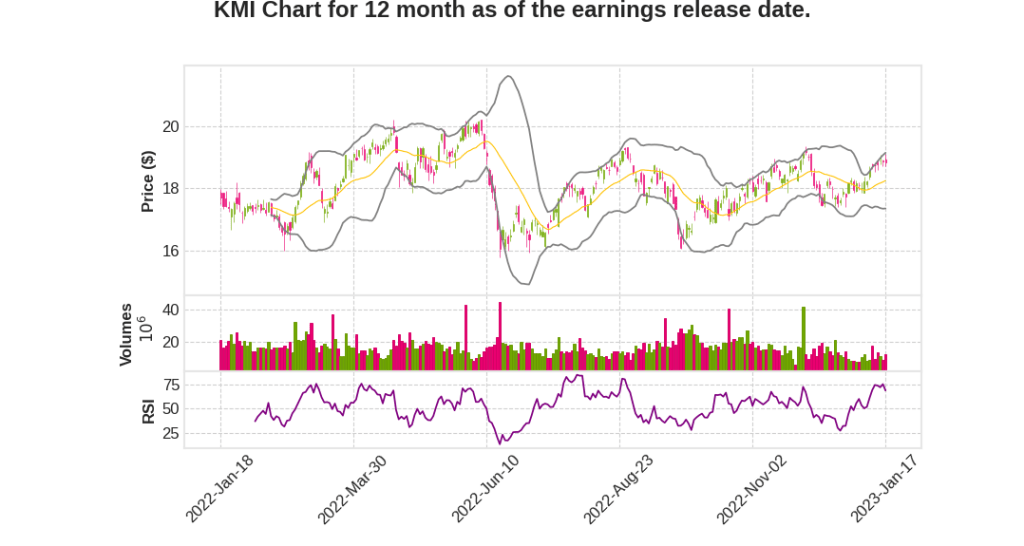

Kinder Morgan, Inc.

CEO : Mr. Steven J. Kean

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2022 Q4 | 3.5% YoY | 16.2% | 3.4% | 2023-01-18 |

Steve Kean says,

Strong Financial Performance in Q4 2022

- KMI had a great Q4 2022, with strong operational and financial performance, especially in the natural gas market.

- The volatility in the gas market created opportunities for KMI as a large transmission and storage operator, resulting in increased demand for transportation and storage services.

Strong Balance Sheet

- KMI finished 2022 with a debt to EBITDA ratio of 4.1x, better than their 4.3x budget, and inside their long-term target of approximately 4.5x.

New Business and Investments in Lower Carbon Future

- KMI originated new business, increasing the backlog to $3.3 billion, made up of high probability projects at an attractive EBITDA multiple of about 3.4 times.

- The investments are weighted towards KMI’s lower carbon future in natural gas, renewable liquid feedstocks and fuels in their products and terminals businesses, and investments in their Energy Transition Ventures business.

- These lower carbon investments are all expected to yield very attractive returns well above KMI’s cost of capital.

Shareholder Value

- KMI returned value to shareholders in the form of a modestly growing dividend and additional share repurchases.

- In 2022 alone, KMI returned nearly $2.9 billion to shareholders in dividends and share repurchases.

- The Board has upsized the total authorization for share repurchases from $2 billion to $3 billion.

Uplift on Base Business

- KMI is seeing nice uplift on their base business, especially in renewals in their natural gas business and built-in escalators in some of their products and terminals, tariffs, and contracts.

- They are putting behind them the contract roll-off headwinds in their gas group.

Kim Dang says,

Higher Natural Gas Pipeline Transport Volumes

- Transport volumes on natural gas pipelines increased by about 4% for the quarter due to increased demand from power and LDCs.

- Physical deliveries to LNG facilities off of Kinder Morgan’s pipes averaged around 5.4 million dekatherms per day, down approximately 450,000 dekatherms per day versus Q4 of ’21 due to the Freeport outage, but would have increased 5% if adjusted for the outage.

- Deliveries to power plants and LDCs increased approximately 7% and 13%, respectively, driven by the weather.

Decrease in Refined Products and Crude Volumes

- Refined products volumes were down a little under 1% for the quarter, outperforming the EIA, which was down 2%.

- Road fuels were down 3%, but there was a 10% increase in jet fuel demand.

- Crude and condensate volumes were down 6% in the quarter due to lower Bakken volumes, and sequential volumes were down about 3% due to lower HH volumes.

Stable Liquids Utilization Percentage in Terminals Business Segment

- Liquids utilization percentage, as a percentage of Kinder Morgan’s tank capacity contracted, remained high at 93%.

- Excluding tanks out of service for required inspection, utilization is approximately 96%.

- Rates on liquids tanks renewals in Houston and New York Harbor were slightly lower in the quarter.

Increased Prices in CO2 Segment

- Prices were up across the board in the CO2 segment.

- Oil production was flat, but CO2 volumes were up 12% and NGL volumes were down 4%.

Fantastic Quarter and Year with Exceeding Full Year Planned DCF and EBITDA

- DCF per share was up 13% for the quarter and 14% for the full year when excluding the impact of Winter Storm Uri.

- Kinder Morgan exceeded their full year planned DCF and EBITDA by 5% and DCF per share by 6%.

Q & A sessions,

Capital Allocation Philosophy

- The company intends to maintain a strong balance sheet and fund projects at attractive returns with $3.3 billion at a 3.4x EBITDA multiple.

- The capacity to upsize is opportunistic to take advantage of opportunities as they arise.

- The company’s capital allocation philosophy has not changed and will continue to add value for shareholders.

Operational Issue

- The company experienced an operational issue in December, which affected its performance.

- Despite the setback, the company is budgeting for a 3.4% increase in aggregate for 2023.

- Jet fuel and diesel are expected to see an increase close to 6.5% due to the company’s slow recovery in jet fuels.

- The company’s renewable diesel projects are coming online at the end of the first quarter, which has take-or-pay contracts for north of 30,000 barrels a day and will help with the diesel picture.