Linde plc

CEO : Mr. Sanjiv Lamba

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

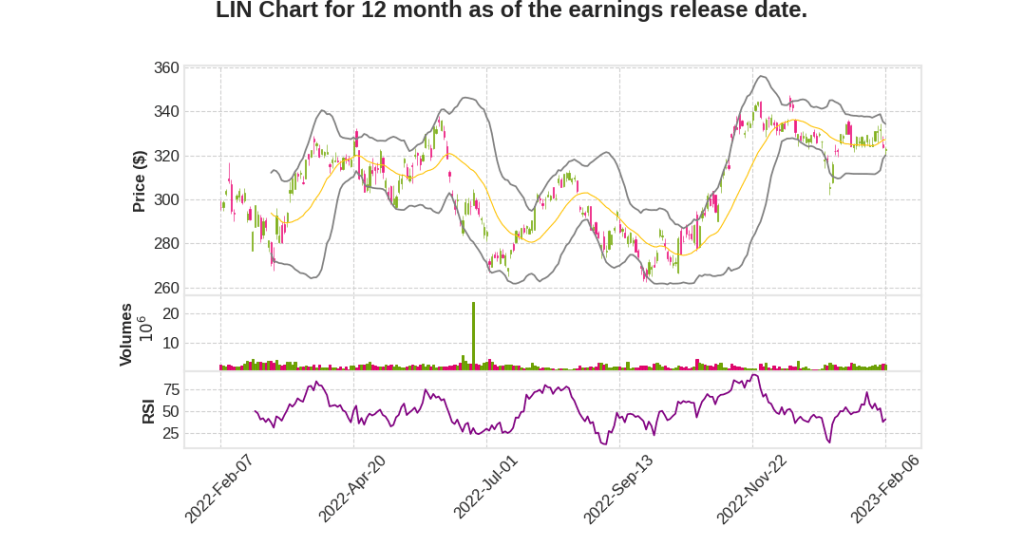

| 2022 Q4 | -4.8% YoY | 28.3% | 34.5% | 2023-02-07 |

Sanjiv Lamba says,

Financial Performance

- Operating margin, EPS, and ROC all reached record highs for Q4 and full year

- 9th consecutive quarter of growing EPS ex FX by 20% or more

- $7 billion returned to owners in dividends and share repurchases

Environmental Progress

- Added 50 additional zero-waste sites, reaching 760 sites globally

- Reduced absolute Scope 1 and Scope 2 greenhouse gas emissions by over 1 million tons of CO2 versus 2021

- Stated goal of reducing 35% greenhouse gas emissions by 2035 recently validated by the science-based targets initiative

Human Capital Performance

- Best in class safety performance with double-digit improvement over 2021

- 28% gender diversity and aiming to exceed 30% by 2030

- Over 500 community engagement projects and more than $10 million donated to charitable and STEM programs

Backlog and Growth Opportunities

- $9.2 billion project backlog with secure returns, increased $2.4 billion versus Q3

- Expect to invest almost $5 billion in CapEx and acquisitions in 2023

- Expect to start up over $2 billion in sale of gas projects this year

- Securing high-quality growth through partnerships with global leaders and sticking to core of management of industrial gases

Overall Assessment and Future Outlook

- Confident in delivering strong results irrespective of economic and geopolitical climate

- Fourth year in a row of double-digit EPS growth

- Expect to win more than fair share of high-quality projects across energy transition spectrum

Matt White says,

Overview of Q4 Results

- Sales decreased by 5% YoY and 10% sequentially.

- Underlying sales increased by 7% YoY but decreased by 2% sequentially.

- Cost pass-through trends are starting to stabilize with a 2% increase over last year but 3% drop sequentially.

- Volume is down 1% from last year and 4% sequentially.

- Pricing actions remain robust with an 8% increase from 2021 and 2% from the third quarter.

Operating Profit and Margin

- Operating profit of $2 billion resulted in a record 25.3% operating margin.

- Excluding pass-through, operating margins expanded both sequentially and YoY in all gas segments as pricing effects net of cost inflation continue to improve underlying business quality.

- The engineering segment had an abnormally high operating margin this quarter due to favorable project timing.

- EPS of $3.16 increased 14% from last year or 20% excluding FX.

Guidance

- For Q1, the EPS range is $3.05 to $3.15, an increase of 4% to 8% versus prior year or 9% to 13%, when excluding FX.

- Full-year guidance is expected in the range of $13.15 to $13.55, representing an increase of 7% to 10% or 9% to 12% when excluding an estimated 2% FX headwind.

- Both ranges assume no material change in economic conditions at the midpoint.

Capital Management

- Operating cash flow was $9 billion for 2022 or 82% of EBITDA, consistent with our multiyear average.

- During the year, we invested $3.3 billion while returning $7.5 billion back to shareholders.

- We anticipate a meaningful step up in 2023 for new business investments while raising the dividend and maintaining a healthy share repurchase program.

Q & A sessions,

OCI Project as a Partnership with Linde

- Linde’s EPC capability and successful track record executing complex projects

- Linde’s reliability and strong operational expertise in managing the ATR ASU complex

- Linde’s hydrogen pipeline and ability to store excess hydrogen

- Linde seen as a complementary partner by ammonia players

- Double-digit unlevered post-tax returns expected from the project

APAC Business Performance

- Solid pricing and record operating margins, up at 26.5%

- Strong sales in electronics, chemicals, energy, and manufacturing

- Weakness in steel and automotive in China; expecting moderated growth in China

Technology and Commercial Viability of Ammonia

- Linde has good technology around backtracking and is running pilots on new catalysts

- Direct ammonia usage makes more sense than back-cracking due to the amount of energy loss in the process

Update on Projects and Carbon Sequestration

- Reasonably confident about getting OCI project up and running in 2025

- Working with multiple partners for the project and have date certain contracts to protect investments

- Talking to world-class companies that are experts in carbon sequestration, and discussions are progressing well

Performance in Americas, EMEA, and Hydrogen Pricing

- Recovered from customer outages due to winter storm in U.S. and January trends look good

- Lower economic activity and volatility on energy costs impacted on-site business in EMEA

- Sentiment improving in Europe, and waiting to see how volume shapes up

- Hydrogen pricing based on double-digit unlevered post-tax IRRs and competitive in the market