Newmont Corporation

CEO : Mr. Thomas Ronald Palmer

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2022 Q4 | -5.6% YoY | -83.6% | 3000.0% | 2023-02-23 |

Rob Atkinson says,

Peñasquito exceeds synergy goals with mining and processing improvements

- Peñasquito delivered $700 million in annual synergies through mining and processing improvements

- Gold grades expected to decline more than 20% in Q1, resulting in 25% lower gold production than 2022

- However, gold equivalent ounces will remain steady year-on-year

Yanacocha spending $300-350 million on advanced engineering and procurement

- Yanacocha delivered slightly higher production in Q4 and is expected to have higher leach recoveries in 2023

- Spending $300-350 million on advanced engineering, procurement, and camp construction for Sulfides project

Merian site delivers highest quarterly production in two years

- Merian is expected to have lower production and higher unit costs in 2023 due to planned mine sequence

- Grades expected to decline more than 15% in Q1 as site enters stripping campaign

Cerro Negro expects progressively higher tons mined and processed throughout 2023

- Production from Cerro Negro is expected to steadily increase each quarter in 2023 and extend mine life beyond 2030

- Investing $200 million in the first wave of district expansions, primarily for underground development activities

Boddington sets new production records with leading technologies

- Boddington delivered exceptional Q4 with 20% higher gold production and over 50% higher copper production

- Expect gold production to remain steady compared to 2022 despite further stripping in Boddington South pit

Tom Palmer says,

2022 Highlights

- Newmont finished the year with a strong Q4, leveraging its scale, teams, and unmatched portfolio of world-class assets to deliver industry-leading ESG, operational, and financial results.

- Newmont is well-positioned to continue leading the sector while remaining firmly grounded in its values and driven by its purpose to create value and improve lives through sustainable responsible mining.

- Newmont has remained fatality free for over four years, and it continues to maintain a clear focus on eliminating the risks that could lead to a fatality.

- Newmont experienced a 36% reduction in the number of significant potential events from the previous year.

Financial Results

- Newmont met its original guidance for production in 2022, producing an industry-leading 6 million ounces of gold and 1.3 million gold equivalent ounces from copper, silver, lead, and zinc.

- Newmont generated $4.6 billion in adjusted EBITDA and $3.2 billion in cash from continuing operations, with $1.1 billion in free cash flow after reinvesting $2.7 billion into its business last year.

- Newmont maintained a strong, flexible, investment-grade balance sheet, while continuing to reinvest in its future and providing shareholder returns of more than $1.7 billion through its established dividend framework.

Reserves and Exploration

- Newmont’s global reserve base now sits at 96 million ounces, and it has successfully replaced depletion for the year.

- Newmont reported nearly 600 million ounces of silver reserves and 16 billion pounds of copper reserves, providing natural exposure to a metal of growing importance, reducing carbon emissions.

- Exploration has always been and continues to be a core competency at Newmont. It is a critical component of its long-term strategy.

2023 Outlook

- Newmont is positioned to safely deliver on its commitments in 2023.

- Newmont’s capital allocation strategy includes investing in its existing world-class portfolio, continuing to advance its two key projects, and executing on sustainable, responsible growth opportunities.

- Newmont expects to maintain its current quarterly dividend in 2023, and it remains committed to returning cash to shareholders while maintaining a strong balance sheet.

Proposed Combination with Newcrest

- Newmont’s CEO will provide comments on the proposed combination with Newcrest at the end of the call.

Q & A sessions,

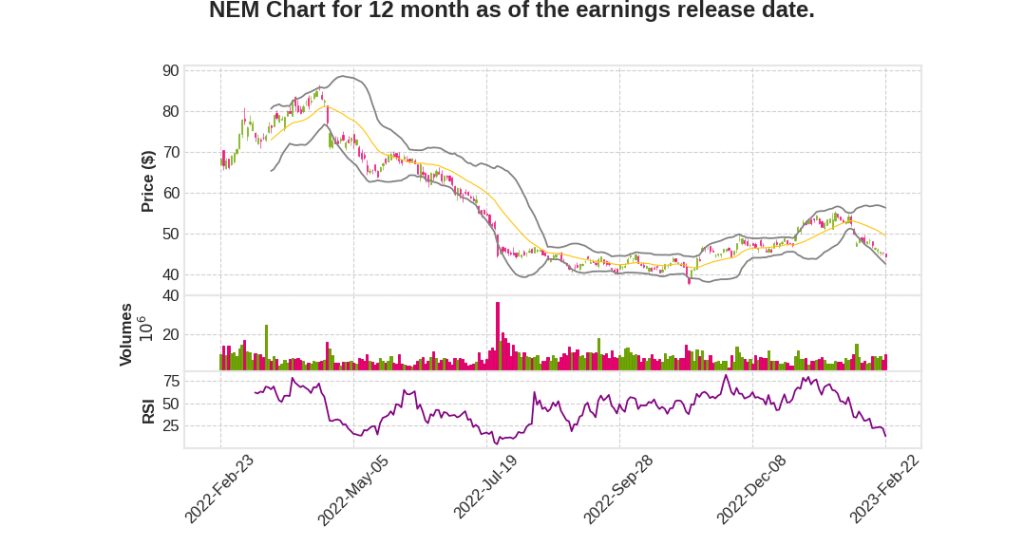

Expected Impact on NEM Stock’s Movement

- Newmont expects to produce around 6 million ounces of gold at an all-in sustaining cost of around $1,200 an ounce in 2023.

- Exploration and advanced project spend will be around $500 million, and highest development capital spend in a generation at around $1.3 billion.

- Newmont has taken a conservative view of gold price for 2023 and assumed $1,700 an ounce.

- Newmont anticipates gold production this year will be weighted 55% to the second half, driven by Ahafo, Tanami, Peñasquito and Cerro Negro.

- Newmont expects to deliver strong gold production and improving unit costs over the next five years, bringing the all-in sustaining cost to around $1,000 to $1,100 per ounce by 2025, supported by the industryâs most robust, balanced and diverse portfolio of operations and projects.