Raymond James Financial, Inc.

CEO : Mr. Paul Christopher Reilly

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

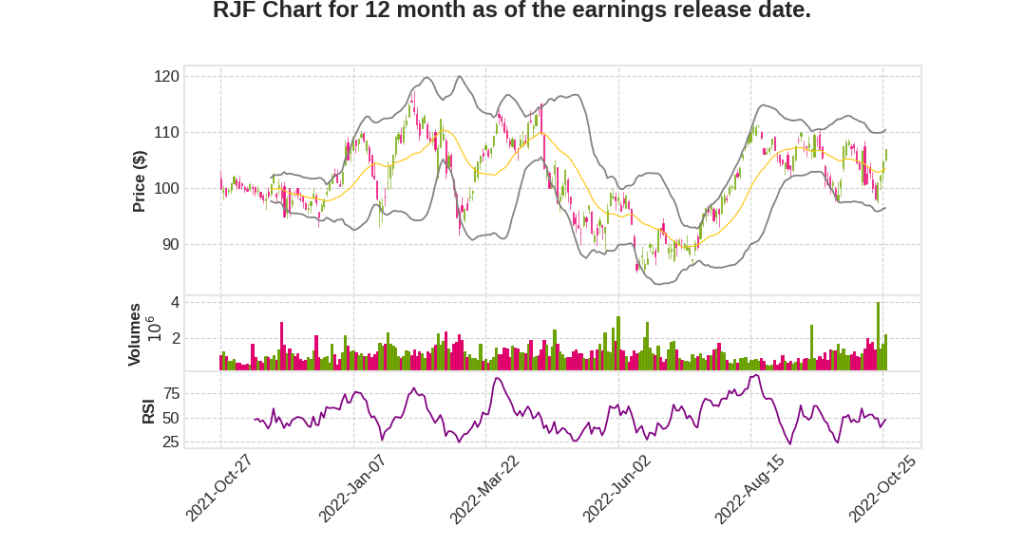

| 2023 Q1 | 10.4% YoY | 49.7% | 9.3% | 2022-10-27 |

Paul Shoukry says,

Consolidated Revenues

- Record quarterly net revenues of $2.83 billion grew 5% year-over-year and 4% sequentially.

- Asset management fees declined 6% compared to the prior yearâs fiscal fourth quarter and 10% compared to the preceding quarter, in line with the guidance provided last quarter based on fee-based assets.

- Equity markets declined further during the quarter, resulting in a 3% sequential decline in private client group assets and fee-based accounts. This decline will create a headwind for asset management and related administrative fees in the fiscal first quarter, which is expected to be down close to 4% sequentially in the fiscal first quarter of 2023.

- Brokerage revenues of $481 million declined 11% compared to the prior yearâs fiscal fourth quarter and 6% compared to the preceding quarter, as lower activity and asset-based trail revenues in PCG, as well as decreased fixed income brokerage revenues more than offset the addition of SumRidge.

- Investment banking revenues of $217 million declined 3% compared to the preceding quarter, however, pipelines remain strong.

Clientsâ Domestic Cash Sweep Balances

- Clientsâ domestic cash sweep balances ended the quarter at $67.1 billion, down 12% compared to the preceding quarter and representing 7% of domestic PCG client assets.

- Most of the decline in our sweep balances were experienced in the client interest program at the broker dealer.

- The Raymond James Bank Deposit Suite Program continues to be a relatively low cost source of stable funding and now with the addition of TriState Capital Bankâs independent deposit franchise.

Net Interest Income

- Combined net interest income and RJBDP fees from third-party banks was $606 million, up 206% over the prior yearâs fiscal fourth quarter and 64% from the preceding quarter.

- Both the NIM and average yield from third-party banks are expected to increase further with the anticipated rate increases.

- For the fiscal first quarter, the average yield on RJBDP from third-party banks is expected to be somewhere around 2.5% and the bank segmentâs NIM to average around 3.15%.

Expenses

- The total compensation ratio for the quarter was 62.1%, which decreased from 67.5% in the preceding quarter.

- Non-compensation expenses of $456 million, which includes $13 million of acquisition related expenses included in our non-GAAP earnings adjustments decreased 3% sequentially.

- The bank loan loss provision for credit losses decreased to $34 million, primarily due to the $26 million initial provision associated with the TriState Capital acquisition in the fiscal third quarter.

- Pre-tax margin trend over the past five quarters was strong with a pre-tax margin of 21.8% and an adjusted pre-tax margin of 22.8% in the fiscal fourth quarter.

