Nucor Corporation

CEO : Mr. Leon J. Topalian

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

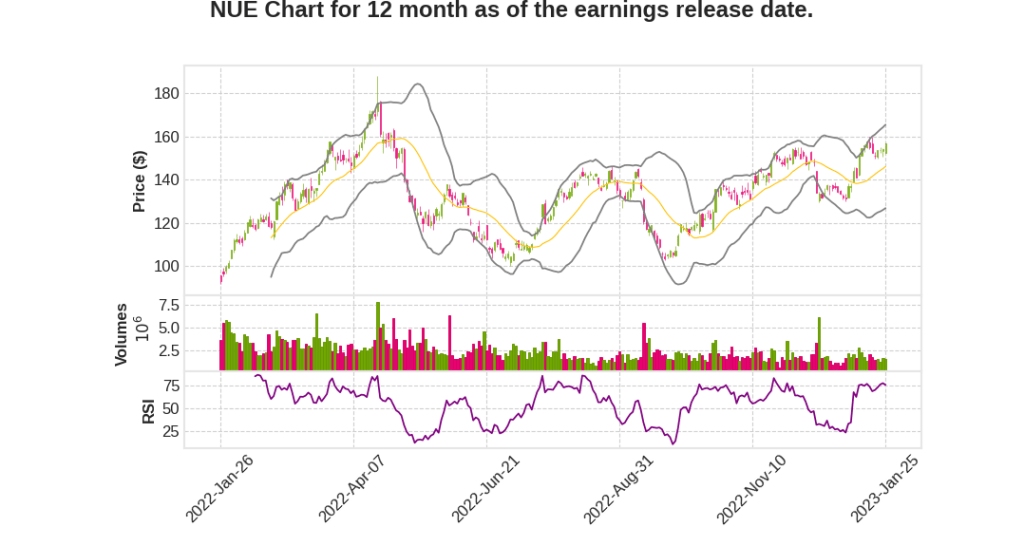

| 2022 Q4 | -15.8% YoY | -48.6% | -41.2% | 2023-01-26 |

Leon Topalian says,

Organizational Changes

- Noah Hanners joined as EVP for Raw Materials

- Doug Jellison accepted the newly created role of EVP for Strategy

Safety and Financial Performance

- 2022 was the safest and most profitable year in Nucor’s history

- Established another record low injury and illness rate for the fourth consecutive year

- Earned $4.89 per share in Q4 2022, setting a new earnings record of $28.79 per share for the full-year

- Operations generated strong cash flow with a record $11.6 billion of EBITDA

- Returned 3.3 billion to shareholders through dividends and share repurchases

Strategic Initiatives

- Deployed approximately $2 billion in CapEx and completed five acquisitions valued at approximately $3.6 billion to grow our core and expand beyond

- Invested in new technologies that can help reduce the carbon footprint

- Announced an equity investment in Electra, a boulder-based start-up that has developed a process to produce carbon-free iron used in making steel

- Became the first major industrial company in the world to join the United Nations’ 24/7 carbon-free energy Global Compact

- Cofounded the Global Steel Climate Council in the International Coalition advocating for a single, transparent global emission standard that is focused on steelmaking emissions

- Announced plans to build a continuous galv line at California Steel Industries to serve construction markets in the Western United States, along with future lines planned for Berkeley and Nucor West Virginia

- Acquired Summit Utility Structures, producer of steel structures for the utility, telecommunications and transportation sectors, and announced plans to construct two new state-of-the-art tower production plants

Economic Backdrop

- Infrastructures Act, the CHIPS Act and IRA are starting to work their way into the steel sector, benefiting Nucor as well as the American steel industry throughout this decade

Allen Behr says,

Brandenburg Mill Performance

- Brandenburg mill completed on time and on budget

- First customer shipment made from Brandenburg

- Focus on ramp-up in 2023

Team and Customer Focus Areas

- Team is a competitive advantage and will continue to be a focus

- Existing and new customers in new markets will be a focus for driving returns

Incremental Returns for Enterprise

- Driving incremental returns for the enterprise is a key focus

- Support from teammates, customers, and shareholders for the Brandenburg project

Q & A sessions,

Strong Demand Trends and Positive Signs in Nonres Construction

- Bookings in the sheet group are up 45% to 50% over the last 8-10 weeks and backlogs climbed about 16% Q-over-Q, indicating a strong demand trend.

- Nonres construction, where Nucor has a 50% market share, is showing positive signs and is expected to remain robust.

Impact of Infrastructure Act and CHIPS Act on Advanced Manufacturing

- The CHIPS Act, a $55 billion package, will result in the production of 27 new chip plants, which will require sustainable and differentiated value products and solutions.

- Nucor is well-positioned to meet the growing demand in this sector, which is part of the advanced manufacturing segment.

- The Infrastructure Act will have a significant impact on Nucor’s business, particularly in the bar group, Vulcraft for decking, and bridge and highway programs.

Growth Strategy through Core and Expand Beyond

- Nucor’s growth strategy is focused on two areas: in the core and expanding beyond.

- The company is investing in the core to produce more galvanized, prepaid, and higher value-added products.

- The executive team is also focused on expanding beyond, acquiring adjacent companies that have steel-centricity and are efficient manufacturers.

Impact of Raw Materials on Nucor’s Positioning Strategy

- Due to the tragedy in Ukraine, Nucor had to pivot quickly and reduce its use of pig iron from about 10% to 5-6%.

- Nucor is well-positioned in terms of its raw materials positioning strategy and use and consumption of raw materials.

Positive Signs in Plate and Long Product Strategy

- Prices in plate are not elevated, and Nucor expects them to return to normal levels closer to $2,000 a ton.

- Import risk is low, and the protections in place today are greatly enhanced from what was seen six or seven years ago.

- The Lexington micromill strategy is to locate in growing regions with proximity to low-priced scrap, which will help shape and provide returns in rebar and long products.