Healthpeak Properties, Inc.

CEO : Mr. Scott M. Brinker

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

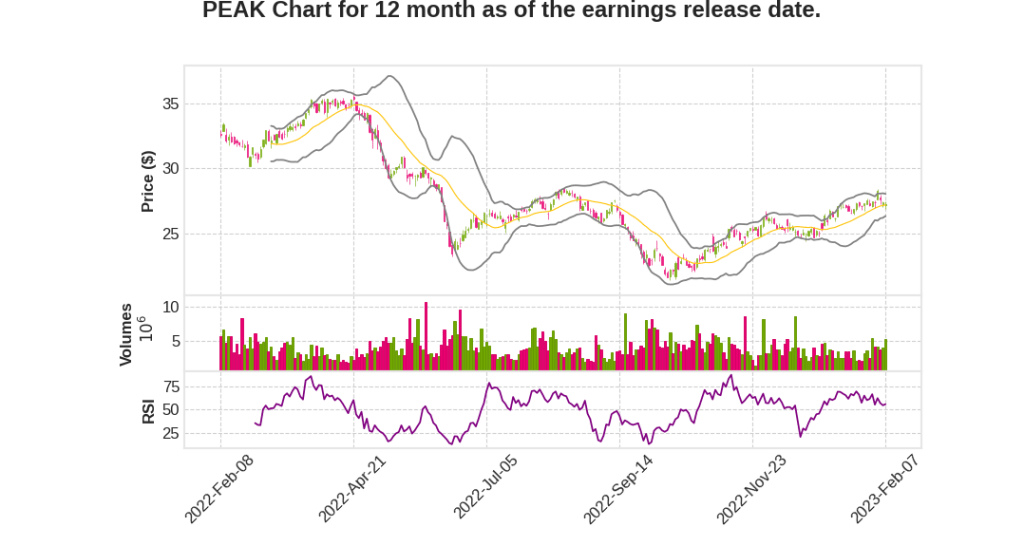

| 2022 Q4 | 8.5% YoY | 180.6% | -16.0% | 2023-02-08 |

Peter Scott says,

Financial Performance

- Delivered excellent operating results with FFO as adjusted of $0.44 per share and total portfolio same-store growth of 6.6% in Q4 2022.

- Reported FFO as adjusted of $1.74 per share and total portfolio same-store growth of 5% for the full year 2022.

- Medical Office had a fantastic quarter with same-store growth of 5.4% and commencing 3.6 million feet of new and renewal leases, the highest year on record for Healthpeak.

- CCRCs same-store growth increased by 15% in Q4 2022, bringing full year growth to the midpoint of their 8% guidance.

Balance Sheet

- Settled $500 million of five-year delayed draw term loans and swapped to 3.5% fixed rate through maturity.

- Successfully issued a $400 million 5.25% fixed-rate 10-year bond in January 2023.

- Closed on the $113 million sale of Durham asset at a 5% cap rate, allowing them to further improve their balance sheet metrics.

- Reduced floating rate debt exposure to approximately 5%.

2023 Guidance

- Forecasting FFO adjusted of $1.70 per share to $1.76 per share, and blended cash, same-store NOI growth of 2.75% to 4.25%.

- In life sciences, they expect same-store growth to range from 3% to 4.5%, Medical office we expect same store growth to range from 2% to 3%, and in CCRCs, same-store growth to range from 5% to 10% excluding CARES Act grants.

- The midpoint of our guidance assumes $1.17 billion of cash NOI increase of $65 million compared to 2022.

- The midpoint of our guidance assumes $205 million of interest expense.

- FFO is adjusted is negatively impacted by $0.03 of deferred revenue recognition.

- Guidance assumes $600 million of development and redevelopment spend, up modestly from 2022.

Scott Brinker says,

Strong Operating Results and Growth Opportunities

- Full year same-store NOI grew 5.1% in Life Science and 4% in medical office.

- Healthpeak is in great shape with only a modest amount of space to lease both this year and next.

- New developments are fully funded and 78% pre-leased.

- Finished the quarter at 99% occupancy and continue to sign leases.

- In recent weeks, there has been positive momentum in the public markets for biotech which could lead to reacceleration in demand.

Strong Balance Sheet and Capital Allocation

- Healthpeak’s balance sheet allows it to be opportunistic and have optionality.

- The attractive spread on the January bond issuance reflects Healthpeak’s strong balance sheet and support in the credit markets.

- The $113 million sale of two R&D buildings in Durham for a 5 cap is a good transaction comp in an otherwise quiet market.

- Progressing entitlements across our core markets, but it’s possible for the first time in several years that risk-adjusted returns on acquisitions will be more attractive than development, which could impact capital allocation in 2023.

Sustainability Initiatives and ESG Recognition

- Advancing sustainability initiatives across the portfolio and proud of our ESG recognition, that includes being named as CDP’s Leadership Band for the 10th consecutive year and being named a best-managed company by the Wall Street Journal.

Changes in Ownership and Leadership

- In South San Francisco, Healthpeak’s sovereign wealth partner has agreed to allow Healthpeak to continue owning 100% of the Vantage Development campus.

- Ankit Patadia was promoted to Healthpeak’s executive team.

Guidance and Economic Uncertainty

- Healthpeak’s underlying business is strong and the NOI growth opportunity described in our November investor presentation is unchanged.

- We’re projecting another solid year of operations and development deliveries in 2023 offset by the change in interest rates and some non-economic timing issues.

- Incoming economic uncertainty could impact capital allocation and we’ll have to see where cap rates and cost of capital settle and what happens with construction costs as the economy slows.

Q & A sessions,

Acquisitions

- Company is in great shape, with capacity to fund acquisitions

- Underwritten IRRs in core segments are higher today, making acquisitions more likely

- Potential pipeline is big in the core submarkets within existing markets

- Less aggressive on development, but land bank is a valuable asset

Revenue Guidance

- Rent escalator is around low 3%

- Guidance for 2023 is primarily focused on rent escalator, with some modest lease maturities and mark-to-market benefit

- NOI growth for 2023 relative to 2022 is $65 million, with a big chunk from development earn-in

- Active pipeline that has not yet delivered is expected to contribute a little less than $10 million to NOI growth

Revenue Recognition

- Issues in revenue recognition for 2023 are due to redevelopment project and development project, where initial occupancy dates were pushed back

Cost Inflation and Margins

- Contract labor is down 70% but paying workers more to bring that number down

- Strong cost inflation in utilities, food, and insurance

- Margins improving, but not reflecting all of the improvement in rate and occupancy

M&A

- Higher likelihood that acquisitions could make sense this year, but still early in the year

- Spread relative to acquisition cap rates is down, making decisions more interesting