Mettler-Toledo International Inc.

CEO : Mr. Patrick K. Kaltenbach

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

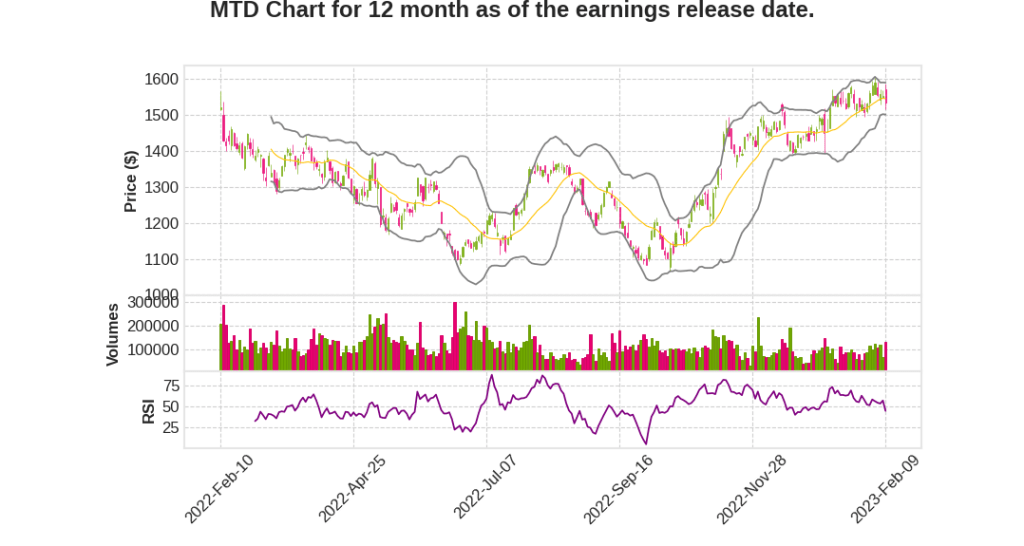

| 2022 Q4 | 2.0% YoY | 18.7% | 17.8% | 2023-02-10 |

Shawn Vadala says,

Sales Growth

- Local currency sales increased by 9% in Q4 2022, with 8% growth in the Americas, 9% in Europe, and 9% in Asia-rest of the world.

- Excluding Russia, sales in Europe grew 13% in Q4 2022 and 9% for the full year 2022.

- Local currency sales grew 11% for the full year 2022 with 12% growth in the Americas, 6% in Europe, and 13% in Asia-rest of the world.

- Excluding Russia, sales in Europe grew 9% in 2022.

P&L Summary

- Gross margin was 59.8% in Q4 2022, an increase of 130 basis points.

- Adjusted operating profit was $358.6 million in Q4 2022, a 12% increase.

- Adjusted operating margin was 33.9% in Q4 2022, representing an increase of 310 basis points.

- Adjusted EPS for Q4 2022 was $12.10, a 15% increase over the prior year or a 24% increase excluding unfavorable foreign currency.

- Adjusted EPS for the full year 2022 grew 17% or 23% excluding unfavorable currency.

Guidance

- Local currency sales growth guidance for full year 2023 is approximately 5%.

- Adjusted EPS for full year 2023 is expected to be in the range of $43.55 to $43.95, representing a growth rate of about 10% to 11% or approximately 11% to 12% excluding unfavorable foreign currency.

- Interest expense for 2023 is forecast to be approximately $78 million and purchased intangible amortization is estimated at $27 million on a pre-tax basis or $0.97 per share.

- Free cash flow for 2023 is expected to be in the range of $900 million and the company plans to repurchase approximately $1 billion of its shares this year.

Patrick Kaltenbach says,

Strong Q4 2022 Performance

- Local currency sales increased by 9% in Q4 2022 compared to the prior year.

- There was broad-based growth across all regions and most product categories.

- Excellent sales growth combined with margin initiatives and cost control led to growth in adjusted operating profit and EPS, despite currency headwinds.

Continued Uncertainty

- There is expected to be continued uncertainty regarding the global economy in 2022.

- The company is expected to face challenging multi-year sales growth comparisons.

Growth and Productivity Initiatives

- The company is confident in their ability to execute growth and productivity initiatives to gain market share and deliver solid financial results.

Financials and Guidance

- Financial details and guidance will be covered by Shawn later in the call.

Q & A sessions,

Lab Business

- Strong sales growth in Q4 with growth across most of the product portfolio, especially in analytical instruments and process analytics

- Pipette business was down due to a decline in pipette tips

- Expect favorable results in 2023, especially from pharma and biopharma customers and faster growing segments like lithium batteries

Industrial Business

- Core industrial had solid growth in each region and continues to benefit from market trends towards automation and digitalization

- Outlook for this year is positive, but business is not immune to potential changes in the economy and will require agility to identify and target growth opportunities

- Product inspection sales were stronger than expected with very strong sales in the Americas, but remain cautious in Europe with softer conditions in packaged foods

Food Retail Business

- Delivered very strong with project activities in the Americas and Europe

- Offset in part by a significant sales decline in China due to disruptions from the pandemic

Service Business

- Service sales grew 11% in Q4 and 12% for the year, contributing 20% of the revenues and a key part of the solution offering

- Two important elements of growth strategy are penetrating the large installed base of instruments and selling service contracts at the point of product sale

- Believe they have the largest installed base of weighing instruments in the world and the largest service network across direct competitors with over 3,000 service technicians around the world

Geography

- Sales in Europe increased 9% in Q4, better than expected with good growth across most product categories, particularly in process analytics and retail

- Americas saw strong growth across product inspection and food retail

- Asia and the rest of the world had another quarter of good growth, led by the lab business with China growing 11% with particularly strong growth in lab