Live Nation Entertainment, Inc.

CEO : Mr. Michael Rapino

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

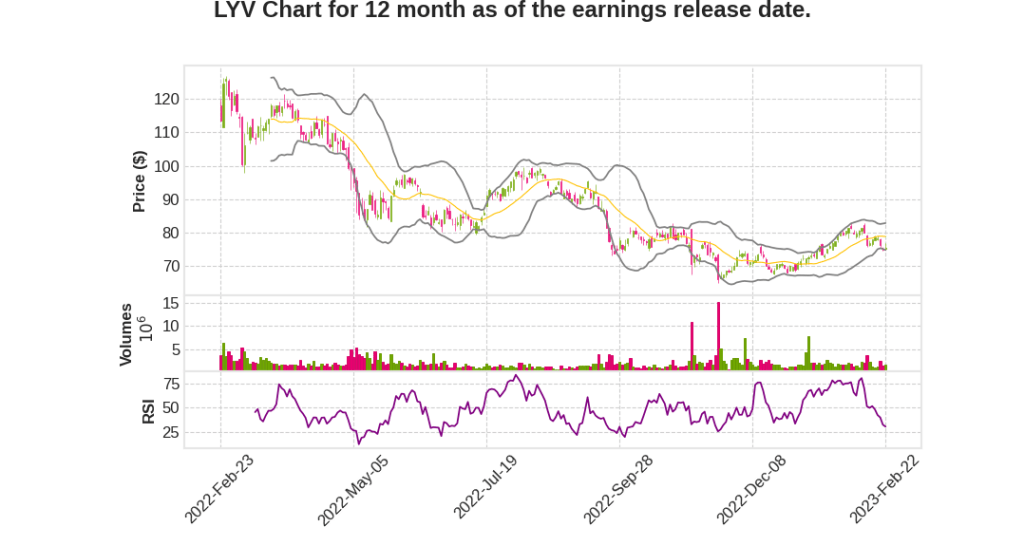

| 2022 Q4 | 58.7% YoY | -4.1% | -31.4% | 2023-02-23 |

Joe Berchtold says,

Revenue and AOI Growth

- The company reported a revenue of $16.7 billion for the year, which was $5.1 billion better than 2019, an increase of 44%.

- The reported AOI of $1.407 billion for the year was also a record for the company, $465 million better than 2019, up 49%, led by an improvement of $345 million in ticketing and $226 million in sponsorship.

Concerts Division

- The company had the most concert fans ever with 121 million fans attending their shows in 2022, up 24% compared to 2019.

- The concerts revenue for the year grew by 43% to $13.5 billion, while the company delivered $170 million of AOI.

Ticketing Division

- In 2022, the company sold $281 million fee-bearing tickets, up 28% compared to 2019, with GTV for the year at $27.5 billion, up 54% compared to 2019.

- The company delivered full year margins in the high 30s, coming in at 37%.

- The average ticket prices on primary tickets rose by 17% compared to 2019, driven by fan demand for the best seats at premier concert and sporting events.

Shock in the Industry

- The industry was hit hard by the pandemic, but the company was able to adapt and emerge stronger, with record-breaking numbers in revenue and AOI.

- The company also announced plans to open a new factory in the United States, which will create jobs and further contribute to the growth of the company.

Sponsorship Division

- It was a record year for the sponsorship business with top line revenue of $968 million, up 64%.

- The AOI for this high-margin business was $592 million, up 62%.

- There was high growth in both on-site and online sponsorship of 61% and 64%, respectively, compared to 2019.

Guidance and Financials

- The company expects CapEx to be approximately $450 million this year, with two thirds on revenue-generating projects.

- The company ended the year with $2.3 billion of available liquidity between free cash an untapped revolver capacity.

- The company issued $1 billion principal amount of 3.8 percent convertible senior notes due in 2029.

- The company is projecting noncash compensation, acquisition transaction expenses, depreciation and amortization, interest expense, accretion, and NCI and income tax expense to grow in line with AOI.

