PPG Industries, Inc.

CEO : Mr. Timothy M. Knavish

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

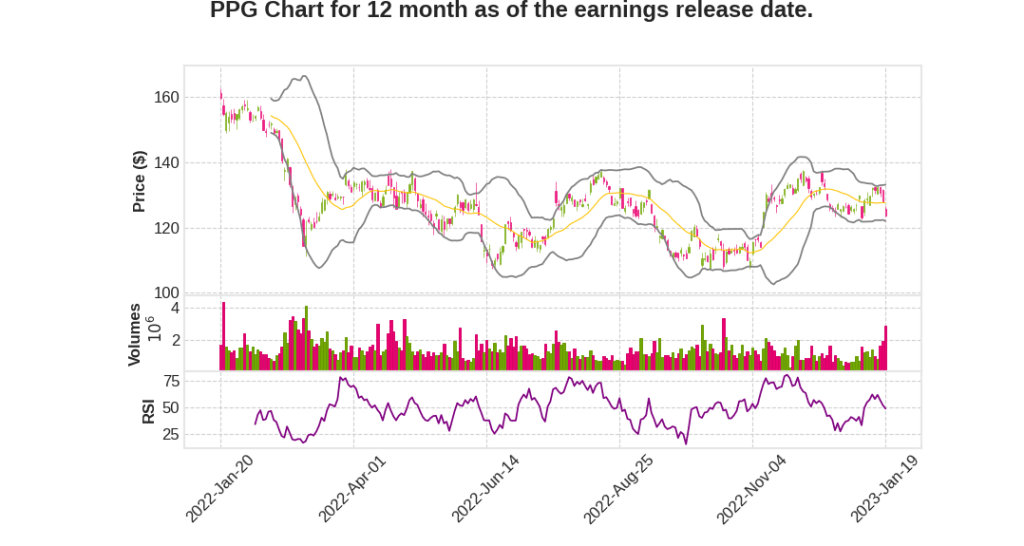

| 2022 Q4 | -0.1% YoY | -244.3% | -16.7% | 2023-01-20 |

Tim Knavish says,

Q4 Sales Performance

- Q4 sales of $4.2 billion were near the record levels achieved in 2021 despite significant unfavorable foreign currency translation

- Sales were aided by strong U.S. automotive refinish volume growth as supply chain disruptions started to moderate and our order books remain robust

- Record results in PPG Comex business in Mexico as the team continued their strong execution and delivered another record quarter of sales and earnings

- Aerospace business delivered organic sales growth of more than 20% on a year-over-year basis and is expected to continue to grow in 2023 and beyond

Q4 Earnings Performance

- Adjusted earnings per diluted share from continuing operations were $1.22, above the midpoint of $1.13 from the guidance provided in October

- More than 20% year-over-year segment earnings improvement driven by selling price realization and strong cost management

- Segment earnings improvement achieved despite significant and unpredictable shutdowns in China from COVID-19

Full Year 2022 Performance

- Did not meet own earnings expectations due to unprecedented cost inflation, unexpected geopolitical issues in Europe, disruptive and unpredictable shutdowns in China, strong appreciation of the U.S. dollar, and rapid escalation in interest rates in the United States

- PPG team responded to challenges by implementing real-time selling price increases that will offset all cumulative cost inflation incurred since early 2021 by early 2023

- Announced and quickly executing new cost savings initiatives with particular focus on Europe

- Lowered SG&A as a percent of sales, decreasing by about 100 basis points, including the delivery of about $65 million in restructuring savings in the year

Outlook

- Expect Q1 demand environment to remain similar to Q4, but several catalysts will enable PPG to drive earnings growth as the year progresses

- Improvements in the supply chain will further moderate raw material costs, and expect to see this flow through P&L more prominently starting in Q2

- Expect coatings demand stabilization beginning in Q2 in Europe, resulting in higher year-over-year earnings

- Benefit from continued recovery of the aerospace and automotive refinish businesses in the U.S. and recent share gains in the architectural business to buffer lower demand from a softer U.S. housing market

- Overall exposure to the U.S. new home construction market is relatively small, only about 1% of global revenues

John Bruno says,

PPG Q4 and Full Year 2022 Financial Results

- Financial information released on January 19, 2023, after the U.S. equity markets closed.

- PPG posted detailed commentary and presentation slides on the Investor Center of their website.

- The slides provide additional support to the brief opening comments Tim will make shortly.

PPG’s Operating and Financial Performance

- The Q4 and full year 2022 financial results conference call includes PPG’s perspective on the Company’s results for the quarter.

- The presentation may contain forward-looking statements, reflecting the Company’s current view of future events and their potential effect on PPG’s operating and financial performance.

- These statements involve uncertainties and risks, which may cause actual results to differ.

- The Company is under no obligation to provide subsequent updates to these forward-looking statements.

Non-GAAP Financial Measures

- The presentation contains certain non-GAAP financial measures.

- The Company has provided reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures.

- For additional information, please refer to PPG’s filings with the SEC.

PPG’s Management Team

- Joining the call from PPG are Tim Knavish, President and Chief Executive Officer; and Vince Morales, Senior Vice President and Chief Financial Officer.

Q&A Session

- After management’s perspective on the Company’s results for the quarter, the conference call will move to a Q&A session.

Q & A sessions,

Impact of Macroeconomic Factors on PPG’s Business

- DIY segment is down due to consumer confidence and COVID impact, as well as a decline in new housing construction.

- Commercial and maintenance segments are stronger, with backlogs floating in the 12-13 week range, and growth expected from the Home Depot Pro program.

- In Europe, volume deterioration continued throughout 2022, with the professional painter business down in single digits. Expectations are for a bounce off the bottom and positive comps in Q2 2023.

Impact of COVID-related Shutdowns on PPG’s Business

- Shutdowns in China due to COVID-19 were worse than anticipated, with absenteeism going from near zero to above 50% across PPG’s 19 manufacturing sites in the country.

- There is a base case for a second wave of infections after Chinese New Year, which may lead to a short but acute impact on PPG’s business.

- March is a crucial month for PPG’s China business.

Performance of PPG’s Refinish Body Shop and Protective Business

- PPG’s net wins on body shops are positive in all major regions, with the majority in the US and Europe. Key metric is key-to-key time.

- Protective and marine business had a strong year in 2022, despite volume degradation in Q4 due to China shutdowns.

- Protective business has growth prospects in LNG, infrastructure investment, and leveraging PPG’s distribution network in Mexico.

Financial Performance Highlights

- Q4 sales of $4.2 billion, near record levels despite unfavorable foreign currency translation.

- Adjusted earnings per diluted share from continuing operations were $1.22, above the midpoint of guidance provided in October.

- Segment earnings improved by over 20% YoY, driven by selling price realization and strong cost management.

- Challenges include unprecedented cost inflation, geopolitical issues in Europe, shutdowns in China, US dollar appreciation, and rapid escalation in US interest rates.

Strategic Initiatives in 2022 and Outlook for 2023

- Successful progress on strategic initiatives, including strengthening relationship with Home Depot and timely execution of acquisition-related synergies.

- Lowered SG&A as a percent of sales by about 100 basis points in 2022, delivered $65 million in restructuring savings, and made progress in lowering inventories on a sequential basis.

- Expectations are for Q1 demand environment to remain similar to Q4, with improvements in supply chain leading to earnings growth throughout the year.

- PPG team to continue progress on ESG program, introducing sustainable products and new 2030 sustainability goals.