Motorola Solutions, Inc.

CEO : Mr. Gregory Q. Brown

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

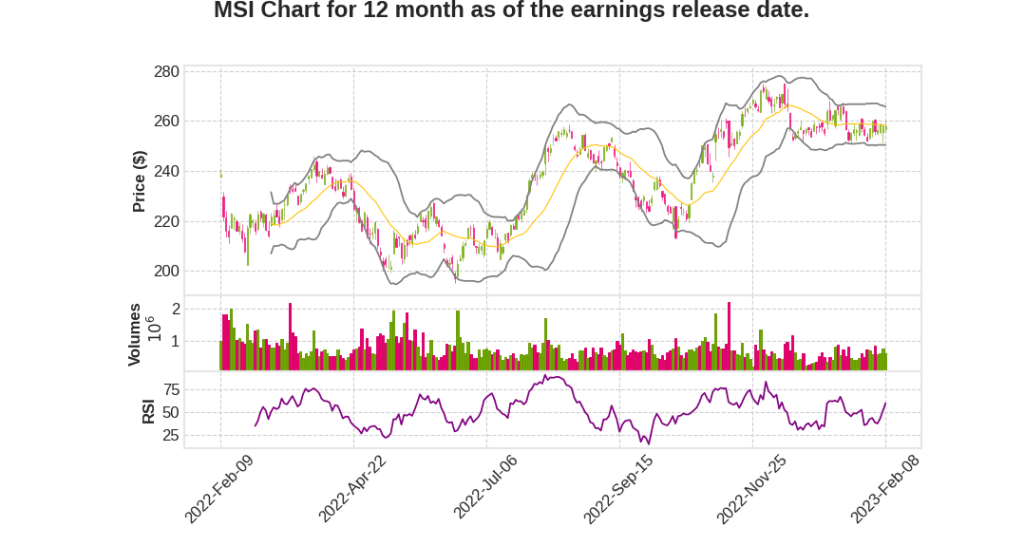

| 2022 Q4 | 16.6% YoY | 26.0% | 47.9% | 2023-02-09 |

Jack Molloy says,

APX NEXT Mid-Tier Launch

- A mid-tier APX NEXT is now available, which will be an accelerant for suburban and county municipalities outside of the big cities.

- $370 million of orders since the product was announced with $210 million of orders in 2022.

ARPA Funding Accelerating P25 Upgrade Cycle

- ARPA funding is expected to be an accelerant to the P25 upgrade cycle.

- City of Houston used ARPA funds and some surplus budgets to move forward with the device.

- 10-year refresh cycle has pulled into a 7-year refresh cycle.

Extended Network and SmartConnect

- The ability to extend the network through mutual events, SmartConnect, and owner experience is driving the demand for the device.

- Upgrading software, cyber fixes, and bug refreshes can be done in 10 minutes leveraging the LTE compatibility.

Location Matters

- GPS provisioning through our CAD networks has been a big add for customers.

Expected Double Orders in 2023

- $210 million of orders in 2022 with the expectation to double orders in 2023.

Greg Brown says,

Record Q4 Results

- Revenue growth of 17%

- Earnings per share growth of 26%

- Expanded operating margins by 150 basis points

- Generated a record $1.3 billion of operating cash flow

- Record ending backlog of $14.3 billion, up $800 million versus last year

Outstanding 2022 Performance

- Products and Systems Integration segment revenue up by 14%

- Software and Services segment revenue up by 8% and 12% when normalized for FX headwinds

- Double-digit growth in both video security and Command Center

- Record backlog, up 22% versus last year

- Expanded operating margins in the Products and Systems Integration segment by 110 basis points despite higher costs related to semiconductors

Positive Outlook for 2023

- Positioned for another year of strong revenue and earnings growth

Q & A sessions,

Revenue Growth and Backlog

- Double-digit revenue growth for the second consecutive year, record sales in both segments and technologies

- Expanded operating margins despite supply challenges related to semiconductors

- Record $14.3 billion backlog, up almost $800 million versus prior year

Acquisition of Rave Mobile Safety

- Adds approximately $70 million of annual recurring revenue for 2023 and expands addressable market by approximately $7 billion

- Helps to accelerate revenue growth, diversify revenue streams, and quadruple addressable market to an estimated $60 billion

Growth Expectations and Funding Environment

- Expecting growth in all three technologies in 2022: LMR to be mid-single digits, video security to be about 15%, and command center to be about 20%

- Multiyear funding horizon for ARPA and strong state budgets add to exceptional funding environment

Land Mobile Radio (LMR) and APX NEXT Device Portfolio Refresh

- LMR remains strong as a platform

- APX NEXT device portfolio refresh includes high-end APX NEXT, mid-tier APX NEXT, and refreshed TETRA portfolio

- PCR returns to prepandemic levels and adds to demand for LMR

- Supply constraints still driving mid-single digit growth guidance

Education and Video Security & Access Control

- Education is the largest vertical in terms of Video Security & Access Control and continues to outpace overall business growth

- Analytics and access control also play a role in school safety

- Domain expertise and market knowledge matter in identifying opportunities for growth in private education systems

Unified Experience in Command Central Market

- Unified experience desired by newer and more technology-savvy dispatchers

- Opportunities to sell different products in different cycles still benefit the company

- Margin opportunity identified in providing unified experience