The Procter & Gamble Company

CEO : Mr. Jon R. Moeller

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

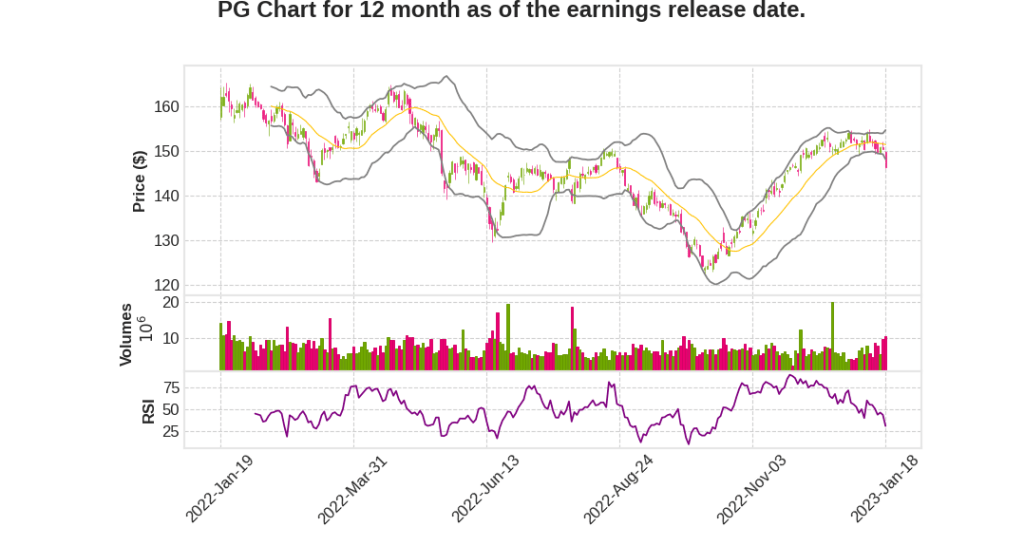

| 2023 Q2 | -0.9% YoY | -10.2% | -9.7% | 2023-01-19 |

Andre Schulten says,

Expected impact on stock movement based on PG Q2 2023 earning call transcript

- Organic sales growth guidance increased from 3%-5% to 4%-5%

- Core EPS growth expected to be in line to +4% versus prior year

- Adjusted free cash flow productivity expected to be 90%

- Plan to return $15 billion to $17 billion of cash to shareholders this fiscal year through dividends and share repurchase

- Raw and pack material costs, foreign exchange, and freight costs remain significant headwinds, estimated at approximately $3.7 billion after tax, a 26 percentage point headwind to EPS growth for the year

The expected increase in organic sales growth guidance and the commitment to return cash to shareholders may have a positive impact on the stock’s movement. However, the significant headwinds from raw and pack material costs, foreign exchange, and freight costs may limit the potential for growth. Investors will closely monitor the company’s ability to offset these headwinds through price increases and productivity savings.

Jon Moeller says,

Global Uncertainty

- The recovery rate in China remains uncertain

- New policies and practices in China may affect consumer confidence

- War in Eastern Europe

- Highest inflation rates in 40 years

- Continued volatility in currency and commodity markets

Currency Exposure

- Currency exposure is not a simple dollar exposure

- Cross rate exposures impact bottom line

- Cross rate between British pound and Euro has significant impact

Progress and Strategy

- The organization is making progress and following the right strategy

- Confident that the strategy will continue to serve well

Guidance

- Difficult to take up guidance to the top range of possibility

Q & A sessions,

EPS Delivery

- Company is on track to deliver the year and guidance ranges communicated

- Desire to reinvest means not every dollar from commodities and foreign exchange immediately flows through to the bottom line

- Anticipate downside towards the lower end of the core EPS range, but more help coming increases confidence to deliver that range or slightly better

Top Line Guidance

- Expecting to deliver the higher end of initial top line guidance with 4-5% organic sales growth

- Low volumes in the current quarter due to 1 point related to portfolio choice in Russia and 2 points related to temporary inventory reductions in China

- Consumption-related volume decline is about 3% on the quarter, which is in line with expectations

- Volume shares are holding globally, value shares are holding globally, and U.S. market is showing acceleration of volume market share

Capacity Investments

- Capacity investments across the business to catch up with significant increase in business size

- Short-term effect will be Fem Care related, but growth anticipated will outweigh cost of investing in capacity

- Need to continue to drive household penetration to reinvigorate overall volume growth in the category

Operating Environment

- Operating environment continues to be difficult, especially in China and Europe

- Investment in the business and execution with excellence will help to get through the difficult environment

Elasticities

- Favorable elasticities seen everywhere except Europe focused markets

- 10% pricing flowing through with benign elasticities that allow for holding volume share and value share

- Europe seeing higher elasticities due to increased pressure on the consumer and slower private label pricing