MarketAxess Holdings Inc.

CEO : Mr. Christopher R. Concannon

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

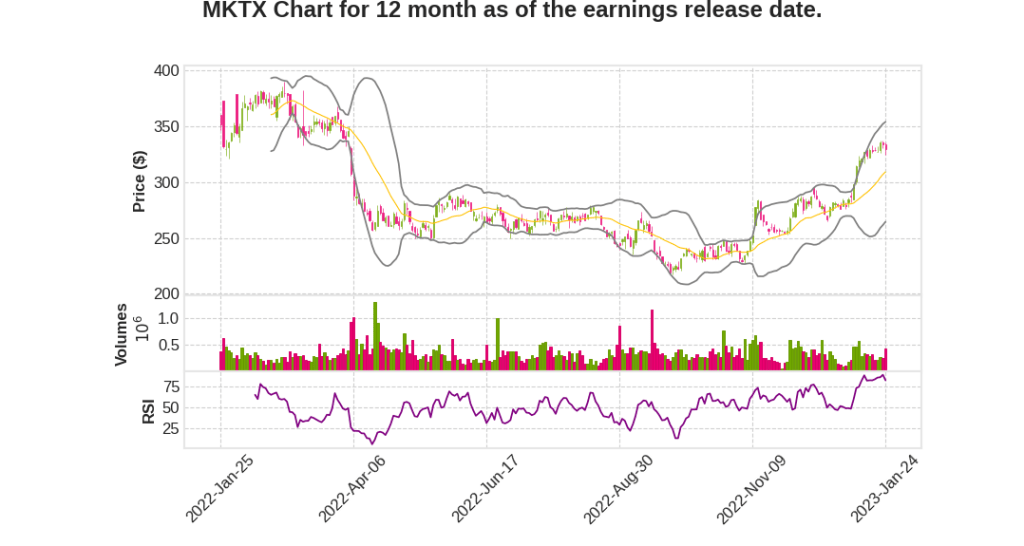

| 2022 Q4 | 7.8% YoY | 8.3% | 13.7% | 2023-01-25 |

Chris Concannon says,

Strong Market Share Gains in Global Credit

- MarketAxess has achieved strong market share gains in global credit, which reflects the sizable revenue opportunity ahead

- The current market conditions with higher yields are expected to increase the demand for electronic trading solutions

- January month-to-date has shown solid double digit growth year-over-year and sequentially in total credit ADV

Diversity of Liquidity Pool and High Levels of Price Improvement in Open Trading

- MarketAxess delivered price improvement of $945 million in Open Trading for the full year, well in excess of the annual revenue of $718 million

- Open Trading is able to deliver high levels of price improvement by increasing market participation and bringing a multitude of investment banks, systematic and alternative funds, ETF market makers and institutional investor clients into one unique pool of liquidity

- Regulators have become more focused on protocols that support liquidity and market resiliency, which is a particular focus in the rate space where MarketAxess is well positioned with its all-to-all solution in U.S. treasuries

Increasing Momentum with Automation and Credit Trading

- Automation tools are critical to solving cost constraints and delivering high quality execution for clients

- Automated trading volume and number of no-touch trades increased to a record $62 billion and 383,000 respectively, reflecting strong adoption

- The use of dealer algorithms continues to grow across the platform

- MarketAxess is launching its Adaptive Auto-X solution in the first half of this year, which will provide algorithmic workflows for clients to systematically access broader liquidity across multiple trading protocols

Record Volume in Portfolio Trading

- The fourth quarter was a record for portfolio trading with total volume of $31 billion, up 135% year-over-year

- Approximately 65% to 70% of the portfolio trading activity is currently using electronic trading venues

- MarketAxess estimates that it had a 31% share of the electronic portfolio trading market, up from 17% in the prior year

Positive Outlook and Growth Opportunities

- The strength of MarketAxess’ franchise in terms of product and geographic breadth has never been stronger

- MarketAxess is well positioned to capitalize on the growth opportunities ahead

Richard McVey says,

Revenue and Earnings Growth

- MarketAxess delivered 8% revenue growth, 10% adjusted for currency, EBITDA growth of 10% and EPS growth of 15% in Q4 2022.

- The company delivered its 14th consecutive year of record annual revenue.

Market Share Gains

- MarketAxess recorded the third consecutive quarter of record market share gains across nearly all its product areas.

- Record estimated market share in high-yield in municipals, record share in Eurobonds and accelerating share gains of almost 300 basis points in emerging markets.

- A record 38% of the company’s credit volume was executed through Open Trading, which has been a key driver of its estimated market share gains.

Liquidity and Trading Volume

- The deep pool of liquidity on MarketAxess platform continues to expand with nearly 2,100 active client firms and a record number of active traders.

- Over 1,300 client firms provided liquidity on the MarketAxess platform in the full year 2022.

- MarketAxess saw especially strong growth in its international business with over 1000 active client firms and nearly 6,000 active traders.

- The importance of MarketAxess’ all-to-all liquidity increases as traditional sources of liquidity have become scarce.

New Leadership

- Chris Concannon, a proven leader, deeply experienced in electronic markets, will assume the CEO role in April.

- The current CEO will take on the new role of Executive Chairman.

Market and Credit Conditions

- The Fed raised the Fed funds rate a total of 425 basis points in 2022, making it the fastest rate hike cycle since 1980-1981, leading to an unprecedented 14% decline in investment grade indices for the year.

- The decline in duration directly impacted high-grade fee capture for institutional client e-trading activity.

Q & A sessions,

Mutual Fund Inflows

- Outflows have turned into inflows, opening up the new issue calendar for the high-grade market

- Retail numbers are up and ETF assets are growing

Fixed Income Market

- Quantitative easing caused significant changes in client asset allocation over the last three or four years, resulting in underweight fixed income, but this is changing

- The increasing demand for liquidity and capital is driving small tickets and requires automation

- The Open Trading order books are seeing significant increases in market participants, both in market makers as well as systematic credit funds

Electronic Trading

- High-grade has seen the highest adoption of electronic trading, followed by high-yield, emerging markets, and munis

- Predicts much higher levels of electronic adoption across fixed income landscape, aiming for 90% adoption rate

Operating Expenses

- 16-17% of total operating expense base is variable

- Compensation is the biggest uplift year-over-year, followed by T&E resuming to more normalized levels

- Depreciation and amortization account for 10% of $40 million in operating expenses

Portfolio Trading

- Growth rate of portfolio trading volume has slowed dramatically due to increased volatility

- Greater concentration in terms of the dealers that are printing portfolio trades

- Client behavior on where they think they’re going to get best execution affects the quality of pricing that comes through in portfolio trading