PG&E Corporation

CEO : Ms. Patricia Kessler Poppe

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

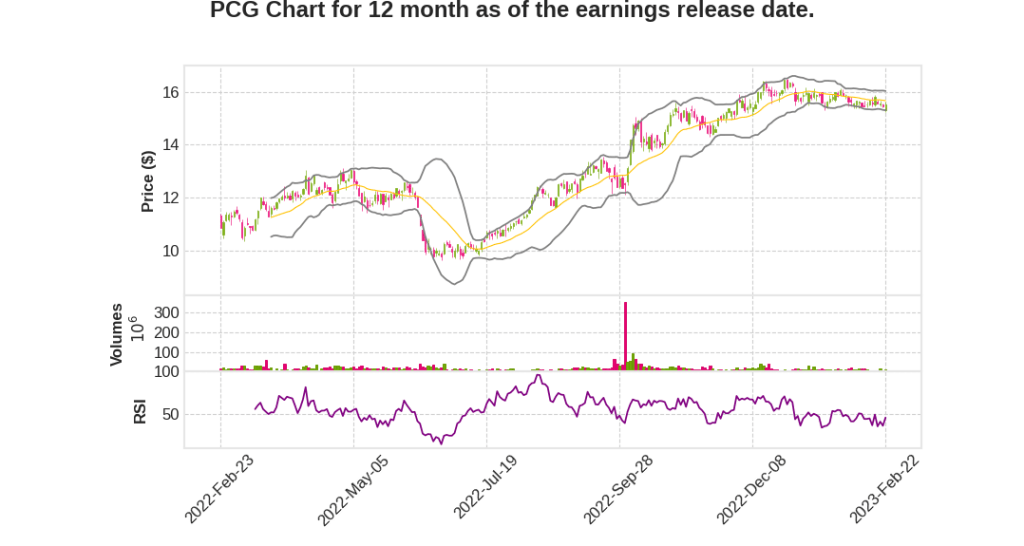

| 2022 Q4 | 2.4% YoY | -66.6% | 8.3% | 2023-02-23 |

Patricia Poppe says,

Financial Performance and Guidance

- PG&E reported full year 2022 core earnings of $1.10 per share, right on guidance, which represents a 10% increase from 2021.

- The company is reaffirming its 2023 core EPS guidance range of $1.19 to $1.23, up 10% at the midpoint, along with its longer-term targets of at least 10% EPS growth in 2024 and at least 9% for ’25 and ’26.

- The company plans to have no new equity through 2024.

Wildfire Mitigation and Risk Management

- The company saw a 99% reduction in acres burned in 2022 relative to the average of the 3 years directly before implementation of Enhanced Powerline Safety Setting.

- The company delivered its earnings guidance as well as non-fuel O&M cost reductions of 3% net of inflation and added undergrounding while removing vegetation management expense.

- The company calculates the layers of protection, including improved situational awareness and coordination with first responders, as delivering over 90% overall wildfire risk reduction.

Operational Efficiency and Customer Investment

- The company’s lean operating system and 4 basic plays have helped drive efficiency and keep cost neutral for customers. In 2023, they will roll out a fifth play: waste elimination.

- The company aims to eliminate waste, improve customers’ experience, make the system cleaner and more resilient, and reduce cost.

- The company’s newly established bill ownership center is looking at the whole customer bill for savings and energy supply costs.

Regulatory Developments and Catalysts

- The company reached a self-insurance settlement as part of its General Rate Case, which can result in up to $1.8 billion of savings for customers over the 4-year GRC period with as much as $300 million expected in 2023.

- PG&E has a number of important catalysts on the horizon, with each containing important benefits for customers and for California.

- PG&E remains conservative in their planning and aims to consistently manage the work and deliver their earnings targets.

Report Card and Outlook

- PG&E’s material fire caused them to miss their goal of 0 CPUC reportable admissions of 100 acres or more.

- The company exceeded its 2% annual O&M cost reduction and delivered net savings of 3%.

- Core EPS came in right on plan at 10%, while the company delivered 6% rate base growth in what was the final year of their GRC cycle.

- Moody’s revised PG&E’s credit outlook to positive earlier this month, recognizing their significant progress on mitigating risk and improving relationships in the state.

Christopher Foster says,

Financial Performance

- Delivered EPS of $1.10 for 2022 and no equity issued.

- Reaffirmed earnings growth guidance for 2023 to 2026 and no equity in 2023 or 2024.

- Identified over $5 billion of incremental investment opportunity not yet in the plan.

Customer Investment and Risk Reduction

- Planning to spend almost 1/2 of capital in the next 5 years on risk reduction across the enterprise, including system hardening and pipeline replacement.

- Improved capital to expense ratio creates headroom in the customer bill, drives earnings per share growth, and improves cash flow from operations.

- Savings of around $200 million in vegetation management costs in 2022 relative to budget.

Regulatory, Legal, and Legislative Updates

- Received final decision on 2023 cost of capital, providing further certainty as the 10% ROE approved applies through 2025.

- Approved self-insurance settlement saved customers up to $1.8 billion through 2026.

- California has established legislative and regulatory processes to allow for constructive outcomes where they perform well.

Dividend Eligibility

- Progressing towards meeting the common stock dividend eligibility threshold later this year.

- Before declaring a dividend, they will first need to report a cumulative $6.2 billion in non-GAAP core earnings since their emergence from Chapter 11, starting from the third quarter of 2020.

Q & A sessions,

Commodity Costs

- PG&E experienced near-term bill pressure due to commodity cost impact.

- California climate credit was pulled ahead to offset the impact.

- Commodity cost is back to normal range and bodes well for customers.

Capital Plan and Infrastructure

- The simple, affordable model allows for necessary work for customers.

- PG&E’s capital plan enables reduction of expenses and improvement of the capital to expense ratio.

- The company delivered 3% O&M savings this year, after factoring in inflation.

- The waste elimination theme aims to make the customer experience better at a lower cost.

Electric Vehicle Growth

- EV sales in PG&E’s service area increased from 16% to 23% between 2021 and 2022.

- Every EV is equivalent to half a house, creating load growth potential.

- PG&E plans to build capacity to meet the increasing demand for electrification.

Undergrounding Program

- PG&E reduced mileage due to conversations with key stakeholders and earned the right to do undergrounding.

- The program is flexible and dynamic to work with regulators and stakeholders and will be built over time.

- PG&E’s undergrounding program is a risk reduction and customer satisfaction initiative.

Financial Outlook and Risk Mitigation

- PG&E’s financial outlook remains unchanged and supported by capital investment and efficiency gains.

- The company invested $9.6 billion of capital into the system in 2022 for the benefit of customers.

- The Enhanced Powerline Safety Setting contributed to a 99% reduction in acres burned in 2022.

- PG&E delivered its earnings guidance and non-fuel O&M cost reductions of 3% net of inflation.