MSCI Inc.

CEO : Mr. Henry A. Fernandez

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

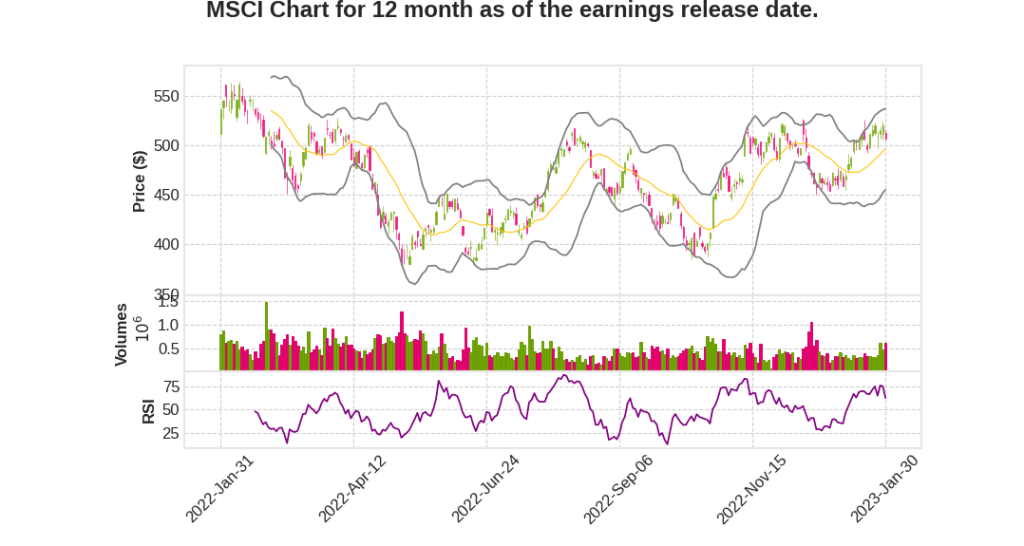

| 2022 Q4 | 4.8% YoY | 7.9% | 14.5% | 2023-01-31 |

Andy Wiechmann says,

Summary of MSCI Q4 2022 Earnings Call Transcript

- Organic subscription revenue growth nearly 16% for the quarter and 15% for the full year, outperforming the long-term target of low double-digit growth.

- Subscription run rate growth was 12% in the quarter, 36th consecutive quarter of double-digit growth, and continued momentum in nonmarket cap index modules with collective subscription run rate growth of 14%.

- Market appreciation contributed approximately $119 billion to AUM balances of equity ETFs linked to MSCI indexes. Equity ETFs linked to MSCI ESG and climate indexes experienced inflows of $6.5 billion.

- Subscription run rate growth was nearly 7% in Analytics, excluding FX, with tremendous strength in factory analytics and climate tools. Climate segment run rate reached $79 million, an increase of 80% from a year ago.

- Expense discipline, coupled with subscription revenue growth, drove strong growth in adjusted EPS even through tough environments. Price increases contributed about 35% of new subscription sales firm-wide across all products and more than 40% within index.

- 2023 guidance reflects the assumption of continued volatility in financial markets with overall equity market levels down slightly from current levels during the first half of the year and gradually recovering in the second half of the year.

Baer Pettit says,

1. Strong Organic Growth in Index

- Delivered 12% organic recurring subscription revenue growth and 95% retention

- Subscription run rate in custom indexes grew 15%

- Record full year revenue of $61 million in listed futures and options

- Sales of structured products linked to indexes grew by more than 60% year-on-year

2. Opportunities in Fixed Income Indexes

- Fixed income ETF AUM linked to MSCI’s proprietary and partner indexes was $46 billion at the end of December

- Attracted more than $19 billion of inflows during 2022

- Flanking strategy in ESG and climate and forging partnerships in fixed income space have been growth enablers

3. Analytics Growth

- 7% subscription run rate growth, excluding FX

- Large business in enterprise risk and performance, which drove about 60% of new subscription sales

- Investments in modern, flexible distribution channels are enabling MSCI to chip away at new opportunities

- Strong pipeline for climate use cases in upcoming year

4. Climate Remains an Attractive and Tangible Opportunity

- Delivered $79 million of run rate, growing around 80% year-over-year across all MSCI product lines

- Recent launch of total portfolio footprinting tool helped close strategic deals with asset managers, banks, insurance companies, and others

- Enabled clients to align with emerging PCAP standards and help with TCFD reporting, climate stress testing, and scenario analysis

5. MSCI One

- Not a new product or a stand-alone new platform to replace other products

- A vehicle for integrating MSCI’s world-leading content and analytics using software powered by Azure

- Provides clients with a common entry point to access key products and applications

Q & A sessions,

Retention Rates

- Overall strong retention rates for full year

- Cautious about sustained market pullback leading to clients pulling back in certain areas

Analytics Margin

- Higher level of expenses related to development work capitalized

- Many downturn actions have hit analytics

- Analytics has benefitted from strong US dollar

Sales and Cancels within Analytics

- Concentration of few large cancels due to competitive and client event-related dynamics

- Encouraged by momentum and improving competitive position in strategic areas

- Committed to long-term growth targets

Market Assumptions and Guidance

- Assuming market levels decline slightly through first half of year and rebound in second half

- Cautious on free cash flow guidance due to slowdown in collection cycles

- Growing investment spend in 2023 by 13%, but being disciplined in expense growth

- Have numerous levers to manage expenses if needed

ESG and Climate Segment

- Very strong year overall

- Climate within ESG and Climate segment growing at close to 80%

- Growth rate likely dynamic, but overall demand strong

Index Subscription Business

- Remarkable strength in established client segments like asset owners and asset managers

- Seeing strong momentum within market cap modules

- Overall healthy dialogue and momentum, but conscious of potential impact from environment