Illinois Tool Works Inc.

CEO : Mr. E. Scott Santi

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

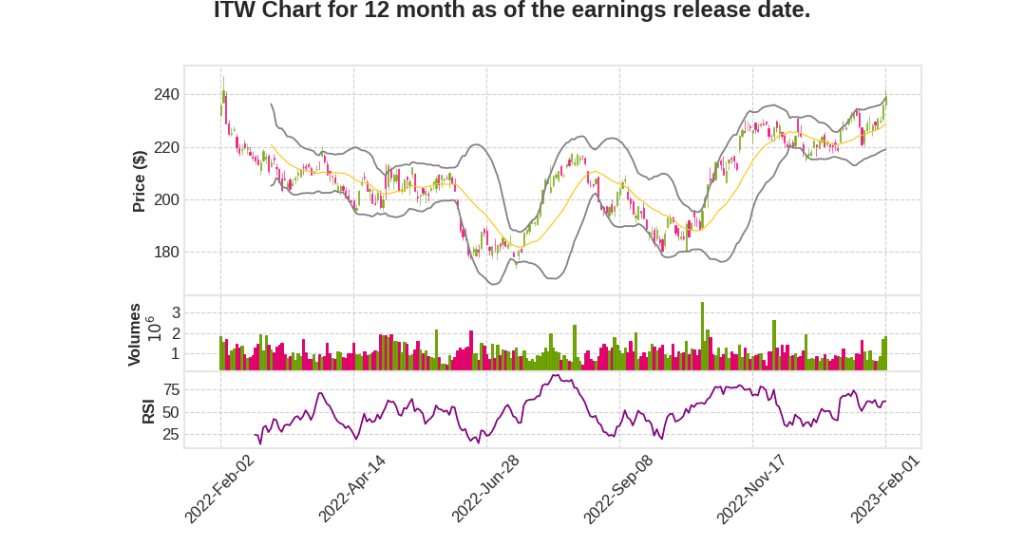

| 2022 Q4 | 7.9% YoY | 18.2% | 52.6% | 2023-02-02 |

Michael Larsen says,

Revenue and Growth

- Revenue grew 8% with organic growth of 12%, and organic growth was 14% on an equal day’s basis.

- Every major region grew in double digits with North America up 13%, Europe up 11%, and China up 10%.

- Foreign currency translation headwind reduced revenue by 5%, and the net impact from acquisitions and divestitures was plus 1%.

- Automotive OEM led the way with an organic growth rate of 20%, and ITW Automotive OEM revenues were up 12% on a full-year basis.

- Food Equipment delivered another very strong quarter with organic growth of 17%, and it expects to grow 8% to 10% in 2023.

Margin and EPS

- Operating income grew 18%, with strong incremental margin performance of 52%, and operating margin improved 210 basis points to 24.8%.

- GAAP EPS grew 53% to $2.95, and excluding divestiture gains and currency headwinds, EPS increased 21% to $2.34.

- Operating margin in our base businesses, excluding MTS, was 25.2%.

- After-tax return on invested capital should improve to 30% plus, and GAAP EPS is expected to be in the range of $9.40 to $9.80 for 2023.

Segments

- Test & Measurement and Electronics revenue grew 15%, with organic growth of 10%, and it expects organic growth projections of 2% to 4% in 2023 for this segment.

- Welding delivered strong organic growth of 15% in Q4, with equipment up 17%, and we expect revenue to grow 5% to 7% in 2023.

- Polymers & Fluids delivered organic growth of 11%, with the automotive aftermarket business up 13%, and we expect Polymers & Fluids to grow 3% to 5% in 2023.

- Overall demand in Construction slowed to an organic growth rate of plus 4%, and we are projecting further slowing in 2023 and a negative organic growth rate of minus 5% to minus 3%.

- Specialty organic growth was 3% as supply chain shortages eased up in Q4, and we expect Specialty organic revenue of negative 1% to plus 1% in 2023.

Michael Larsen says,

Margin Improvement for ITW expected in 2023

- Volume leverage expected to contribute positively to margins year-over-year, ranging from 50 to 100 basis points

- Enterprise initiatives expected to contribute 100 basis points to margins

- Price/cost expected to add approximately 100 basis points to margins

- Wages and inflation on wages expected to be a headwind of less than 100 basis points, but running higher at 150 to 200 basis points

- Overall, ITW is expecting a margin improvement of 100 basis points or more on a year-over-year basis

Q & A sessions,

Semi slowdown expected to continue into 2023

- Coming off a strong three-year growth cycle with growth in high teens, slowdown in order intake seen in Q4

- Semi is the incremental 5% this quarter, but the other 75% of the portfolio continues to perform well

- Guidance shows mid- to high single-digit growth in Automotive OEM, Food Equipment, Welding, mid-single digit in Polymers & Fluids, a little lower in Test & Measurement, Construction projected to be down, and Specialty flat.

Good momentum and well-positioned going into next year

- Sales per day went up 4% from Q3 to Q4, more than offsetting the slowdown seen in 25% of the portfolio

- 12% organic growth in Q4 and for the full year

Positive outlook on price/cost

- Slightly positive on margins on price/cost in Q4, driven by both price and cost

- First time in eight quarters that margins on price/cost turned positive, encouraging for 2023