LyondellBasell Industries N.V.

CEO : Mr. Peter Z. E. Vanacker

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

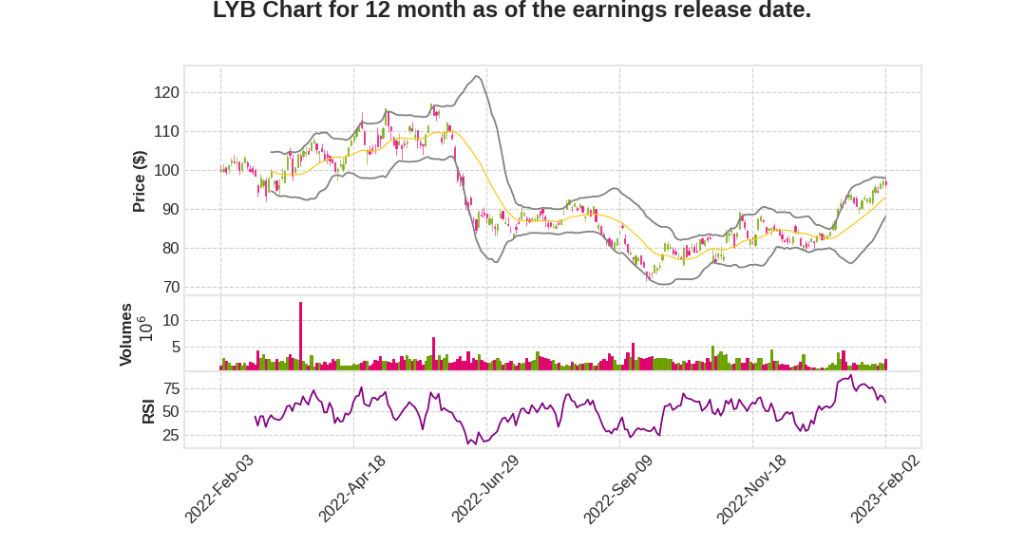

| 2022 Q4 | -20.5% YoY | -68.3% | -52.0% | 2023-02-03 |

Michael McMurray says,

Cash Generation and Capital Allocation

- LyondellBasell generated $6.1 billion cash from operating activities during 2022. Cash conversion reached an outstanding rate of 203% in Q4.

- The company returned a total of $3.7 billion to shareholders in 2022 including $3.2 billion in quarterly and special dividends and $420 million in share repurchases.

- $1.9 billion in capital expenditures were invested in maintenance and growth projects with the final stages of construction of the world-scale PO/TBA plant funded.

Quarterly Results for Segments

- LyondellBasell’s business portfolio delivered $865 million of EBITDA during Q4 2022.

- Margins at oxyfuels and refining businesses remained above historical averages due to strong demand for fuels.

- High cost for utilities and raw materials coupled with low seasonal demand negatively impacted the Advanced Polymer Solutions segment.

- A noncash LIFO inventory valuation charge impacted pretax Q4 results by approximately $90 million.

Annual Modeling for 2023

- The company expects to produce and sell about half of the asset’s nameplate capacity in 2023 as the PO/TBA plant ramps up.

- The value enhancement program can achieve recurring annual EBITDA of $150 million by the end of 2023 through the execution of about 1,000 projects.

- Maintenance downtime will impact 2023 EBITDA by approximately $290 million.

- The company expects capital expenditures to decline by about $300 million to approximately $1.6 billion this year with the completion of the PO/TBA plant and disciplined spend resulting from the current business environment.

- The effective tax rate is expected to be approximately 20% and the cash tax rate to be lower than the ETR.

Peter Vanacker says,

Impact of Inflation Rates and Interest Rates on Demand for Mature Goods

- High inflation rates and increasing interest rates are expected to continue depressing demand for durable goods in the foreseeable future

Stability of Demand for Nondurable Goods

- Demand for nondurable goods is expected to remain stable, and even strong in certain areas

Utilization Rates in Americas and Europe

- The operating assets in the Americas and Europe are currently at 80% utilization

Startup of PO/TBA Sands in I&D

- The startup of PO/TBA sands will add more volumes of propylene oxide, but scheduled shutdowns and turnarounds have been moved to the periods when the new facilities are starting up

- The operating assets in I&D are also at 80% utilization, slightly higher than at the end of last year

Q & A sessions,

Value Enhancement Program

- The program is ramping up impressively with major sites in the US and Germany being completed

- Expanding to other sites in the US and Europe with over 3,000 identified projects including manufacturing, procurements, commercial excellence, and supply chain management

- Focus is on projects with fast payback time

- More specifics to be given during Capital Markets Day on March 14th

Operating Rates and Cash Flow

- The teams have done an outstanding job managing assets during Q4 to maximize cash flow

- Operating rates will increase as markets improve

- Export increase to continue, but company strategy is to find high-value customers and segments closer to home

Capital Allocation Priorities and Cash Flow

- Capital allocation priorities remain unchanged

- Expectation for generating strong cash flow and returning to gain cash flow to shareholders

- CapEx expected to be $1.5 billion in 2023

- Working capital expected to be flattish in the first quarter but consume some throughout the year with better sales and pricing

- Growth investments starting to pay dividends

- Expectation to continue returning meaningful cash to shareholders and growing recurring dividend