The Interpublic Group of Companies, Inc.

CEO : Mr. Philippe Krakowsky

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

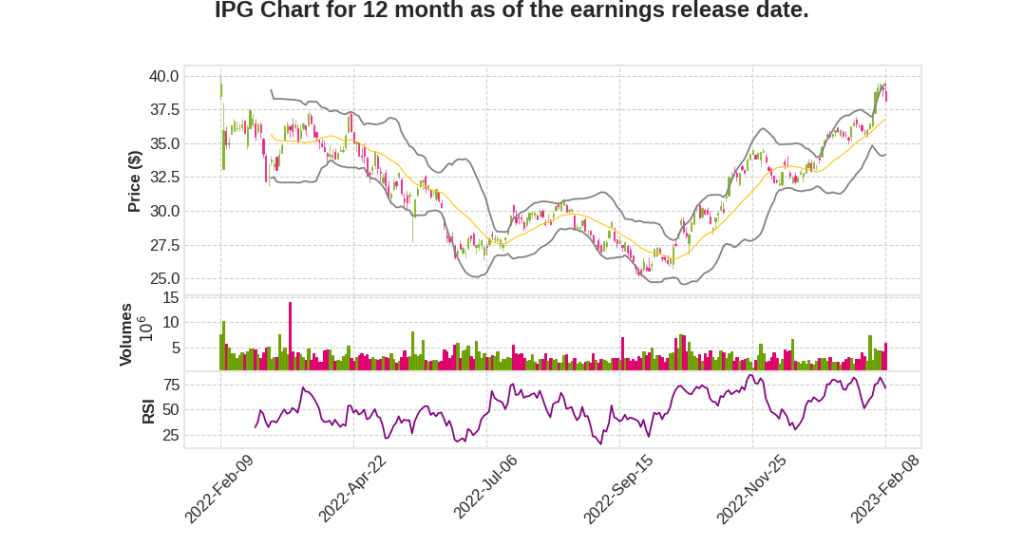

| 2022 Q4 | 1.8% YoY | 19.5% | -15.4% | 2023-02-09 |

Ellen Johnson says,

Organic Growth and Financial Performance

- Fourth quarter net revenue was essentially flat from a year ago, with organic growth of 3.8%.

- Adjusted EBITDA in the quarter before a net restructuring charge was $568.4 million and margin on net revenue was 22.3%.

- Restructuring charge in the quarter was $101.7 million, resulting in $20 million of permanent expect savings.

- Diluted earnings per share in the quarter was $0.76 as reported and $1.02 as adjusted.

- Adjusted diluted EPS was $2.75 for the full year.

Real Estate Portfolio Optimization

- IPG reduced the occupied real estate footprint by approximately 500,000 square feet or 6.7%.

- There was no severance involved in these most recent actions.

- IPG does not anticipate additional restructuring charges.

Dividend and Share Repurchase Program

- IPG Board increased a quarterly dividend to $0.31 and authorized another $350 million repurchase program, in addition to the $80 million remaining on our prior authorization.

- IPG repurchased 3.2 million shares in the fourth quarter, bringing our full year repurchases to $10.3 million, returning $320 million to our shareholders in 2022.

Revenue Growth by Region

- The U.S., which was 63% of our fourth quarter net revenue grew 2.4% organically on top of 12.1% in last year’s fourth quarter.

- International markets were 37% of our net revenue in the quarter and increased organically.

- The U.K., organic growth in the quarter was 9.4% led by notably strong performance in media, experiential and at MullenLowe.

- Continental Europe grew 5.7% organically. We were led by very strong growth in Spain, while Germany and France were relatively flat year-over-year.

Segment Net Revenue Performance

- Our Media, Data & Engagement Solutions segment grew 5% organically on top of 11.9% in the fourth quarter of 2021.

- Our growth in the quarter was led by a strong increase in IPG Health, which grew in the high single digits.

- At our Specialized Communications & Experiential Solutions segment, organic growth was 3.5%, which compounds 15.2% in last year’s fourth quarter.

Philippe Krakowsky says,

IPG Q4 2022 Earnings Call Summary

- IPG reported strong performance in the full year with 7% organic growth and an adjusted EBITDA margin of 16.6%, which is a consolidation of 260 basis points of margin improvement over the last three years.

- Organic net revenue growth in Q4 was 3.8%, with growth continuing in every world region, despite global macroeconomic and geopolitical crosswinds.

- Second telco, which is IPG’s second-largest client sector, began to show the impact of sector-specific issues, which will continue to present headwinds for IPG for at least the first half of 2023.

- The loss of a large food and beverage client in late 2021 will finish running off at the end of Q1 2022.

- IPG’s adjusted EBITDA was $568.4 million, with an adjusted EBITDA margin of 22.3%, bringing full-year adjusted EBITDA to $1.57 billion and margin on net revenue of 16.6%.

- IPG closed on the acquisition of RafterOne, a leading e-commerce implementation partner.

- IPG returned capital to shareholders in the amount of $777 million between dividends and share repurchases, and its Board raised IPG’s quarterly dividend by 7% to $0.31 per share.

- IPG expects organic net revenue growth for 2023 of 2% to 4% on top of industry-leading multiyear comparators and further expansion of its adjusted EBITDA margins to 16.7% for the full year.

- IPG’s priorities for the year remain consistent, focusing on building IPG’s strategic differentiation and combining client-focused offerings with operational excellence.

Q & A sessions,

Financial Performance

- Organically added $1.2 billion of revenue to the business over the past 3 years

- Increased adjusted EBITDA by over $360 million since the start of 2020

- Expect to deliver growth in 2023 of 2% to 4%

- Foresee adjusted EBITDA margin expansion to 16.7%

Specialized Assets

- Expertise in first-party data management, performance media, and accountable marketing solutions

- Media, data, and health care offerings are strong contributors to the company’s performance

- Specialized assets have evolved their offerings to combine marketing services with emerging communication channels and technology

Strategic Investments

- Recent acquisition of RafterOne, a team specialized in architecting and implementing scaled sales force solutions

- Enterprise marketing suites like Salesforce and Adobe are the foundation of many brands’ marketing technology stacks

- IPG can serve as a bridge between those brands, their consumers, and these platforms, strengthening every touch point in the customer journey

Awards and Recognitions

- IPG Health named the large Healthcare Network of the Year at the 2022 M&M awards

- FCB named as 1 of the 10 most innovative advertising agencies of 2022 by Fast Company

- McCann named Network of the Year to 2022 EpicaAwards for the fifth time at 6 years

- IPG included on the Bloomberg Gender Equality Index for the fourth consecutive year and recognized for the first time as a top-rated ESG performer by Sustainalytics

Capital Allocation

- Continued commitment to capital returns

- Focusing on opportunities that are consistent with strategic growth areas, primarily commerce and Performance Media, business transformation, and consultancy