Everest Re Group, Ltd.

CEO : Mr. Juan Carlos Andrade

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

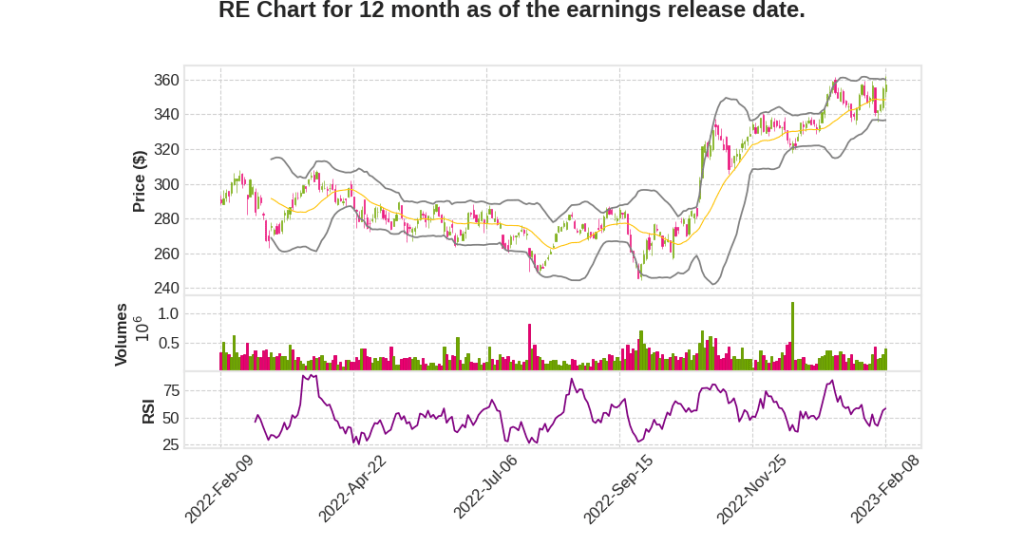

| 2022 Q4 | 7.4% YoY | -56.9% | 16.2% | 2023-02-09 |

Mark Kociancic says,

Strong Fourth Quarter Results

- Operating income for Q4 2022 was $478 million or $12.21 per diluted share, with an operating ROE of 19.4%

- Group’s gross written premiums for Q4 2022 was $3.7 billion, representing 9% growth in constant dollars

- Combined ratio for the quarter was 87.8%, a 4.1 point improvement over the prior year’s quarter, driven by lower CAT losses

Segment Results

- Reinsurance gross premiums written grew 3.7% to $2.4 billion in constant dollars; combined ratio was 86.4%, an improvement of 5.1 points year-over-year primarily on lower CAT losses

- Insurance gross premiums written grew 20.5% in constant dollars to nearly $1.3 billion in the quarter; combined ratio was 91.4%, a 1.4 point improvement from a year ago

Investments, Tax, and Balance Sheet

- Net investment income for Q4 2022 was $210 million versus $205 million a year ago

- Operating income tax rate for Q4 2022 was approximately 11%

- Shareholders’ equity ended the quarter at $8.4 billion, driven primarily by strong earnings in the quarter

Book Value

- Book value per share ended the quarter at $215.54 per share, while the book value per share, excluding unrealized depreciation and depreciation of securities, stood at $259.18 versus $252.12 per share at the end of 2021

Outlook

- The company remains confident in the strength of its reserve position and has momentum as it looks ahead into 2023

James Williamson says,

Property CAT Renewal

- Received significant rate increases in the US property CAT business on the order of 50%

- Improved every metric used to measure CAT portfolio including attachment points and probabilities

- Expected combined ratio dropped materially and expected ROE increase materially

- Expected loss in dollars went up slightly, but dollars of expected profit per dollar of expected loss increased

- International markets took 40 points of rate including over 30 points of rate in the UK

PML Movement

- PMLs on a net basis were essentially flat compared to the previous quarter

- More deployment of some gross capacity offset by improved AUM in Mt. Logan resulted in a roughly flat P&L picture

- Expected to remain in that sort of territory with stable risk position

Q & A sessions,

Portfolio Performance Expectations

- Expected lower participation in frequency CAT events $1 billion, $2 billion events than prior to 1/1 ’23

- Retention of losses like Q4 CAT loss primarily by seeds

- Preserving capacity for major industry events

- Meaningful increase in the amount of cat premium available to pay these losses

Casualty Renewal Results

- Participation in market hardening over the last few years by taking increasing share of casualty programs for core clients

- Significant movement in terms and conditions, mainly in the U.S.

- Modest improvement in average ceding commissions across the portfolio

Effect of ILS Market on Business

- Dislocated market coming into 1/1 due to multiple years of CAT activity

- Mt. Logan faces challenge in raising funds due to sidelined investors and trapped capital

- Driving improvement in primary reinsurance business is first priority

Portfolio Movement of P&L

- Flat profile of PML deployment at a variety of return periods

- Portfolio has shifted toward areas where risk-adjusted returns are strong

- Discipline required in the underwriting and terms and conditions to ensure appropriate inflation loading

Reserve Evaluation Process

- Comprehensive year-round process aligning underwriting, pricing, reserving claims

- Ground-up rules and processes used to evaluate

- Prudent loss picks held in a disciplined fashion until seasoning in different lines of business