Marsh & McLennan Companies, Inc.

CEO : Mr. John Quinlan Doyle

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

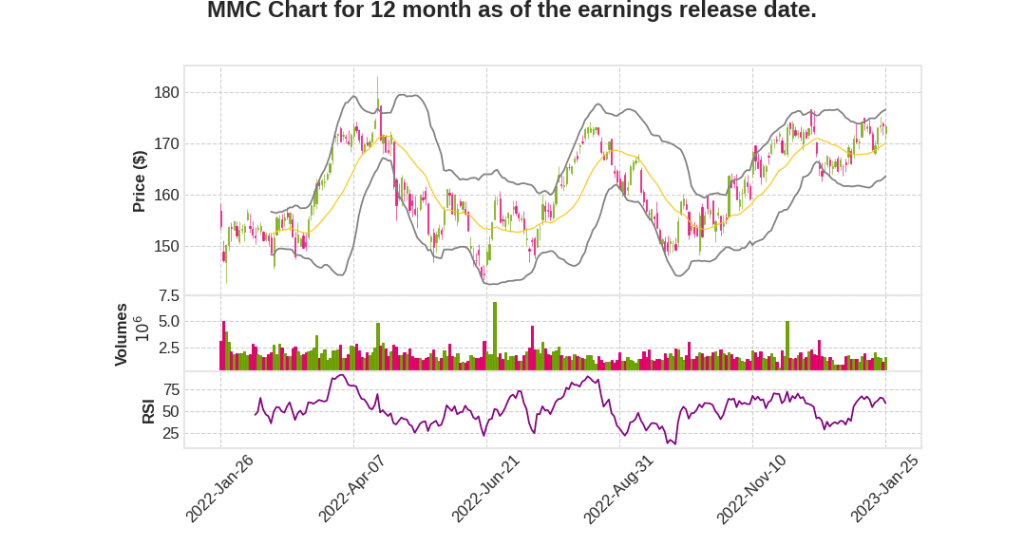

| 2022 Q4 | -2.2% YoY | -36.2% | -42.5% | 2023-01-26 |

ceded says,

Financial Performance

- Generated adjusted EPS of $1.47, up 8% YoY or 12% excluding forex impact

- Underlying revenue grew 7% with growth in all businesses

- Adjusted operating income growth of 13% and adjusted operating margin expanded 160 basis points YoY

Economic Outlook

- Mixed economic picture with risks of recession, but factors supporting growth for business

- Softer real GDP growth offset by elevated inflation, driving higher insured values and loss costs

- P&C insurance rates continue to increase as insurers account for rising frequency and severity of catastrophe losses, risks of social inflation, and higher reinsurance costs

- Healthcare costs continue to rise due to higher wages and labor shortages

- Demand for services typically rises in volatile and uncertain times

Global Risks and Business Strategy

- Global risks extend beyond economic and insurance cycle concerns

- Cost of living crisis, failure to mitigate and adapt to climate change, extreme weather, natural resource crises, erosion of social cohesion, cybercrime and geo-economic confrontation among top risks facing society over near-term and next decade

- Working with clients to meet challenges, build resilience and capture new opportunities

- Expect mid-single-digit or better underlying revenue growth in 2023 and strong growth in adjusted EPS

Outlook and Uncertainty

- Track record of resilience across economic cycles

- Assumes current macro conditions persist, but meaningful uncertainty exists and economic backdrop could be materially different

Overall, Marsh McLennan had an outstanding year in 2022 with strong financial performance, record revenues and earnings, and a positive economic outlook for 2023. Demand for their services typically rises in times of volatility and uncertainty, and they are well-positioned to meet global risks and capture new opportunities. However, meaningful uncertainty remains and the economic backdrop could be materially different.

John Doyle says,

Impressive Q4 2022 Results Reported

- Generated 9% underlying revenue growth, continuing the best period of growth in more than two decades with each of our businesses delivering strong results

- Total revenue surpassed $20 billion

- Adjusted operating income grew 11% to $4.8 billion on top of 18% growth in 2021

- Reported adjusted margin expansion for the 15th consecutive year

- Adjusted EPS growth was 11%

Successful Capital Return to Shareholders

- Raised dividend by 10%

- Completed $1.9 billion of share repurchases, the largest annual amount in our history

Strategic Investments in Talent

- Performance included costs related to strategic investments in talent

CEO’s Positive Outlook for the Future

- CEO is confident that the company is well positioned for the years ahead

- Leadership team is focused on delivering full capabilities of Marsh McLennan to clients, continuously improving client and colleague experience, efficiently managing capital, and driving growth and value for shareholders

Client and Colleague Experience Focus

- Leadership team is focused on continuously improving the client and colleague experience

Q & A sessions,

Employee Turnover and Wage Pressure

- Voluntary turnover was elevated in the early part of the year but moderated in the second half.

- Wage pressure has been manageable, and the company is being thoughtful about merit pools and allocation.

- The company has a strong culture, which attracts outstanding talent.

Business Strategy and Market Position

- The company has been in the right businesses for nearly seven years, with market-leading brands.

- Continuous improvement and excellent financial performance remain a focus.

- Collaboration and efficiency across the business are essential for client success.

- Unique capabilities will be leveraged to accelerate client impact, and opportunities will be pursued.