Quest Diagnostics Incorporated

CEO : Mr. James E. Davis

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

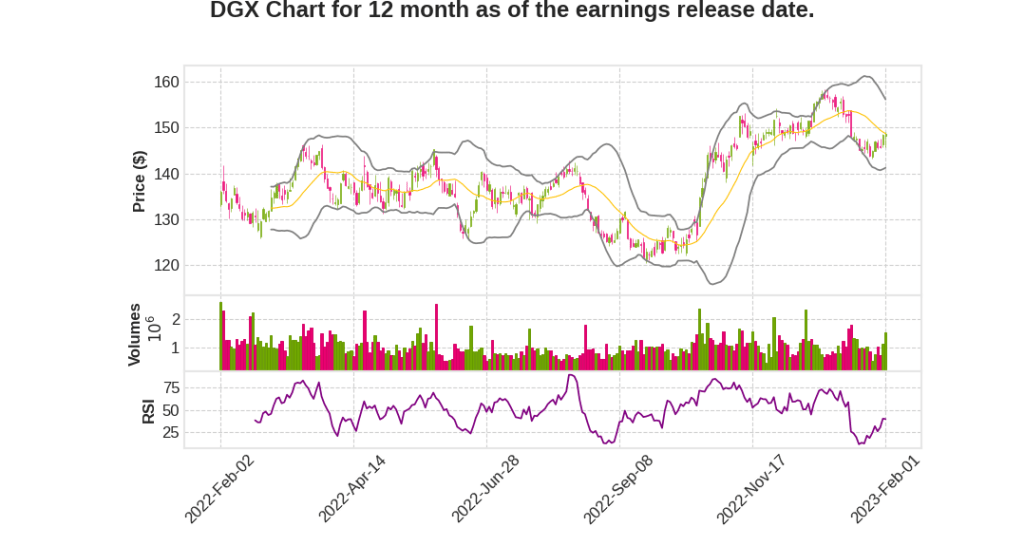

| 2022 Q4 | -15.0% YoY | -75.0% | -72.0% | 2023-02-02 |

Jim Davis says,

Revenue and Earnings

- Base business revenues grew by more than 6% in Q4 2022 and 5% for the full year.

- Total revenues were $2.3 billion in Q4 2022 and $9.9 billion for the full year 2022.

- Earnings per share were $0.87 on a reported basis and $1.98 on an adjusted basis in Q4 2022, while for the full year, earnings per share were $7.97 on a reported basis and $9.95 on an adjusted basis.

COVID-19 Testing

- COVID-19 testing revenues declined but still exceeded $1.4 billion in 2022.

- COVID-19 volumes have steadily declined since late December, and Quest expects COVID-19 revenues to be significantly lower in 2023 compared to 2022.

- The company has lowered its prior COVID-19 volume expectations in 2023 from 10,000 to 15,000 molecular tests per day to 5,000 to 10,000 tests per day.

M&A Pipeline and Value-Based Contracts

- Quest completed the acquisition of Suma Health’s outreach laboratory services business and entered into an agreement to acquire select assets of Northern Light Health’s outreach laboratory services business located in Maine.

- The company’s M&A pipeline is strong, including potential deals with health systems, small regional labs, and other capability-building assets.

- Quest continues to gain traction with value-based contracts and has started to benefit from incentives related to these contracts.

Automation and Productivity Improvements

- Quest is increasing its efforts to drive productivity and expand margins in its base business.

- The company continues to drive additional productivity improvements with lab platform consolidation and greater use of automation and artificial intelligence.

- Quest began a new automation conversion project in its Lenexa laboratory, introduced a new highly automated microbiology platform, and realized savings from the urinalysis platform conversion.

SG&A Reduction and Workforce Stabilization

- Quest has taken actions to reduce its SG&A by approximately $100 million in 2023, including workforce reductions of approximately 1.5% primarily in corporate support functions.

- The company has taken actions to stabilize its workforce and improve frontline employee engagement and retention, which is expected to enhance productivity in 2023.

Sam Samad says,

Revenue and Volume

- Consolidated revenues for Q4 2022 were $2.33 billion, down 15% YoY, with base business revenues growing by 6.3% to $2.15 billion.

- COVID-19 testing revenues declined 75% to $184 million, and diagnostic information services revenues declined 15.3% compared to the prior year.

- Total volume, measured by the number of requisitions, declined 11.2% versus the fourth quarter of 2021, with total base testing volumes declining by 0.6% versus the prior year.

Operating Income and EPS

- Reported operating income in Q4 2022 was $135 million or 5.8% of revenues compared to $536 million or 19.5% of revenues in the prior year.

- Adjusted operating income was $330 million or 14.2% of revenues compared to $579 million or 21.1% of revenues in the prior year.

- Reported EPS was $0.87 in Q4 2022 compared to $3.12 in the prior year. Adjusted EPS was $1.98 compared to $3.33 in the prior year.

2023 Guidance

- Revenues for 2023 are expected to be between $8.83 billion and $9.03 billion, with base business revenues expected to be between $8.65 billion and $8.75 billion.

- Covid-19 testing revenues are expected to be between $175 million and $275 million.

- Reported EPS is expected to be in a range of $7.61 to $8.21, and adjusted EPS to be in a range of $8.40 to $9.

- Cash from operations is expected to be at least $1.3 billion, and capital expenditures are expected to be approximately $400 million.

Covid-19 Testing Volumes and Reimbursements

- Covid-19 molecular volumes are expected to average roughly 5,000 to 10,000 tests per day for the full year.

- Volumes are expected to continue to decline throughout the spring and summer but could see a modest uptick during respiratory season in Q4.

- Average reimbursement for Covid-19 molecular testing is expected to continue near recent levels through the end of the PHE, with reimbursements at $51 when the PHE expires in May.

- The company continues to negotiate with health plans regarding coverage policies and reimbursements for Covid-19 testing post-PHE.

Q & A sessions,

Productivity and Pricing

- Targeting roughly 3% of entire cost base for the company (around $6.4 billion) with Invigorate plan for 2023

- $100 million cost takeout is incremental to Invigorate plan

- Expect productivity plan to offset inflation in 2023

- Price all-in across Quest Diagnostics expected to be a positive for 2023

- Expect rate increases at a minimum rate for renegotiated contracts

COVID-19 Testing and Other Business

- Expect COVID-19 testing volumes to remain high in 2023

- Pushing for $51 rate for COVID-19 testing with commercial payors

- Investments in consumer initiated testing, oncology, genomic sequencing services, and pharma services

- Bullish on the country’s need for COVID-19 testing and driving discussions with commercial payors

- Expect growth in prenatal testing and rare genetic disorders

Revenue Projections and Margin Rate

- COVID-19 assumptions will differentiate the bottom versus the top of the revenue range

- Took COVID-19 down by $150 million in total revenues versus projections in October 2022

- Expect investments to be less dilutive in 2023 versus 2022

- Expect $100 million in SG&A reductions over the course of 2023

- Expect margin rate to benefit from specimen collection fee reimbursement