Mohawk Industries, Inc.

CEO : Mr. Jeffrey S. Lorberbaum

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

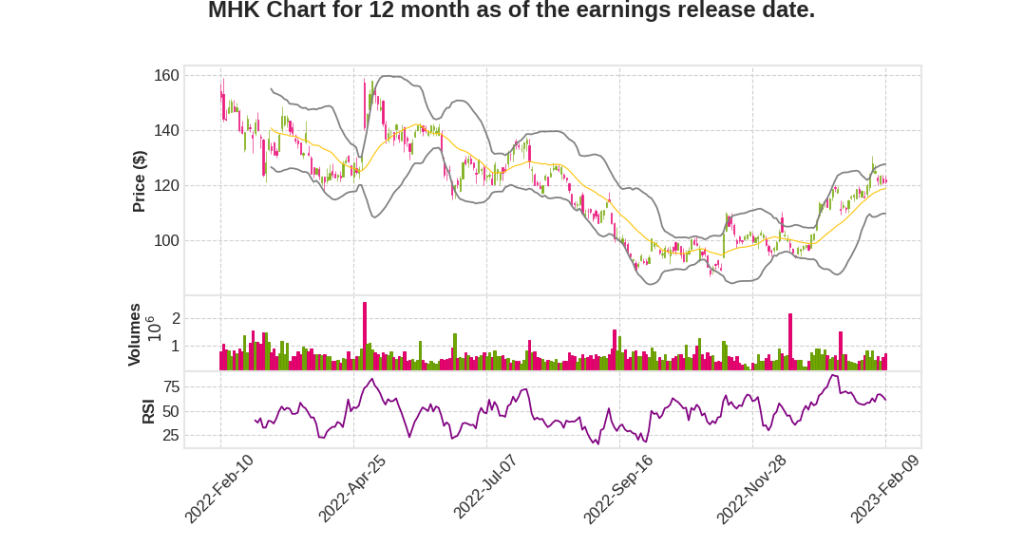

| 2022 Q4 | -4.0% YoY | -75.9% | -81.1% | 2023-02-10 |

Christopher Wellborn says,

Ceramic Segment

- Residential ceramic sales in all geographies are slowing and operating margins are contracting due to lower volumes and manufacturing shutdowns.

- Cost inflation increased as higher energy and transportation expenses from prior periods were incurred.

- Reducing discretionary spending and limiting capital investments.

- To support additional growth in our quartz countertop sales, we are adding manufacturing capacity by the end of this year.

- The Ceramic business in Europe remains under pressure with slowing demand, customer inventory reductions and inflation.

- We have completed the acquisition of Elizabeth in Brazil and are awaiting regulatory approval to close Vitromex in Mexico.

Flooring Rest of World Segment

- The segment was impacted by high inflation in energy prices and consumers reduced investments in Home Improvement.

- Our sheet vinyl sales outperformed our other flooring categories as consumers chose lower-priced alternatives.

- We’re adding new rigid production that makes smaller runs with additional patented features. We will phase out of the residential-flexible LVT products and will close the supporting production.

- Our Insulation business is growing as conserving energy has become a higher priority and building requirements have increased.

Flooring North America Segment

- Flooring North America sales decreased faster than anticipated, primarily due to declines in residential channels, rug and customer inventory reductions.

- Our hard surface products outperformed soft and the commercial sector remains stronger than residential with hospitality showing the most growth.

- During 2022, we reduced our costs through process enhancements and rationalization of less efficient facilities while absorbing historically high inflation.

- Our commercial business remains solid as remodeling and new construction projects continue.

Residential Soft Services Segment

- Sales weakened as retailers reduced inventory with declining consumer sentiment and home sales.

- The multifamily channel was the strongest performer, and we are realigning resources focused more on this sector.

- Our rug sales were lower as national retailers continue to adjust inventories with reduced consumer spending.

- Our resilient sales grew in the quarter as we leveraged our WetProtect and antimicrobial technologies to differentiate our collections.

- Our Premium Laminate sales were impacted by slowing retail traffic and customer inventory adjustment.

Jeff Lorberbaum says,

Net Sales and Adjusted EPS

- Net sales for 2022 were $11.7 billion, up approximately 4.8% as reported or 8.8% on a constant basis.

- Adjusted EPS for the year was $12.85.

- Net sales for Q4 2022 were $2.7 billion, down 4% as reported or approximately 1.3% on a constant basis, and adjusted EPS was $1.32.

Market Environment

- The flooring industry entered 2022 with momentum from strong housing markets supported by record home sales, low interest rates and rising household formations.

- High home equity levels, shifts to larger homes, and the desire to customize living spaces during the pandemic were driving remodeling investments.

- In the first half of the year, the company implemented pricing actions and production that offset the inflation incurred.

- With reduced home sales and remodeling in the second half of the year, the company’s Flooring volumes decreased.

- Commercial and new construction and remodeling activity outperformed residential throughout the year.

Acquisitions

- The company acquired five bolt-on businesses during the year, extending the scope of their product offering and distribution.

- They acquired Elizabeth in Brazil and are awaiting regulatory approval to close Vitromex in Mexico, both of which will almost double their local market positions in ceramic and expand their customer base and product offering while improving their manufacturing capabilities.

- The teams are preparing to integrate the businesses, which will create significant sales and operational synergies.

Segment Performance

- The Global Ceramic segment outperformed the others due to a higher level of commercial and new construction sales in Q4 2022.

- The Flooring Rest of the World segment softened as higher inflation and energy costs reduced demand in Europe.

- The Flooring North America segment sales declined with lower residential activity and a reduction in customer inventory levels.

- In both Flooring North America as well as Flooring Rest of the World, they’re taking restructuring actions in specific areas to align their operations with the present market conditions.

Q & A sessions, Industry Challenges and Mohawk’s Response

- The flooring industry is experiencing a slowdown due to higher interest rates, inflation, and low consumer confidence.

- Mohawk is adjusting its business by reducing production level, inventory, cost structures, and capital expenditures.

- The company is implementing restructuring actions to streamline operations, reduce SG&A, and rationalize higher-cost assets.

- Mohawk is refocusing its sales teams on the best-performing channels and introducing new innovative collections and merchandising as well as targeted promotions to improve sales.

Financial Guidance

- First quarter EPS is anticipated to be between $1.24 and $1.34, excluding restructuring and other charges.

- The second quarter is expected to have sequentially stronger improvement with seasonally higher sales, increased production, and lower material costs.

- The long-term demand for housing will require significant investments in new construction and remodeling, which Mohawk is uniquely positioned to benefit from.

Business Investments

- Mohawk is adding laminate, which has been a growing category, as an alternative to LVT and is actually more resistant to scratches and more durable.

- The company is increasing its quartz countertop business to support greater sales.

- Investments in LVT in the western part of the country should support broader local-based production of it and should give us advantages by having both East Coast and West Coast production.

- Mohawk is increasing its production in the ceramic slab and just started up a new insulation plant in Europe.

Q1 Expectations

- Residential sales are slowing, and customers are minimizing inventory.

- Production volumes are lower than last year.

- More pressure on pricing and mix due to industry volume and competition.

- Inflation is impacting labor costs around the world.

Acquisitions

- Mohawk is concluding two ceramic acquisitions in Brazil and Mexico, putting the company in either the first or second position in each marketplace and enabling it to have a complete offering from top to bottom in both marketplaces.