Organon & Co.

CEO : Mr. Kevin Ali

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

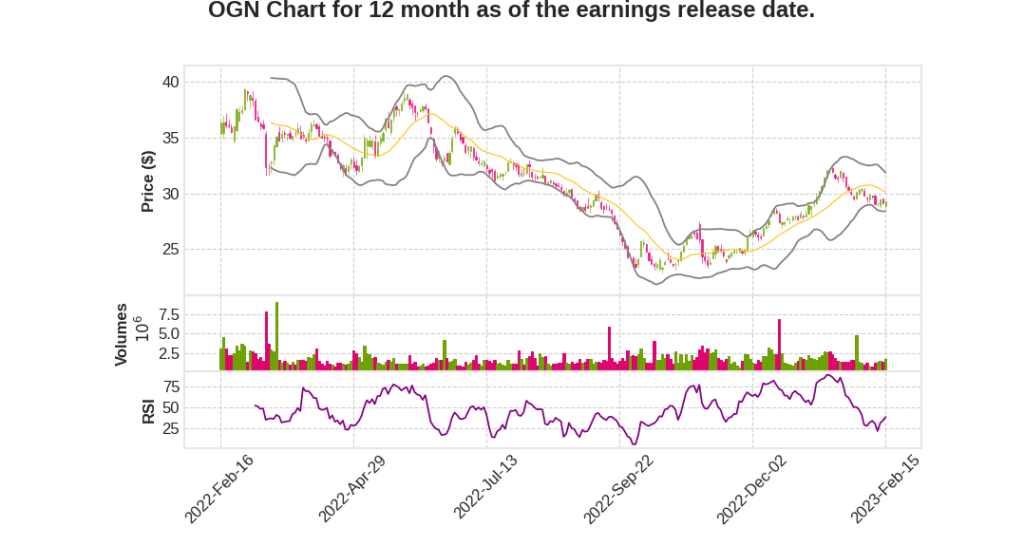

| 2022 Q4 | -7.4% YoY | -31.1% | -47.5% | 2023-02-16 |

Matthew Walsh says,

Fourth Quarter and Full Year Revenue

- Fourth quarter revenue was approximately $1.5 billion, down 7% as reported, but up 1% at constant currency.

- Full year 2022 revenue was approximately $6.2 billion, down 2% as reported but up 4% at constant currency when compared to prior year.

- Foreign exchange translation was the largest FX translation reporting impact of any quarter in 2022.

Performance by Franchise

- Women’s Health had a strong performance in 2022, up 8% ex FX in the quarter and 11% for the full year.

- Biosimilars continue to be an important growth driver for Organon.

- Established Brands experienced a market action for sterile suspension injectables, Diprospan and Celestone Chronodose, in January 2023 reducing fourth quarter revenue by $8 million for potential sales returns and recording a one-time inventory charge of $36 million that shows up in cost of goods sold.

Adjusted Gross Margin and EBITDA Margin

- Adjusted gross margin was 65.7% compared with 64.7% for the full year 2021.

- Adjusted EBITDA margin was 25.6% in the fourth quarter compared to 29.3% in the same period of last year.

- Adjusted EBITDA margin was 33.8% for the full year 2022 compared with 36.1% for the full year 2021.

Debt Capitalization and Leverage

- Organon has gross bank debt of $8.9 billion netted against cash and cash equivalents of $706 million.

- Organon ended the year with a net leverage ratio of about 3.8x and leverage is likely to be stubborn in 2023.

Cash Flow

- Organon’s free cash flow generation was very strong in the fourth quarter.

- The key message here is that putting aside the $300 million of working capital build that should not repeat in 2023, Organon’s free cash flow ex onetime costs related to the spinoff is in that north of $1 billion range that we communicated at the time of the spin.

Kevin Ali says,

Revenue and Profits

- Organon delivered a 4% increase in total company revenue at constant currency in full year 2022.

- The company generated an adjusted EBITDA of $2.1 billion, representing a 33.8% margin.

Women’s Health

- The Women’s Health franchise delivered 7% growth on a constant currency basis in 2022.

- Nexplanon, which grew 11% in 2022 at constant currency, contributed $834 million of revenue to the Women’s Health franchise.

- Organon trained more than 20,000 health care providers to insert Nexplanon in 2022 and will continue to train more providers in 2023.

- Organon continues to monitor the impact of the overturn of Roe v. Wade on the contraception market and has seen demand growth for Nexplanon in the most restricted states as well as protected and semi-restricted states.

- The Fertility portfolio grew approximately 9% at constant currency in 2022 despite the impact of COVID in China.

Biosimilars

- The Biosimilars franchise grew 17% on a constant currency basis in 2022, marking its second consecutive year of double-digit growth.

- Renflexis, the largest selling biosimilar, grew 22% last year, driven by solid performance in the U.S. and Canada.

- Hadlima, Organon’s biosimilar for Humira, had a very strong performance in 2022, reflecting its successful 2021 launch in Canada and Australia.

Established Brands

- Established Brands currently represents about 2/3 of Organon’s overall business and generated significant free cash flow.

- Over the longer term, given the maturity of the portfolio, the company expects close to flat performance for its Established Brands business.

- In 2022, the franchise delivered growth of 3% at constant currency for the full year.

Geographic Performance

- Each geographic region, including China which faced significant challenges related to COVID in 2022, grew in 2022.

- Strength in the retail channel, growth in fertility, as well as the benefits from the reacquisition of Marvelon and Mercilon are expected to offset the expected VBP impact to Organon’s China business in 2023.

Q & A sessions,

Nexplanon

- Expect first quarter to be a little soft but strong demand growth in the US and ex-US

- Expectations of very strong growth due to physician demand growth and driving access and awareness of Nexplanon throughout the world

- Ex-US business continues to grow, and tender business expected to ramp up in the emerging markets in the second half of the year

Follistim

- Softness in Q4 due to COVID infections in China, but strong growth expected in 2022 as things recover

Hadlima

- Canada and Australia continue to do well, strong double-digit growth outside of the US

- Half year of Hadlima sales expected in the US in 2022

- Expect solid year for Hadlima in 2022 due to product presentation and being the closest to the originator

China

- Fertility and Marvelon business ramping up well, expect good growth drivers in China

- Seventh round of VBP may cause headwinds, but strong growth expected after 2023

Established Brands

- Expect growth in non-volume-based procurement products, retail sector, Atozet, and respiratory products

- Latin America, Middle East, Africa, and Russia business continues to grow robustly