Northern Trust Corporation

CEO : Mr. Michael G. O’Grady

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

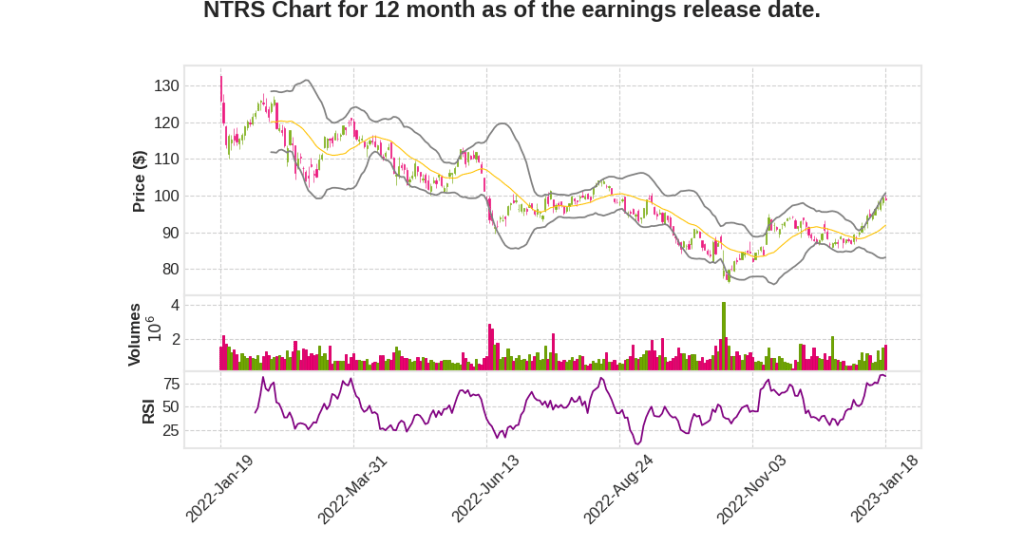

| 2022 Q4 | -8.9% YoY | 61.5% | -63.8% | 2023-01-19 |

Jason Tyler says,

Financial Results

- Net income of $155.7 million, with EPS of $0.71 and return on average common equity of 5.9% in Q4 2022

- $266 million in pre-tax charges impacted the results, including $213 million of investment security losses, $32 million of severance-related charges, $14 million of occupancy charges, and $6.8 million of pension settlement charges

- Year-over-year revenue was down 8%, expenses increased 13%, and net income was down 62%, but excluding the charges, revenue was up 5% and expenses increased 9% YoY

Revenue

- Trust, investment, and other servicing fees totaled $1 billion, down 6% YoY and down 3% sequentially, primarily due to unfavorable currency movements and weaker equity and fixed income markets

- Net interest income on an FTE basis was $550 million, up 48% YoY and up 5% sequentially, with a net interest margin of 1.63% in the quarter

Asset Servicing Business

- Custody and fund administration fees were $406 million, down 11% YoY but flat sequentially, while investment management fees were $124 million, up 9% YoY and down 9% sequentially

- Assets under custody and administration for asset servicing clients were $13 trillion at quarter-end, down 16% YoY and up 6% sequentially

Wealth Management Business

- Trust, investment, and other servicing fees were $454 million, down 7% YoY and down 5% sequentially

- Assets under management for wealth management clients were $351 billion at quarter-end, down 16% YoY and up 5% sequentially

Expenses

- Expenses in Q4 2022 were $1.3 billion, up 13% YoY and up 8% sequentially, with compensation expense up 15% YoY and up 6% sequentially

- The expenses included $53 million in charges, reflecting steps taken in conjunction with the launch of the office of productivity

Capital Ratios

- Common equity Tier 1 ratio was 10.8% under the standardized approach, up from the prior quarter’s 10.1%, and Tier 1 leverage ratio was 7.1%, up from 7% in the prior quarter

- In early January 2023, non-HQLA debt securities worth $2.1 billion were sold, and proceeds were invested into higher yielding HQLA assets

Michael OâGrady says,

Revenue and Return on Equity

- Revenue increased by 5% for the full year, while excluding the impact of charges, it grew by 8%.

- The return on average common equity was 12.7%, and excluding the impact of charges, it was 14.9%.

Wealth Management and Asset Management

- Assets under management and advisory fees grew sequentially in the fourth quarter for wealth management, but total fees declined due to the lag effect of markets and shifts in client allocations.

- In asset management, assets under management were up sequentially, but fees declined due to outflows in liquidity and indexed products.

- Alternative funds showed solid growth throughout the year, including a year-over-year growth of more than 20% in the fourth quarter.

- ESG capabilities were a focus for product launches, including three new ESG funds in the fourth quarter.

Asset Servicing

- Whole office offering, integrating global asset servicing platform with innovative partners, saw healthy momentum throughout the year.

- A recent client win showcases Northern Trust’s ability to digitalize the investment process and offer a full suite of core asset servicing, capital markets, and data and analytics products and services.

- Continued strong demand for integrated trading solutions offering throughout both the quarter and the year, with a 20% year-over-year increase in the number of clients on the platform.

Expenses

- Expense growth continued to be elevated in the quarter.

- Charges were announced to bring down the trajectory of expense growth to better align with the current operating environment and create capacity for profitable growth.

- A dedicated office of productivity was launched to reinforce the approach to driving efficiencies throughout the company.

Outlook

- Northern Trust remains well positioned to navigate the ongoing macroeconomic and market uncertainty from a position of strength.

- The focus is on driving organic growth, improving productivity, and continuing to bolster the foundations.

Q & A sessions,

Volume and Rate Changes

- Volume expected to be in the range of 110 to 115 for Q1 2022

- Beta for interest-bearing deposits expected to remain similar

- Balance sheet repositioning involves moving $2 billion from 2% to overnight

- Runoff on the portfolio is just over $1 billion, moving to higher rates

Expense Management

- Compensation expected to flatten out in the near term due to severance-related activities

- Retirement-eligible incentives hit $50 million in Q1 2022

- Equipment and software line item expected to flatten out beyond Q1 2022

- Productivity goals for each group to drive expense management

Fees and Wealth Management

- Fee compression still persistent in asset management

- Client repositioning in money market space and product re-pricing led to decline in fees

- Net new business and flow activity in wealth management was positive

Asset Servicing

- Organic growth calculated as negative in regions for Q4 2022

- Core business in asset servicing is strong, but product mix and other factors led to negative organic growth