The Kroger Co.

CEO : Mr. William Rodney McMullen

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2023 Q4 | 5.4% YoY | -14.4% | -26.3% | 2023-03-02 |

William McMullen says,

Introduction

- Kroger’s strategy of Leading With Fresh and Accelerating With Digital has helped the company exceed financial goals and deliver attractive total shareholder returns in the last two years.

- In 2022, customer preferences shifted in response to inflation and macroeconomic uncertainty, leading to more customers gravitating towards affordable meal solutions offered by Kroger.

- Kroger managed to deliver strong results in 2022, leading to total household growth and enhanced customer loyalty.

Leading with Fresh

- Kroger’s end-to-end fresh initiative is changing the way they deliver on their commitment to freshness, with over 1,400 stores implementing the solution in 2022.

- In 2023, Kroger will continue to innovate the fresh experience by improving inventory management tools, strengthening their supply chain, and enhancing their offerings to meet customer demand.

- Kroger’s merger with Home Chef brought significant capabilities in in-store and restaurant quality meal solutions, and they will be expanding their Home Chef production facilities to meet growing customer needs.

Our Brands

- Kroger’s Our Brands portfolio offers exciting products at great value while driving incremental sales and improving margins.

- Kroger launched a new opening price point product line called Smart Way, which consolidated and simplified several brands into one, offering customers a point of differentiation across the full portfolio.

- Kroger will continue expanding Our Brands to more categories with innovative product offerings and help customers find high-quality, affordable products they love from pantry staples to fresh food to ready-to-heat restaurant-quality meals.

Personalization

- Kroger’s data science teams are using predictive science to serve customers the right products at the right time and at the best value.

- Kroger grew loyalty as their customers more deeply engaged with personalized coupons and fuel rewards, with digital coupon engagement hitting an all-time high in 2022.

- Kroger launched Boost, the industry’s most affordable membership nationwide, in July, and early results are exceeding expectations with incremental engagement and overall household spend.

- In 2023, Kroger will make significant investments to build out their personalization capabilities, including increasing the use of real-time data to predict customer needs, which will support sales growth over the next three years.

Seamless

- Kroger’s digital platform offers a seamless shopping experience with 0 compromise, allowing customers to shift effortlessly between store, pickup, and delivery solutions.

- Kroger expects digital sales will continue to grow at a faster pace than overall food at home sales and believes they are well-positioned to deliver double-digit growth over the next three years.

- To become the most trusted online grocery destination, Kroger is focused on providing a compelling Kroger-owned digital destination, delivering best-in-class fulfillment, reaching new customers and adding more shopping occasions, and driving their profit flywheel by reducing their digital cost to serve and growing their alternative profit streams.

Alternative Profits

- Kroger invested heavily in technology to transform their business and enter new high-growth and high-return businesses, with alternative profit businesses achieving $1.2 billion in operating profit in 2022.

- Kroger Precision Marketing is one of their fastest-growing businesses and is well positioned to win within the U.S. retail media landscape, projected to be a $55 billion industry by 2024.

Conclusion

- Kroger invests in their associates’ success, including wages and comprehensive benefits, and plans to invest more than $770 million in associate wages in 2023.

- Kroger’s Zero Hunger | Zero Waste social impact plan is an industry-leading commitment to build communities free from hunger and waste.

Gary Millerchip says,

Kroger’s Value Creation Model

- Kroger’s value creation model has been key to delivering consistent and strong results over the past 4 years and is positioning Kroger for growth in years to come.

- Executing the go-to-market strategy enables Kroger to win customers in the core supermarket business and drive significant customer traffic and data into their ecosystem.

- Investments in technology and 84.51° deliver greater value for customers and create new high-growth, high-margin alternative profit businesses.

Kroger’s Financial Performance in 2022 and Q4

- Kroger delivered adjusted EPS of $4.23 per diluted share, an increase of 15%.

- Identical sales, excluding fuel, grew by 5.6%, while adjusted FIFO operating profit was $5.1 billion, an increase of 18% from last year.

