Lennar Corporation

CEO : Mr. Jonathan M. Jaffe

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

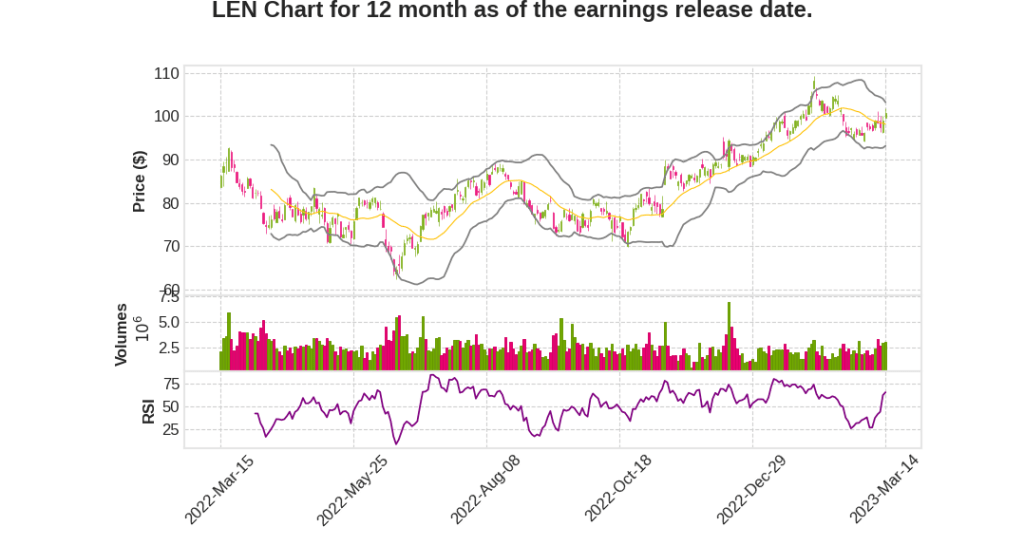

| 2023 Q1 | 64.0% YoY | 158.9% | 157.6% | 2023-03-15 |

Rick Beckwitt says,

Impact of Higher Mortgage Rates on Housing Market

- Higher mortgage rates have impacted affordability and homebuyer confidence, resulting in adjustments to base prices, incentives, and mortgage rate buy-downs to maintain targeted sales pace.

- Gross margins have been sacrificed to generate sales through the price-to-market strategy.

Q1 2023 Results

- New sales orders declined 10% from the prior year, but compared favorably to competitor and nationally reported results.

- New sales orders increased sequentially from the fourth quarter, and cancellation rates improved during the first quarter with sequential improvement in each month of the quarter.

- Cancellation rates in February were much below the normalized cancellation rate, benefiting from the flawless execution of the Financial Services group in finding the right mortgage product and locking mortgages with home buyers.

- New order sales price in the first quarter totaled 452,000, up 8% from the fourth quarter, with a slight improvement and a reduction in incentives that was partially offset by lower base prices.

Market Performance

- 10 markets are performing well, including Southeast Florida, Southwest Florida, Tampa, Palm Atlantic, New Jersey, Philly Metro, Charlotte, Coastal Carolinas, Indi, and San Diego, benefiting from extremely low inventory, strong local economy, employment growth, and migration.

- 29 markets have made significant adjustments and regained sales momentum, including Jacksonville Ocala, Orlando, Gulf Coast, Northern Alabama, Atlanta, Raleigh, Virginia and Maryland, Chicago, Minnesota and Nashville, all the markets in Texas, including Austin, Colorado, Phoenix, Tucson, Las Vegas and the rest of California, Pacific Northwest, including Portland and Seattle, Utah, Reno, and Boise.

- Base prices have stabilized in all Category 2 markets, with some able to increase net sales price primarily by reducing incentives and to a lesser extent, by raising base prices.

Land Life Strategy and Community Count

- The execution of the land strategy has helped drive sales, delivery, and production while managing inventory, with 90% of 12,000 home sites being purchased for finished home sites from various land structures in the first quarter.

- The year’s supply of owned home sites improved to 1.9 years from 2.7 years, and controlled home site percentage increased to 68% from 63% year-over-year.

- The community count increased 1% to 12,017 communities at the end of the first quarter from the year ago period, with expectations to increase in the high single digits by the end of the fiscal year, mostly in the fourth quarter due to development timelines.

Stuart Miller says,

Impact of Interest Rates on Sales

- Interest rates started moving dramatically in a different direction at the end of February

- Direct impact on traffic levels observed as a result of the interest rate movements

- The sales pace remained relatively strong despite the impact on traffic levels

- Interest rate movements are not disrupting sales as they might have before

New Normal Relative to Interest Rates

- The sticker shock of the rapid change in interest rates is subsiding

- Interest rate movements are being managed effectively in relation to discounting, incentives, and consumers’ affordability assessment

- We have entered into a new normal relative to interest rates

Anomalous Sales Performance

- Despite the impact on traffic levels, there was not much of an impact on sales

- There are various ways to read this information, but it suggests that the impact of interest rates is being managed effectively

Q & A sessions,

Impact of Unintended Consequences on the Housing Market

- Capitalization rates and cost of capital will affect SFR buyers

- Unintended consequences cannot be predicted, and the market needs to adapt to them

Organic Growth as Primary Focus

- The company is focused on being a best-of-breed homebuilder and generating cash

- Continuous internal improvement is a major opportunity for the company

- Opportunistic acquisitions are not the primary focus

Asset-Light Program and Land Strategy

- The company is focused on an asset-light program to execute its land strategy

- The land value is relative to the sales price of the home and the ultimate use of the land

- The company is waiting for the market to reconcile and for land sellers to understand the new valuation