Juniper Networks, Inc.

CEO : Mr. Rami Rahim

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

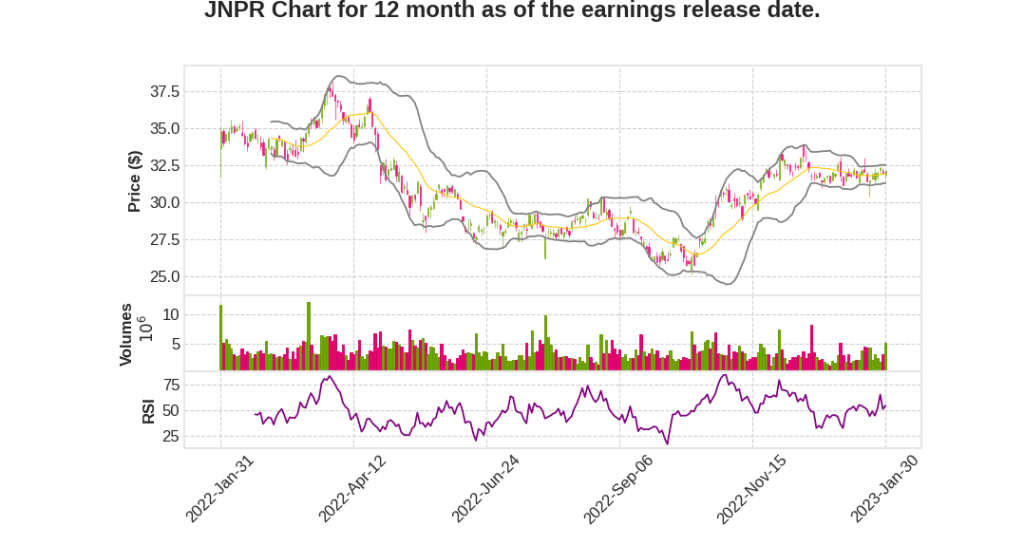

| 2022 Q4 | 11.5% YoY | 32.2% | 36.6% | 2023-01-31 |

Rami Rahim says,

Record Q4 Revenue and Full Year 2022 Growth

- Record revenue during Q4, although sales were slightly below the midpoint of guidance

- Second consecutive quarter of double-digit YoY revenue growth

- Enterprise business grew by more than 20% YoY, Cloud business grew by more than 13% YoY, and Service Provider business grew by approximately 3% YoY, exceeding the high end of the long-term model

Normalization of Buying Patterns Among Cloud and Service Provider Customers

- Overall demand moderated in the December quarter, with total orders declining more than 20% YoY

- Normalization of buying patterns among Cloud and Service Provider customers

- Revenue growth will be the most important metric to gauge customer demand over the next several quarters

Reasons for Optimism in 2023

- Focus on leveraging AI-driven cloud-based automation tools to simplify customer operations and improve the end user experience

- Continued investment in go-to-market organization to capitalize on product differentiation and take share, particularly in the Enterprise

- Strong 400-gig progress with more than 100 new wins across wide area and data center use cases

- Progress transitioning the business to a more software-centric model, with total software and related services revenue growing 26% YoY and annualized recurring revenue increasing 43% YoY

- Exceptional backlog of more than $2 billion, providing the company with exceptional revenue visibility and enabling another year of healthy growth

Performance by Customer Solutions

- Automated WAN business experienced revenue weakness during Q4 due to timing of supply but grew 12% on a full year basis

- Cloud-ready data center revenue grew more than 20% on a full year basis with strong 400-gig momentum and increasing interest in Apstra freeform capability

- AI-driven enterprise revenue significantly outpaced the market, growing more than 30% YoY in Q4 and 24% on a full year basis, with Mist AI driving growth in the mid-to-five business

Industry Recognition of Juniper’s Differentiation

- Ranked highest in both completeness of vision and ability to execute in Gartner’s latest Magic Quadrant for Enterprise wired and wireless LAN infrastructure for a second consecutive year

- Received top score in four out of five use cases in the Gartner Enterprise wired and wireless LAN infrastructure critical capabilities report

Ken Miller says,

Record Revenue and Earnings per Share

- Record revenue of $1.449 billion in Q4 2022, up 11% YoY and 2% sequentially

- Non-GAAP earnings per share of $0.65, above the midpoint of guidance

Decline in Product Orders

- Total product orders declined more than 20% YoY in Q4 2022

- Adjusted orders placed to accommodate extended lead times declined single digits YoY but grew sequentially

Revenue by Vertical

- Enterprise had record revenue and was the largest vertical in Q4 2022, increasing 32% YoY and 16% sequentially

- Cloud grew 14% YoY and increased 1% sequentially

- Service Provider declined 8% YoY and 10% sequentially

Full Year Results

- Revenue for 2022 was a record at $5.301 billion, 12% growth versus 2021

- Growth across all verticals, customer solutions, and geographies

- AI-driven enterprise revenue increased 24%, Cloud-ready data center revenue grew 21%, and automated WAN solutions revenue grew 12% on a full-year basis

Guidance for 2023

- Expect at least 8% revenue growth for full year 2023

- Full year non-GAAP gross margin to be flat to slightly up YoY

- Full year non-GAAP operating margin to expand by at least 100 basis points versus 2022

- Non-GAAP EPS to grow double digits on a full-year basis

Q & A sessions,

Service Provider Segment Outlook:

- Q4 was mostly impacted by supply constraints, but the Service Provider segment is showing strong growth potential in the long term, with new products like MX 304 and PTX product family performing well.

- There are still 400-gig projects that are important for Service Providers to keep ahead of their demand pattern in their networks, as well as Metro opportunities to carry 5G traffic in fiber optic networks.

- Long-term outlook for the Service Provider segment is a minus two to plus two range, despite macro concerns.

Enterprise Segment Performance:

- Enterprise segment is now Juniper’s largest segment, with the company executing exceptionally well across all solution areas.

- Juniper’s competitive differentiation in AI-driven enterprise solutions is working well for them.

400-gig Opportunities:

- There have been 100 new wins between Service Providers and Cloud providers since the last update, indicating promising success in the cloud-ready data center space.

- Juniper has real strength, experience, and know-how in WAN for Service Providers and hyperscale cloud providers.

- Juniper is in pretty much all of the major cloud providers, hyperscale, and top 10 cloud providers as well.

Backlog and Order Momentum:

- Backlog is expected to start to normalize and reduce in 2023, but remain elevated. The new normal range is expected to be somewhere between $500 million and $1 billion.

- Orders are understated now as customers have already placed orders and Juniper is now shipping those orders, causing orders to be understated compared to true demand.

Durable Backlog and Q4 Revenue Mix:

- Juniper believes their backlog remains extremely durable, with low cancellation levels compared to backlog levels.

- Q4 revenue mix was impacted by the fact that orders were accelerating to account for multiple periods of time to adjust lead times, causing orders to be overstated through demand in the past 3 quarters.