- In Q4, adjusted EPS was $0.99 for the quarter, an increase of almost 9%. Identical sales without fuel grew by 6.2%.

Cash Flow and Capital Allocation

- Adjusted free cash flow for the year came in $800 million lower than anticipated due to movements in working capital towards the end of the year.

- Kroger will continue to be disciplined with capital investments, prioritizing the highest growth opportunities that strengthen the business and deliver solid returns for shareholders.

- The company anticipates capital investments of $3.4 billion to $3.6 billion this year, which is consistent with their long-range TSR model.

2023 Guidance

- Identical sales without fuel are expected to be between 1% to 2% in 2023.

- Excluding the effect of Express Scripts, underlying identical sales without fuel growth is expected to be between 2.5% and 3.5%.

- Kroger expects adjusted FIFO operating profit of between $5 billion and $5.2 billion, and adjusted net earnings per diluted share of between $4.45 and $4.60, including the expected benefit of the 53rd week.

Cost Savings and Investments

- Kroger remains focused on eliminating waste in areas that do not affect the customer experience and is making investments in technology to improve store productivity, lower digital fulfillment costs, and reduce waste and shrink.

- Improvements will drive an incremental $1 billion of cost savings in 2023, marking their sixth year in a row of delivering $1 billion of savings.

- Kroger will fund investments in gross margin in 2023 by improving their product mix, accelerating momentum with their Fresh and Our Brands initiatives, and growing alternative profit businesses.

Q & A sessions,

Expected Gross Margin and Investment in Customer

- Continued investment in the customer in key areas of value

- Boost creates a short-term headwind as loyalty is built but there will be incremental value over a longer period of time.

- Meaningful tailwinds in gross margin rate are expected as the company continues to execute its go-to-market strategy.

- Improvement in Our Brands penetration is helpful to gross margin.

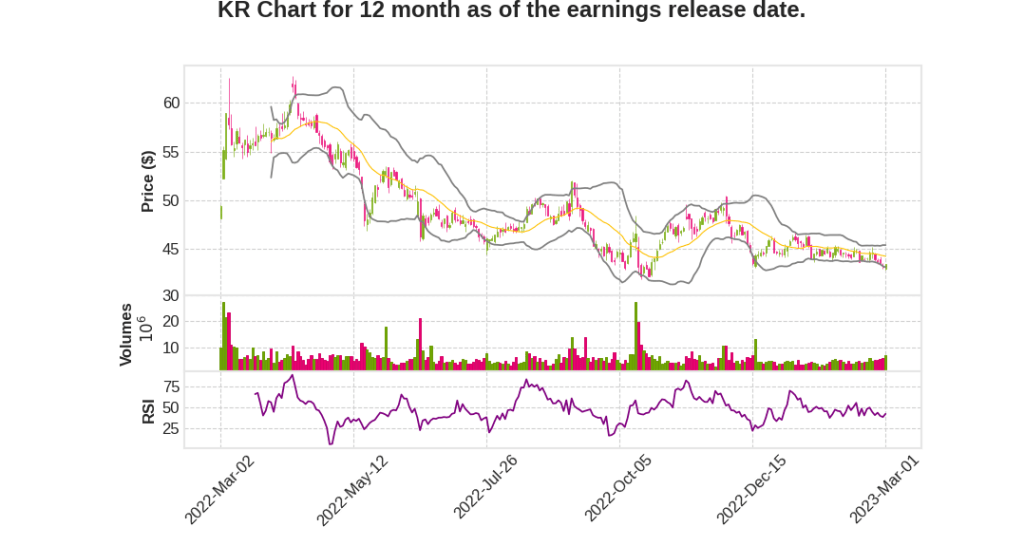

Factors Impacting Stock Movement

- 53rd week can add $0.15 of earnings per share and a $150 million tailwind

- Fuel is expected to be a headwind in the $200 million to $250 million range

- Core supermarket business executing on value creation model, with underlying sales growth of 2.5% to 3.5% expected

- Merger with Albertsons is expected to create customer benefits beginning day 1 post-close

- Annual productivity savings road map is expected to continue to identify additional savings opportunities