Moody’s Corporation

CEO : Mr. Robert Scott Fauber

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

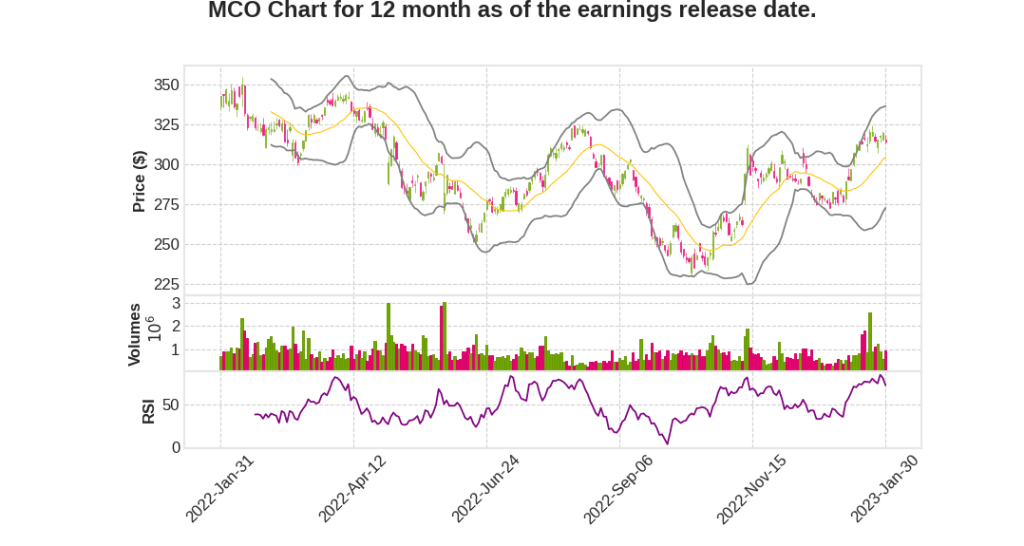

| 2022 Q4 | -16.2% YoY | -40.5% | -41.7% | 2023-01-31 |

Rob Fauber says,

Moody’s Q4 2022 Earnings Call Highlights

- Moody’s Analytics (MA) had a strong finish to the year, delivering its 60th consecutive quarter of growth and 10% ARR growth with revenue growing 15% for the year.

- Moody’s total revenue was $5.5 billion with MA contributing approximately half of the total revenue for the first time in Moody’s history.

- Moody’s adjusted operating margin exceeded 30%, achieving the Rule of 40 distinction.

- MIS generated $2.7 billion in revenue, weathering a challenging year for issuance.

- Moody’s expects revenue to grow in the mid- to high single-digit percent range in 2023 with adjusted operating margin to be in the range of 44% to 45% and adjusted diluted EPS in the range of $9 to $9.50.

Mark Kaye says,

Expense Ramp

- Anticipate operating growth, inclusive of annual merit increases, reset of incentive compensation and incremental organic investments will lead to an expense ramp of between $10 million and $30 million between Q4 2022 and Q1 2023, excluding restructuring-related items.

- From Q1 2023 to Q4 2023, expect expenses to remain relatively stable and only ramp between $10 million and $20 million.

Restructuring

- Expect up to $170 million in aggregate charges through year-end 2023, split into $70 million to $90 million for MIS and $65 million to $80 million for MA.

- In 2022, accrued $114 million in total restructuring charges, up from $85 million guided in October, split into approximately $49 million for MA and $65 million for MIS.

- Estimate up to $15 million in incremental pre-tax personnel-related charges and $20 million to $40 million in real estate charges in 2023.

Q & A sessions,

Issuance Outlook

- 2021 total issuance was more than 35% higher than average from 2009 to 2022 if excluding the 2020 and 2021 years

- 2022 total issuance was down about 5% from the historical average, and corporate issuance was down about 15%

- There might be some upside to the way we think about the medium term if corporate issuance as a percent of the total increases

MA Growth

- MA ARR figure excluding RMS was about 11.4%, up from 10% in the third quarter

- Momentum in portfolio including KYC, life insurance, banking, CreditView Research, and Orbis offering

Issuance Outlook for 2023

- Expecting investment-grade to grow modestly by about 5% for the year, while leveraged finance will grow by about 25%

- Have a pretty healthy backlog of first-time mandates that did not go to market last year

Decision Solutions Business

- Organic constant dollar basis growth of 15% in Q4 2022 and about 11% growth in ARR for the full year

- Strength in KYC, life insurance, and banking businesses, as well as the CreditView Research and Orbis offering

Margin Expenses and Private Credit Space

- Making sure we have the right resources to monitor over $70 trillion in rated debt and service the flow of new issuance

- Restructuring exercise to get more efficient in the business

- Opportunity to address the private credit market and provide independent credit assessments, credit scoring, company data, benchmarking portfolio management, and ESG support