The Mosaic Company

CEO : Mr. James C. O’Rourke P.Eng.

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

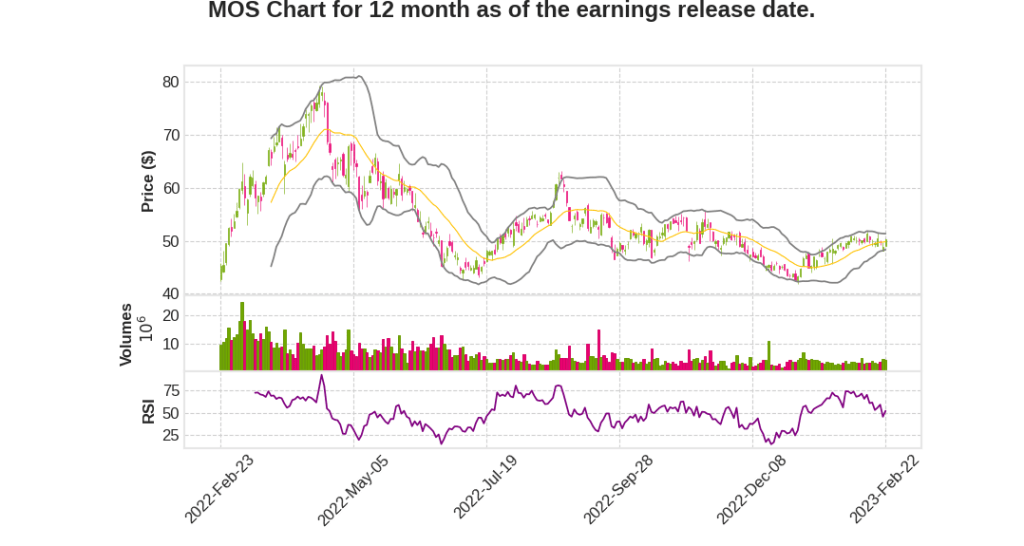

| 2022 Q4 | 16.7% YoY | -27.8% | -13.5% | 2023-02-23 |

Joc OâRourke says,

Financial Performance

- Mosaic had a record year in 2022 with revenues of $19 billion, adjusted EBITDA of $6.2 billion, and adjusted earnings per share of $11.01.

- The company generated strong free cash flow, allowing it to return significant capital to shareholders, including share repurchases of $1.7 billion and dividends of nearly $200 million.

Market Fundamentals

- The agriculture and fertilizer markets remain constructive, with global stocks-to-use ratios at 25-year lows and ongoing food security concerns.

- Fertilizer shortages are still prevalent in many key agricultural markets, threatening global crop production and underpinning strong crop prices.

- Phosphate and potash prices are now half of what they were at the peak, improving farmer affordability and suggesting a strong rebound in demand.

Operational Milestones

- Several operational milestones were reached in 2022, including K3 reaching its initial capacity of 5.5 million tons and the growth of distribution market share in Brazil from 16% to 18%.

- The company is expanding its MicroEssentials capacity and exploring new markets like food production and batteries.

Balance Sheet Management and Shareholder Capital Returns

- Mosaic remains committed to its approach to balance sheet management and shareholder capital returns, retiring $550 million in long-term debt and reducing long-term debt by $1 billion.

- The company plans to return substantially all of its free cash flow to shareholders in 2023 through a combination of share repurchases and dividends, including a $300 million accelerated share repurchase program in the first quarter and a special dividend of $0.25 per share.

Joint Venture Performance

- Mosaic’s joint venture in Saudi Arabia is performing well, with equity earnings totaling $195 million in 2022 and plans to reduce debt by $800 million in 2023.

Jenny Wang says,

Impact of shipment reduction on yield

- Over 11 million tons shipment reduction last year may have impacted the yield in some markets.

- In markets like North America and Brazil, farmers may not have been able to afford reducing application rate for two consecutive years.

- Therefore, the demand for potash in these markets is expected to recover as farmers aim to maximize their production.

Government support for potash use

- Some governments are supporting their farmers to use potash to secure food security.

- This government support is expected to continue in 2023.

Spring demand for potash

- There is a clear desire among farmers in North America to go back to applying potash, especially for those who skipped a season or cut the rate last year.

- The farmers need to engage with their retailers and then the retailers to cover the last part of the buying from MOS.

- Increasing inquiries in the south part of the U.S. indicates a recovering demand for potash.

Supply constraint and price

- Despite a recovering demand, there is still a significant constraint on supply.

- The price is expected to remain at a healthy level, although it is much more moderated from last year.

Q & A sessions,

Impact of Potash Market

- Low potash usage last year resulted in depleted soil levels and increased demand for potash this year.

- Expectation of good farmer demand in North America and Brazil, but people are waiting for the last moment to avoid price risk.

- Production may be limited as Russia and Belarus are expected to export less than in the past.

Second Half of 2022 Expectations

- Reversal in prices from the first half of the year impacting distribution and production business.

- High cost raw materials such as sulfur and ammonia are being worked through the system. Margins expected to return to normal after Q1.

Challenges Faced in Production Business

- Various extraordinary circumstances have impacted production in the past including sulfur shortages, refinery shutdowns, and natural disasters.

- Efforts being made to improve plant resilience to such occurrences through fortification and reinforcement of plants.

- Expectation of running at 85%-90% of the 10-K value for phosphates and Brazilian businesses.

Pricing and Demand Expectations

- Expectation of potash and phosphates prices moving up as the season gets moving.

- Summer fill program should be strong in North America while Brazil market will be more stable throughout the year.

- Expectation of ramp up in demand from Central America, China, India, Asia, and Indonesia and Malaysia.

- Challenge in maintaining farmer affordability with price spikes and yield drops.

Impact of Fertilizer Market on Poorer Parts of the World

- Demand affected in Africa as they are buying for subsistence farming and struggle with affordability even with high crop prices.

- Asia expected to be able to afford fertilizer but the poorest parts of the world will struggle.

Capability of Making Grades of Purified Phosphoric Acid Required for Batteries

- Testing phase completed and able to make required grades.

- Discussion ongoing for LFP lithium iron phosphate plants in the U.S.