ON Semiconductor Corporation

CEO : Mr. Hassane S. El-Khoury

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

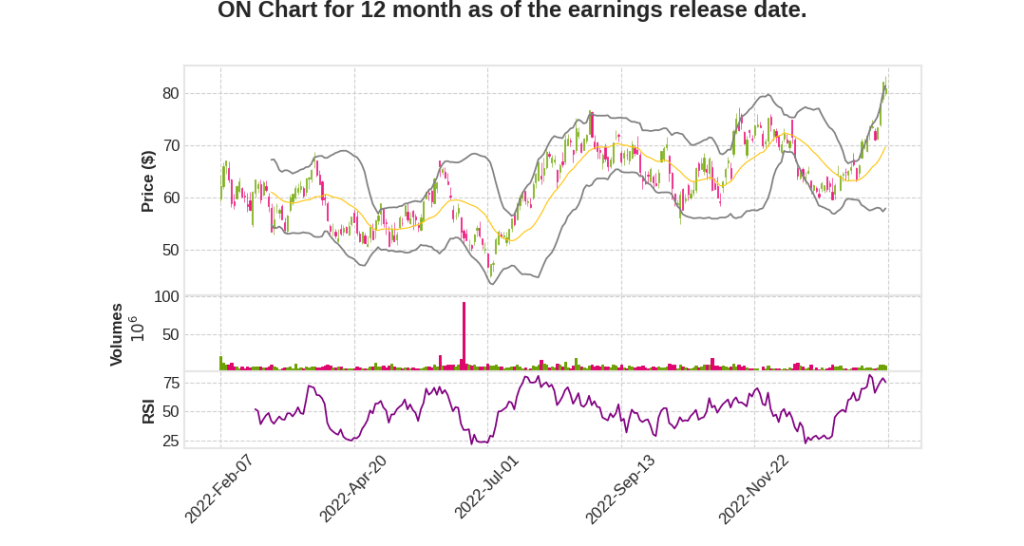

| 2022 Q4 | 13.9% YoY | 46.6% | 41.4% | 2023-02-06 |

Thad Trent highlighted that the company’s revenue has increased by 24% YoY to $8.3 billion, primarily driven by automotive and industrial businesses, with record automotive revenue of $989 million increasing 13% QoQ and 54% YoY to 47% of total revenue. The company has optimized its manufacturing footprint, product portfolio, and go-to-market strategy, with a threefold increase in free cash flow since the start of transformation, growing approximately 4x as fast as revenue, with 2022 coming at a 20% free cash flow margin. The company has also announced a new share repurchase program authorizing up to $3 billion of share repurchases through 2025, representing twice that of the last authorization. The guidance for Q1 2023 expects continued strength in automotive amid softness in all other end markets, with non-GAAP earnings per share to be in the range of $1.02 to $1.14.

Hassane El-Khoury says,

Record Revenue and Earnings

- Record revenue of $8.3 billion in 2022, an increase of 24% year-over-year

- Earnings grew 3x faster than revenue

- Gross margin of 49.2% increased 880 basis points for the full year and 1,650 basis points since transformation journey began

Automotive Business

- Automotive business grew 54% year-over-year in Q4 and accounted for 47% of total revenue

- Expect vehicle electrification to be a long-term driver for the business

- Expect to remain supply constrained for the next several years even as aggressive capacity is added to manufacturing sites in Hudson, Czech Republic, and South Korea

- Volkswagen Group selected onsemi as a corporate strategic supplier to provide the silicon carbide modules that enable a complete traction inverter solution for its entire fleet of next-generation electric vehicles

Industrial Business

- Industrial business grew 6% year-over-year in Q4 and accounted for 26% of total revenue

- Expect traction in energy infrastructure and medical applications to offset the softness in legacy parts of the business

- Revenue for energy infrastructure increased 75% year-over-year

- Partnered with Ampt, the world’s #1 DC optimizer company for large-scale solar and energy storage systems

Silicon Carbide

- Shipped more than $200 million in silicon carbide revenue in 2022

- Expect to deliver $1 billion in 2023 based on committed revenue from LTSAs

- Have more than $4.5 billion of committed silicon carbide revenue between 2023 and 2025

- Leading automakers are choosing onsemi for the performance of its silicon carbide solutions and vertical integration from substrates to state-of-the-art modules

Long-Term Supply Agreements

- Customers are investing with onsemi to deliver leading-edge technologies that address complex intelligent power and sensing requirements in automotive, industrial, and cloud power markets

- Getting true value for products with multiyear commitments from customers

Q & A sessions,

Revenue Guidance

- The company is reconfirming its $1 billion revenue for 2023 and expecting an increase of $0.5 billion in the same timeframe until 2025.

- Customers are committing to long-term supply agreements, indicating a testament to the strength of the business, technology, and supply.

Internal Substrate

- The company remains committed to its internal substrates and has ramped its capabilities for internal substrates through 2022, and this ramp will keep increasing.

- The plan is to support growth in the long-term supply agreements from 2023 to 2025 and beyond.

- The company’s yields are coming in per plan, and the ramp is on track, as shown in the margin in the fourth quarter and the guide in the first quarter.

Automotive Market

- The company is outperforming its own goal of outgrowing the market in the automotive industry.

- Winning more share as others cannot supply, and locking in that share gain in long-term supply agreements to sustain long-term growth.

- The company’s growth is going more towards pact content versus unit sold, and its portfolio’s breadth highlights the strength of its business.

Long-Term Supply Agreements

- Long-term supply agreements are broad in nature, and the majority is in automotive, tying to the total market.

- The breadth of the company’s portfolio targets applications like electric vehicle electrification, autonomous driving, and parts of the industrial sector.

Brownfield Investment

- The company is investing in brownfield to support its long-term strategy.

- The manufacturing footprint and optimization in the last couple of years have positioned the company well to grow.

- The manufacturing sites in South Korea, East Fishkill, and the Czech Republic are increasing proportionately to support the ramp and long-term supply agreements.