Invesco Ltd.

CEO : Mr. Martin L. Flanagan CFA, CPA

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

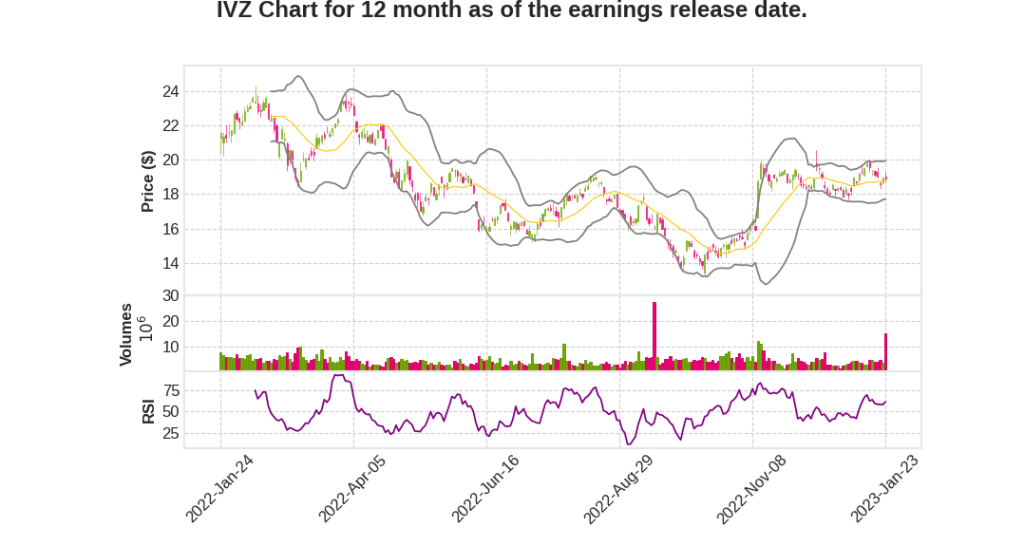

| 2022 Q4 | -18.1% YoY | -38.4% | -65.8% | 2023-01-24 |

Allison Dukes says,

Investment Performance

- 61% and 63% of actively managed funds in the top half of peers or beating benchmark on a three-year and a five-year basis, up from 57% and 62% in the third quarter

- Strength in fixed income and balanced strategies where there is strong client demand

- Short-term performance is trending positively in several U.S. and global equity strategies

Assets Under Management (AUM)

- Ended 2022 with $1.41 trillion in AUM, an increase of $86 billion from the end of the third quarter

- Total net inflows were $25 billion, inclusive of $30 billion into money market products

- Passive capabilities returned to net inflows this quarter at $7.3 billion, while net outflows were $10.5 billion in active strategies

ETF Capabilities

- Net long-term inflows into our ETF capabilities were $28 billion, equivalent to an 11% organic growth rate and we gained market share

- Invesco captured 3.8% of industry net inflows, higher than our 3.1% share of total industry assets under management

- Net inflows were inclusive of $2.4 billion in maturing BulletShares ETFs, which are included in our gross redemptions

Fixed Income Capabilities

- Sustained organic growth in the fourth quarter with $800 million in net inflows

- Experienced heightened redemptions on the Chinese fixed income products as well as a $2.4 billion outflow related to BulletShares ETFs that reached their planned maturity last month

- Have a diverse platform of fixed income offerings with strong investment performance across the full range of risk appetites and durations that are positioned to capture future growth

Institutional Channel

- Net inflows achieved $13 billion or a 4% organic growth rate in calendar year 2022

- 13 straight quarters of net inflows

- Won new mandates, notably in fixed income and active equity in the fourth quarter

Adjusted Operating Income

- $339 million in the fourth quarter

- Adjusted operating margin was 30.6% as compared to 33.3% in the third quarter and 42% in the fourth quarter of 2021

- Historically, compensation to net revenue ratio has been in the 38% to 42% range on an annual basis

Marty Flanagan says,

Market Performance and Industry Challenges

- The year 2022 saw significant headwinds and volatility in global markets with no immunity for any geography or asset class.

- Market showed signs of stabilization in the fourth quarter, but uncertainty continued to weigh on investor sentiment and impacted client demand.

- Rising COVID infections in China and tax loss harvesting in developed economies made for a challenging organic growth dynamic in the industry.

Key Capabilities and Organic Growth

- Despite industry challenges, key capabilities in areas with high client demand continued to deliver organic growth, offsetting net outflows and capabilities that experienced redemption pressure.

- Key capabilities that delivered net long-term inflows for the year included ETFs, fixed income, Greater China, and the institutional channel, which demonstrates the strength and resilience of the diversified platform in the face of extraordinary market headwinds.

- Invesco separated itself from most industry peers by generating net inflows in key capability areas led by strong growth in ETFs in the quarter.

- Fixed income capabilities in the institutional channel have been pillars of organic growth for several years now.

- Our business in Greater China performed exceptionally well during 2022, building on our leading position in the world’s fastest-growing market class asset managers.

Net Long-term Outflows and Expense Management

- The firm experienced net long-term outflows this quarter of $3.2 billion, with active global equity remaining the biggest drag on organic growth.

- The firm continues to be disciplined in its approach to expenses, tightly managing discretionary spending and limiting higher roles that are critical to support the organization and future growth.

Strong Balance Sheet and Capital Resource Allocation

- The firm entered 2023 with a strong balance sheet, giving it the needed flexibility to operate strategically in this environment.

- Long-term debt remains at low levels, and cash balance increased to over $1.2 billion at year-end.

- The firm remains focused on identifying areas of expense improvement that will deliver positive operating leverage as the market recovers and organic growth resumes.

- The firm is being extremely thoughtful about capital resource allocation in this environment and will be well-positioned to maintain investments in areas that deliver future growth.

Future Outlook

- The firm is partnering with its clients to meet the most pressing needs in this dynamic environment.

- The firm remains prepared to meet challenges that will arise in 2023 and is well-positioned for future growth.

Q & A sessions,

Revenue Dynamics:

- Markets have been better in January, but the mix shift in the portfolio will impact revenue dynamics.

- Encouraging signs in ETF capabilities and fixed income, but with different revenue levels than prior quarters.

Expenses:

- Expected $20-25 million in usual seasonality of comp expense in Q1.

- No recurrence expected in performance fees as seen in Q4.

- Higher VAT taxes and FX revaluation impacted G&A in Q4.

- Investment and focus on foundational projects in technology and professional services.

- Expect G&A to be somewhat consistent with last year with reopening of travel and foundational investments.

Asset Classes:

- Outflows in liquid alternatives such as commodity and currency ETFs.

- Negative $200 million in real estate outflows, but have a fair amount of dry powder in real estate.

- Bullish on private market asset classes with strong funds and client demand, but credit appetite may be impacted by recession fears.

Net Revenue and Average Fee Rate:

- Expected downward pressure on average fee rate due to demand for ETF and passive strategies, and mix shift in developing markets and global equities.

- More focused on managing operating income and margin than net revenue yield or average fee rate.

Transformational Projects and Expenses:

- Alpha NextGen is the most significant investment that will take several years to see the payback on.

- Compensation is the biggest driver of expenses, with market-related variability.

- Managing discretionary expenses and reallocating towards foundational investments for operating leverage in the future.