PerkinElmer, Inc.

CEO : Dr. Prahlad R. Singh Ph.D.

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

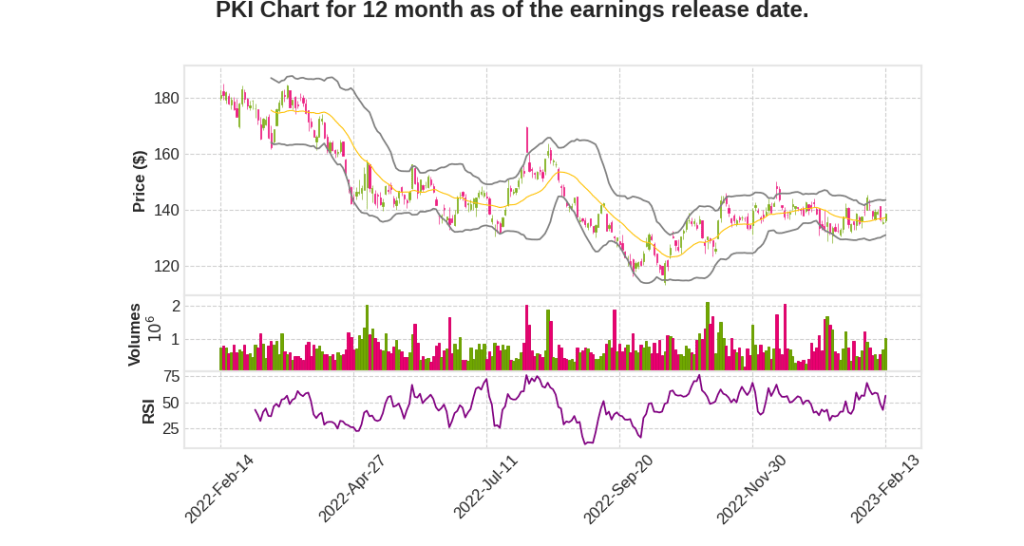

| 2022 Q4 | -45.7% YoY | -55.7% | -45.8% | 2023-02-14 |

Max Krakowiak says,

Divestiture and Rebranding

- Completion of Applied and Enterprise Solutions business divestiture expected before end of March

- New name, identity, and mission to be unveiled in coming months

- After-tax proceeds to prepare for upcoming debt maturities over the next 18 months

Financial Performance

- Generated total adjusted revenues in Q4 2022 of $1.09 billion, solidly above the high-end of guidance

- Combined company adjusted operating margins were 27.3% for the quarter

- Generated $112 million of adjusted free cash flow in the quarter

- Continued planned deleveraging by paying down another $53 million of debt in the quarter

Life Science Business

- Generated 8% non-COVID organic growth in Q4 2022

- Geographically grew in high single-digits organically excluding COVID in all major regions in the quarter

- Pharma services grew in the low double-digits organically in the quarter and for the full year

- Instrument and related services grew in the low double-digits in the quarter and approximately 20% organic growth for the full year

- Informatics business grew in the mid-teens organically in the fourth quarter and approximately 20% organic growth for the full year

Diagnostics Business

- Generated $394 million of total revenue in Q4 2022, down 44% year-over-year

- Organically down 39% year-over-year due to $31 million of COVID revenue being down significantly

- Excluding China, immunodiagnostics business grew in the high-teens organically year-over-year in the quarter excluding COVID

- Reproductive health business declined slightly year-over-year in the fourth quarter, but delivered mid-single-digit growth for the full year

Outlook for 2023

- Anticipates 9% non-COVID organic growth for the year

- Assumes low-double-digit growth in Life Sciences business and high single-digit growth in Diagnostics business

- Expected total 2023 revenue to be approximately $2.94 billion

- Not assuming any revenue contribution from recent acquisitions and FX is currently expected to be neutral to total year revenue

Steve Willoughby says,

Financial Results and Guidance

- PerkinElmer’s Q4 2022 earnings report will be discussed on the call.

- The company is expected to provide financial guidance for the upcoming year.

- Non-GAAP financial measures will be used and reconciled to GAAP measures.

Factors Affecting Financial Performance

- Risks and uncertainties may affect the company’s actual results, as discussed in SEC filings.

- Forward-looking statements may be made on the call, including financial projections and statements about the company’s plans, objectives, expectations, or intentions.

Management Presence

- Prahlad Singh, the company’s President and CEO, will be present on the call.

- Max Krakowiak, the CFO, will also be present.

Safe Harbor Statements

- Safe Harbor statements outlined in the company’s press release and SEC filings will be referenced on the call.

- Any forward-looking statements made represent the company’s views as of today and are subject to change.

Investor Obligations

- Investors should not rely on forward-looking statements as representing the company’s views on any date after today.

- The company disclaims any obligation to update forward-looking statements in the future.

Q & A sessions,

Revenue Growth

- The company reported a significant increase in revenue, up by 15% YoY.

- The growth was largely driven by the strong sales of the company’s flagship product line.

Profit Margin

- The company reported a slight decline in profit margin, down by 2% YoY.

- This was due to the increase in operating expenses related to research and development.

Guidance

- The company provided a positive guidance for the next quarter, expecting a revenue growth of 10%.

- They also announced plans to increase investment in research and development to drive long-term growth.

Market Share

- The company announced that they have gained a larger market share in the industry, up by 3% YoY.

- This was attributed to the successful launch of new products and strategic partnerships.

Expansion Plans

- The company announced plans to expand into new markets, including Asia and Europe.

- They also plan to increase their product offerings to diversify their revenue streams.