Michael Rapino says,

2022 Results and Indicators for 2023

- Live Nation had 121 million fans attend its shows across 45 countries, up 24%, and revenue increased 43% to $13.5 billion in 2022 compared to 2019 figures.

- Live Nation invested $9.6 billion in putting artist shows on in 2022, up 45%, with every venue type having double-digit attendance growth.

- Last year, Live Nation grew its average revenue per fan by 20% at all venue types and sold 23 million net new tickets in 2022.

- Live Nation’s deferred revenue at the end of 2022 was $2.7 billion, up 125% from 2019.

- Ticket sales for Live Nation’s shows in 2023 exceeded 50 million fans, up 20% from this point last year.

- Live Nation’s global ticketing fee-bearing GTV is up 33% to $9.8 billion through the early stages of 2023.

- Over 70% of Live Nation’s planned sponsorship activity for the year is confirmed, up double digits relative to this time last year.

Concerts

- Live Nation grew attendance by 24% to 121 million fans at 44,000 events, which drove revenue up 43% to $13.5 billion in 2022 compared to 2019 figures.

- Live Nation invested $9.6 billion in putting artist shows on in 2022, up 45%, with every venue type having double-digit attendance growth.

- Part of Live Nation’s fan growth continues to come from the venues they operate globally, closed almost 50 million fans in 2022 with international markets delivering the majority of the growth.

Ticketing

- Live Nation grew fee-bearing ticket volume by 28% to $280 million, which in turn drove their fee-bearing GTV, up by over 50% to $28 billion across 38 countries.

- Live Nation’s ticketing revenue was $2.2 billion, up 45%.

- Live Nation signed 23 million net new tickets in 2022, 70% were with international clients.

- Live Nation focuses on developing the leading software for venues, invests tens of millions of dollars every year to continue innovating every aspect of ticketing technology products, and has products such as Verified Fan designed to help artists cut down resale.

Sponsorship

- In 2022, Live Nation had 120 large strategic sponsors globally across its businesses, 32% more than in 2019, driving over 80% of the growth, with overall revenue up 64% to $1 billion.

- Their international markets led this growth with international sponsorship ROI up 70%.

- Over 70% of Live Nation’s planned sponsorship activity for the year is confirmed, up double digits relative to this time last year.

Regulatory Environment and Industry Reforms

- Live Nation’s market share has gone down, not up since the merger, because of the competitive bidding process, and venues regularly take more of the economics on every renewal as they set and keep a majority of the service fees.

- Live Nation is engaging with policymakers to advocate for reforms, and they launched the Fair Ticketing Act, saying artists should decide resell lots selling, speculative tickets should be illegal, and there needs to be industry-wide all-in pricing, so fans see the full cost they are paying upfront.

Q & A sessions,

Ticket Pricing and Revenue Streams

- Artist takes most of the ticket fee base, while the venue, promoter or ticketing company earns revenue fees through an extra fee.

- Live Nation supports all-in pricing to let the consumers know the true cost of the ticket from the beginning of the shopping process.

Challenges in the Business

- The historic challenge is when the demand supply is out of whack, and it creates tension and unhappy customers.

- Live Nation Ticketmaster is a B2B business that services the venue and the artist.

- Consumers’ perceptions of magical extra fee added on that is not part of the overall show cost is a problem.

Action Plans and Products

- Education reform and lobbying for better policies are necessary.

- Verified Fan products and new products on the Live Nation venue side will lead the industry.

- Live Nation aims to be more transparent and do a better job telling the artist side of the story.

Growth and Demand

- Live Nation sees a strong growth demand all over the world in stadiums, festivals, clubs, and theaters.

- Concerts are still an affordable option for fans to go out for a memorable night compared to other activities.

Artist Control and Underpriced Products

- The artist has the best shot when they unite around their IP, and they should have more control over their ticket pricing and revenue streams.

- Ticket exchange platforms and selling should be available, but the artist should have a say in how tickets go to market.

- Governments in most other countries have some level of regulation on this aspect.