Monolithic Power Systems, Inc.

CEO : Mr. Michael R. Hsing

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

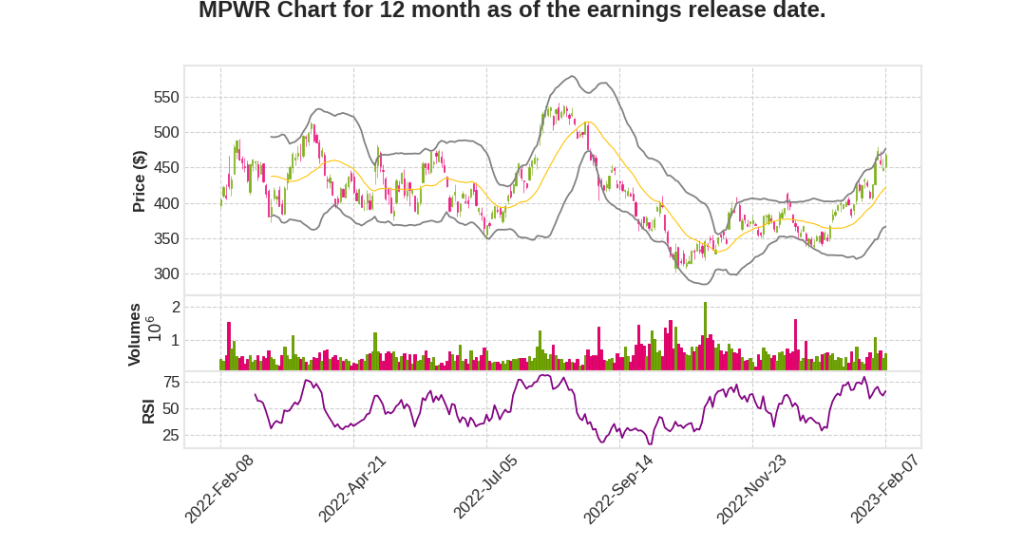

| 2022 Q4 | 36.7% YoY | 60.1% | 60.1% | 2023-02-08 |

Genevieve Cunningham says,

Overview

- Discussion of MPS Fourth Quarter 2022 Earnings

- Forward-looking statements and projections involve risk and uncertainty

- Risks, uncertainties, and other factors that could cause actual results to differ.

Financial Measures

- Gross margin, operating expense, R&D and SG&A expense, operating income, other income, income before income taxes, net income, and earnings on both a GAAP and a non-GAAP basis will be discussed.

- Non-GAAP financial measures are not prepared in accordance with GAAP and should not be considered a substitute for or superior to measures of financial performance prepared in accordance with GAAP.

- A table outlining the reconciliation between non-GAAP financial measures to GAAP financial measures is included in the Q4 and full year 2022 earnings release.

Growth

- The company experienced significant growth in the past year due to increased demand for its products.

- The company is continuing to invest in research and development to sustain this growth.

Webinar Details

- The conference call is being webcast live over the Internet.

- The webinar will be available for replay on the company’s website for one year.

Guidance

- The company will provide guidance for the upcoming year during the earnings call.

- The guidance will include projected revenue, expenses, and earnings.

Shock

- The company experienced a shock in production due to supply chain disruptions.

- The company has taken steps to mitigate these disruptions and is working to restore production to normal levels.

New Factory

- The company has opened a new factory to increase production capacity.

- The factory is equipped with state-of-the-art technology to improve efficiency and reduce costs.

Michael Hsing says,

Launch of MPS in Remote Technical Support

- The launch of MPS in remote technical support helped a lot in ramping up the modules side.

- Customers can now schedule a meeting online and have their technical issues solved when they’re logging in.

Ramp-up is from MPS now more than the website

- The most part of the ramp-up is from the MPS rather than the website.

E-commerce Resistance

- There is a lot of resistance in e-commerce as it takes time for engineers to change their behaviors in designing and purchasing products.

- Products are designed for easy plugging and play use and purchasing from the internet.

Behavior Changes in Engineers

- Engineers are changing their behavior towards designing products as they want to do Google searches rather than the fundamental design like 20 years ago.

Longer Timeframe for Changes

- It will take time to see changes in e-commerce behavior, possibly 10-12 years for millennials and the next 5-10 years for other generations.

Q & A sessions,

Revenue Growth

- MPWR reported a revenue growth of 15% YoY for Q4 2022.

- The company attributed this growth to strong demand in the automotive and industrial markets.

- The revenue was also higher than the company’s guidance range.

Margin Expansion

- MPWR reported a gross margin of 62.5%, which is higher than the previous quarter and the same quarter last year.

- The company attributes this to strong product mix and cost management initiatives.

- The company expects to continue improving margins in the upcoming quarters.

Guidance

- MPWR provided a strong revenue guidance for Q1 2023, with an expected growth of 10-15% YoY.

- The company also expects gross margins to continue improving in Q1 2023.

- The company plans to continue investing in R&D and expanding its product portfolio to drive future growth.

Acquisition

- MPWR announced the acquisition of a small semiconductor company, which is expected to enhance its product offerings and strengthen its position in the market.

- The acquisition is expected to close in the next quarter.

Dividend

- MPWR announced a 10% increase in its quarterly dividend.

- This reflects the company’s strong financial performance and commitment to shareholder returns.