Capital Actions and Credit Metrics

- Since the closing of the TriState acquisition, they’ve repurchased approximately 2.1 million common shares for $200 million or approximately $96 per share under their Board authorization.

- They remain committed to offset the share issuance associated with the acquisition of TriState, as well as share-based compensation dilution.

- Loan portfolio remains healthy with most trends continuing to improve.

- Bank loan allowance for credit losses as a percentage of total loans held for investment ended the quarter at 0.91%, down from 1.27% at September 2021 and nearly flat sequentially.

Paul Reilly says,

Impact of Hurricane Ian

- Over 200 associates on Florida Central Gulf Coast experienced a loss from Hurricane Ian.

- Raymond James family impacted by the storm is safe.

- The firm provided emotional and mental health resources to associates, delivered a $500 relief check to all associates in impacted counties, and provided additional time off to help them manage their personal situations.

Record Revenue and Net Income

- Despite the significant decline in equity markets during the year, the company generated record net revenues and record pre-tax income for the fourth quarter and fiscal year.

- The private client group had strong retention and recruiting of financial advisers contributed to industry-leading growth with domestic net new assets of 9% over the fiscal year.

- Annual investment banking results were very strong, only 3% lower than the record results achieved in fiscal 2021.

- The bank segment loans grew 73% year-over-year and 3% during the quarter, reflecting attractive growth across nearly all loan categories.

Acquisition and Expansion

- The acquisition of SumRidge Partners on July 1st has enhanced the fixed income platform with technology-driven capabilities and a fantastic team with extensive experience dealing with corporates.

- The Charles Stanley acquisition completed earlier in the year significantly expanded our presence in the U.K.

- The acquisition of TriState Capital Bank this year added a best-in-class third-party securities-based lending capability, while also diversifying our funding sources.

Quarterly and Full Year Results

- The firm reported record net revenues of $2.83 billion, record pre-tax income of $616 million and net income available to common shareholders of $437 million or earnings per diluted share of $1.98 in the fiscal fourth quarter.

- The company generated record net revenues of $11 billion and record pre-tax income of $2 billion, both up 13% over fiscal 2021 for the fiscal year.

Effect on Client Assets

- Equity market declines in the quarter negatively impacted client asset levels.

- We ended the quarter with 8,681 financial advisers in PCG, a net increase of 199 over the prior year period and 65 over the preceding quarter.

- Total client domestic cash sweep balances declined 12% to $67.1 billion or 7% of domestic PCG assets under administration.

Q & A sessions,

Private Client Group

- Expected 4% sequential decline in asset management fees and related administrative fees for next quarter

- Optimistic for industry-leading growth in the long-term with current and prospective advisers attracted to client focused values and leading technology

- Continued benefits from higher short-term interest rates despite expected cash sorting as the Fed increases short-term interest rates

Capital Markets

- M&A pipeline remains strong, but the pace and timing of closings heavily influenced by market conditions

- Confident for growth given significant investments made over the past five years

Fixed Income

- Challenging environment expected in fiscal 2023 due to shift in dynamic where depository clients have less cash available for investing in securities

- Expect SumRidge Partners to enhance current position in rapidly evolving fixed income and trading technology marketplace, which typically benefits from elevated rate volatility

Asset Management

- Financial assets under management starting the fiscal year lower due to decline in equity and fixed income markets

- Confident for strong growth of assets in fee-based accounts in private client group segment to drive long-term growth of financial assets under management

- Raymond James Investment Management expected to drive further growth through increased scale, distribution, operational, and marketing synergies

Bank Segment

- Well positioned for rising short-term interest rates with ample funding and capital to grow balance sheet prudently

- TriState Capital Bank to be operated separately with respect to its relationships with its clients, which coupled with strong capital and funding, should foster ongoing growth

- Credit quality of bank’s loan portfolio remains strong

Non-compensation Expenses

- Full quarter of results for TriState Capital and SumRidge, which sequentially added about $25 million of non-compensation expenses

- Technology investments to support advisers, clients, and all businesses and functions across the firm will continue to be a significant focus for growth

- Potential best guess for fiscal 2023 is $1.7 billion in non-compensation expenses, representing around 1.5% growth sequentially each quarter in 2023

Securities Portfolio

- Expect buildup in securities to run-off over the next year to fund loan growth

- Duration associated with mortgage portfolio gives same type of protection as securities

- Excess cash beyond loan growth would be invested in securities as good return, along with cash swept off to third-party banks