Jack Henry & Associates, Inc.

CEO : Mr. David B. Foss

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

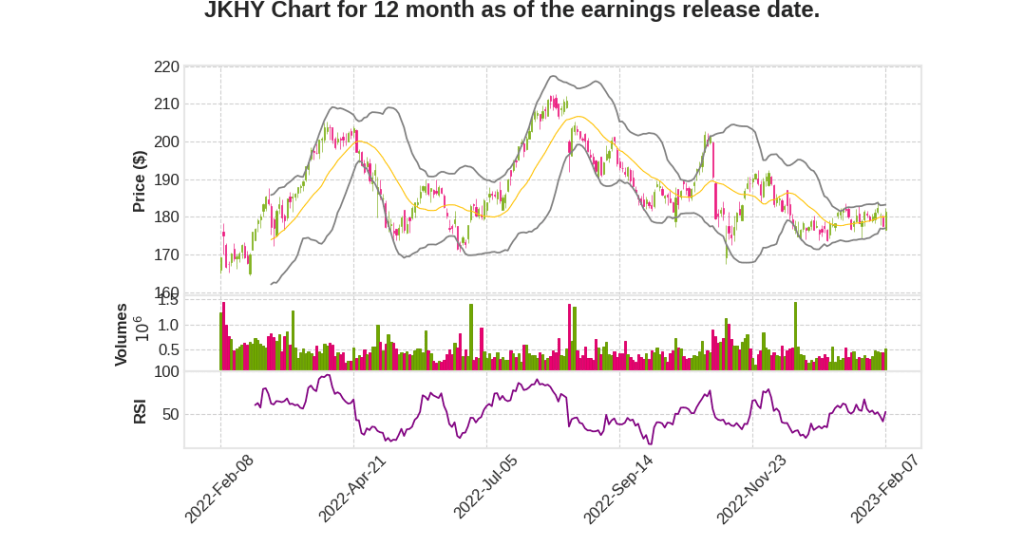

| 2023 Q2 | 2.3% YoY | -14.6% | -15.5% | 2023-02-08 |

David Foss says,

Revenue and Guidance

- Total revenue increased 2% for Q2 of fiscal 2023 and 6% on a non-GAAP basis.

- Deconversion fees are down $20 million year-to-date, impacting GAAP revenue and operating income performance for Q2, resulting in revised guidance.

- Reduction in deconversion revenue is due to the lack of consolidation by financial institutions, which is impacting the services revenue associated with convert and merge activities.

- Change in consumer spending behavior is impacting the card processing business, which is significantly weighted to debit processing, leading to revised guidance to reflect a temporary economic trend.

- Revised guidance is primarily due to reduction in deconversion revenue and change in consumer spending behavior.

Segment Performance

- Core segment revenue was flat for the quarter but increased by 6% on a non-GAAP basis.

- Payments segment revenue increased 3% for the quarter and 6% on a non-GAAP basis.

- Complementary solutions businesses revenue increased 4% for the quarter and 8% on a non-GAAP basis.

New Business Wins and Offerings

- Q2 set a new quarterly sales record for Jack Henry with 12 competitive core takeaways and 15 deals to move existing in-house core clients to their private cloud environment.

- 12 new card processing clients were signed this quarter, and 36 new contracts were signed for the Banno digital suite.

- The Banno business solution is scheduled to go into general release next quarter and has 308 clients under contract for the solution.

- Real-time data streaming is currently in beta, essential to support real-time payments and fraud detection, and expected to go into live production later in this calendar year.

- Financial Crimes defender, the next-gen Financial Crimes platform with enhanced capabilities, including machine learning and artificial intelligence, will be launched this summer.

- Jack Henry is moving from acting as a core processor to offering a full banking ecosystem, including their own capabilities, and access to leading fintechs through a single platform.

Technology Monetization Strategy

- Jack Henry developed a multiyear strategy to help deliver public cloud-native capabilities to community and regional financial institutions.

- They are redefining the core processing system by unbundling services and building them as standalone modules on the public cloud.

- They are providing multiple data integration options utilizing their open philosophy and technology.

- Delivering industry-leading capabilities across a single next-generation platform is a priority.

- Jack Henry is moving from acting as a core processor to offering a full banking ecosystem, including access to leading fintechs through a single platform.

Mimi Carsley says,

Total Revenue growth

- GAAP revenue is up 2% for the quarter and up 5% year-to-date.

- Non-GAAP revenue increased 6% for the quarter and 7% year-to-date.

Services and support revenue growth

- GAAP revenue decreased 2% in the second quarter but increased 3% year-to-date.

- Non-GAAP revenue grew 6% for the quarter and 7% year-to-date.

Processing revenue growth

- GAAP processing revenue increased 9% for both the quarter and year-to-date.

- Non-GAAP processing revenue growth was 7% for the quarter and 8% year-to-date.

Cost of revenue and expense growth

- Cost of revenue was up 8% for both the quarter and year-to-date.

- Research and development expense increased 22% for the quarter and 23% year-to-date.

- SG&A was up 2% for the quarter and up 7% year-to-date.

Updated guidance

- GAAP revenue growth is now expected to be 5.4% to 5.8% due to the impact of lower deconversion fees and a slower rate of growth in debit transaction volumes.

- Non-GAAP revenue growth guidance is now 7% to 7.3%.

- Full-year GAAP EPS guidance is a range of $4.79 to $4.83.

Q & A sessions,

Strong Sales Record and Trending Larger

- Set another sales record in Q2 with a larger pipeline than ever before

- Accounts involved in are trending larger with bigger institutions coming to Jack Henry

- Core side accounts trending to be larger due to technology modernization strategy and Jack Henry’s reputation for great technology and service

- Anecdotal feedback from CEO roundtable forum suggests an average spend increase for calendar 2023 is around 7%

Selling Banno and Core Side Strategy

- Win rate for selling digital banking is high due to Banno’s outstanding reputation

- Prepared to sell outside the base technically, but being strategic about which core basis to go after to avoid potential negative impact on Jack Henry’s reputation

Credit Space and Conversion Backlog

- Prepared to offer credit to customers in production and signed up with programs, sales, and technical abilities to deliver

- Conversion backlog is well into the next fiscal year and managed effectively, taking into account customer absorption and validation of data to be converted

Best-of-Breed Solutions and Balancing Act

- Regulators are pushing for customers to limit the number of vendors to work with while customers are seeking best-of-breed solutions

- Jack Henry is well positioned to serve both ends of the spectrum with a broad suite of non-core solutions and acquiring best-of-breed solutions like Payrailz

Trending Up with Technology Modernization Strategy

- Conversations with core prospects are trending up as the technology modernization story is becoming a significant part of most conversations

- Larger institutions are coming to Jack Henry to develop a strategy that gets them to the public cloud and tie in FinTech solutions, complementary solutions into that experience for their customers