Norwegian Cruise Line Holdings Ltd.

CEO : Mr. Frank J. Del Rio

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

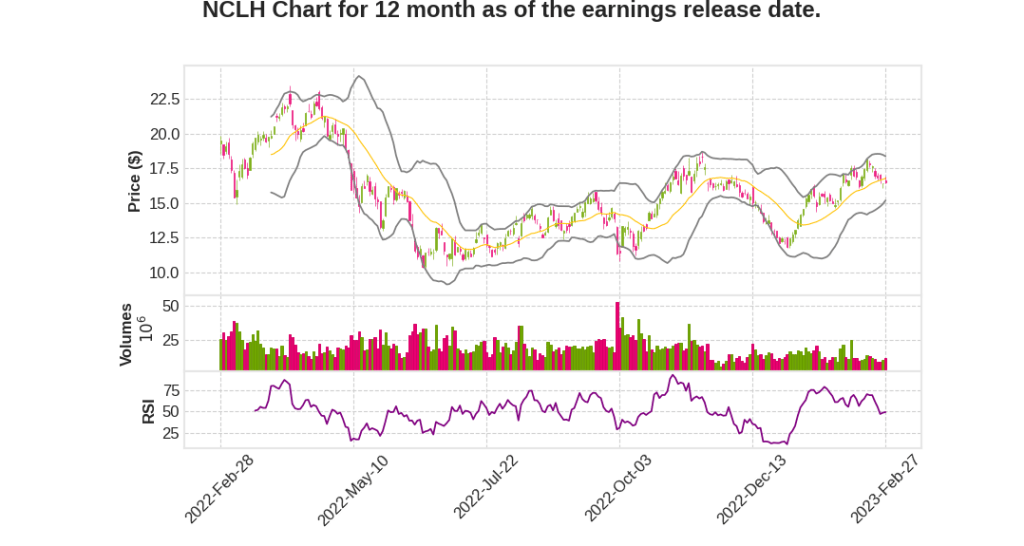

| 2022 Q4 | 211.7% YoY | -59.1% | -71.6% | 2023-02-28 |

Mark Kempa says,

Key Points from NCLH Q4 2022 Earnings Call

- Total revenue per passenger cruise in Q4 2022 was up 24% versus 2019, with net per diems increasing approximately 15%.

- Adjusted EBITDA for the second half of 2022 was nearly breakeven, with positive adjusted free cash flow generated for the first time in three years.

- Full year 2023 adjusted EBITDA is expected to be in the range of $1.8 billion to $1.95 billion, with net per diem growth expected in the range of approximately 9% to 10.5% as compared to 2019.

- Adjusted net cruise cost ex fuel per capacity day is expected to average approximately $160 for the full year 2023, representing a nearly 15% decrease as compared to the second half of 2022.

- Adjusted EBITDA for Q1 2023 is expected to be approximately $195 million, and adjusted EPS is expected to be a loss of approximately $0.45.

Frank Del Rio says,

1. Strong Recovery and Financial Performance

- NCLH successfully concluded its “great cruise comeback” with all vessels reentering service, carrying nearly 1.7 million guests and ending the year in a record booked position for 2023 and at record prices.

- The company maintained industry-leading pricing and achieved several significant milestones on its road to recovery, including reaching financial inflection points.

- Despite the challenges of COVID-19, NCLH achieved robust booking curves and onboard revenue, demonstrating the willingness of consumers to spend on travel and experiences.

2. Strategic Priorities and Cost Optimization

- NCLH is taking actions to align with its strategic priorities and strengthen the foundation for sustained profitable growth.

- The company has initiated a broad effort to improve operating efficiencies and right-size its cost base to rebuild and enhance margins.

- The goal is to identify and evaluate incremental opportunities to reduce costs and maximize revenue generation, while prioritizing delivering an exceptional guest experience and superior service levels.

3. Industry-Leading Newbuild Pipeline

- NCLH has an industry-leading newbuild pipeline with plans to deliver one newbuild for each of its brands in 2023, adding over 5,000 additional berths to its fleet.

- The company has made modifications to its newbuild pipeline, primarily related to the last two shifts in the Prima Class, resulting in approximately 10% to 20% larger gross tonnage and a shift in delivery days.

- NCLH remains confident in its ability to profitably absorb this capacity with continued consumer demand for travel, expansion into unserved and underserved markets, and vast under-penetration compared to land-based vacation alternatives.

4. Booking, Demand, and Pricing Trends

- NCLH’s load factor reached 87% in Q4 2022, demonstrating sequential improvement in closing the occupancy gap versus 2019.

- The ramp is continuing through Q1 2023, with 100% occupancy achieved, leading to a return to historical levels beginning in Q2 2023 and beyond.

- The company achieved another strong result in pricing, with net per DM growth up approximately 14% on an as-reported basis and up 15% in constant currency over 2019.

- Cumulative book position for 2023 is within the optimal range of approximately 60% to 65%, ahead of 2019’s record performance and at higher prices.

5. Positive Booking Momentum and 2023 Guidance

- Positive booking momentum continues, including a very strong wave season that likely started two months earlier than usual.

- November and January were record-breaking months for Norwegian Cruise Line and Regent brand, respectively.

- Cumulative book position and strong demand dynamics give NCLH confidence that it can achieve its 2023 guidance, which will be discussed in more detail by Mark later in the call.

Q & A sessions,

Guidance and Targets

- Company’s internal goal is to turn the year with a 5x handle, which includes an adjustment for the newbuilds that they will take delivery of this year

- Expectation of decreasing costs in sequential quarters with Q1 being the highest cost quarter

- Targeting to achieve pre-pandemic EBITDA per capacity day

Newbuild Pipeline and Sustainability Program

- Transformative growth with almost 50% growth between now and 2028, with scheduled pipeline of deliveries

- Plans to modify contracts for final two PRIMA Class ships for Norwegian Cruise Line scheduled for delivery in 2027 and 2028 to accommodate green methanol as an alternative fuel source

- Sail & Sustain program made meaningful progress to advance commitment to pursue net zero greenhouse gas emissions

Marketing Strategy

- Basic go-to-market philosophy is to market to fill, not discount to fill

- Company will now start paring back on marketing spend as bookings continue to be strong

- Added three new ships that need to be filled, but marketing costs will come down on a per capacity day basis

Guests and Overall Industry

- New guests and past guests are critical for continued growth, with a great base of loyal guests who enjoy the product

- Significant runway ahead to attract new to cruise guests

- Believe the company is well positioned in the current economic environment, and the target upmarket consumer remains resilient

Overall Financial Position

- Company believes it is well positioned in the current economic environment

- Cash generation engine continues to rev up, which along with the transformational new build pipeline provides a path to meet liquidity needs and restore the balance sheet in the coming years