash flow for the full year was a negative $159 million due to growth in working capital and costs related to integration and transaction-related items

- Initiated actions across the business and supply chain teams to rapidly reduce inventories to drive cash flow

- Committed to achieving deleveraging target of 3x net debt-to-credit adjusted EBITDA by 2024

2023 Outlook

- Expect revenue to be approximately $12.5 billion and adjusted operating EBITDA to be approximately $2.34 billion, representing comparable currency-neutral sales growth of approximately 6% and comparable currency-neutral adjusted operating EBITDA flat versus prior year

- Expect negative manufacturing absorption to impact adjusted EBITDA growth by several percentage points expressed in YoY growth terms

- Plan to drive significant productivity by accelerating previous launch programs and undertake additional actions to cut costs across the organization

Key Areas of Focus for 2023

- Accelerating sales growth through sharpening sales execution discipline, pricing actions, targeted growth investments, and increasing focus on revenue synergies

- Focusing on enhancing customer service levels and supply chain efficiencies through more granular customer service and inventory goals and redesigned sales, inventory, and operations planning process

- Accelerating expansion of productivity efforts, cost savings, and debt reduction

Q & A sessions,

Challenging Q1 expected due to volume decline and inflation

- Q4 2022 saw high-single-digit volume decline, accelerating in December

- Q1 2023 expected to have similar challenging trends as Q4 2022

- First half of 2023 to face challenges from inflation and other pressures

- Overall, 2023 expected to have flattish volume year-over-year, but with 6% overall sales growth

- Focus on reducing inventory to improve cash flow will impact EBITDA profit growth

- Accelerating productivity program and S&OP process to control cost

Portfolio performance and changes

- Scent business comparable to peers with some instances of gaining share

- Health and Biosciences seeing good performance in food and culture enzymes, but challenges in health segment due to shift in market demand and destocking

- Ingredients business facing volume challenges, with price trade-offs made to preserve margin and some share loss in Protein Solutions

- Portfolio overall seen as the right one, with a focus on executing against it

- 20% of portfolio being evaluated from an ROIC lens, but Protein Solutions and Food Designs ex Savory seen as important parts of the portfolio

Customer trends

- Seeing some trade down with regards to quantities and private label, but not significant trade-offs overall

- Customers expecting continued challenging first half of the year from a volume perspective and increasing prices