Prudential Financial, Inc.

CEO : Mr. Charles Frederick Lowrey Jr.

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

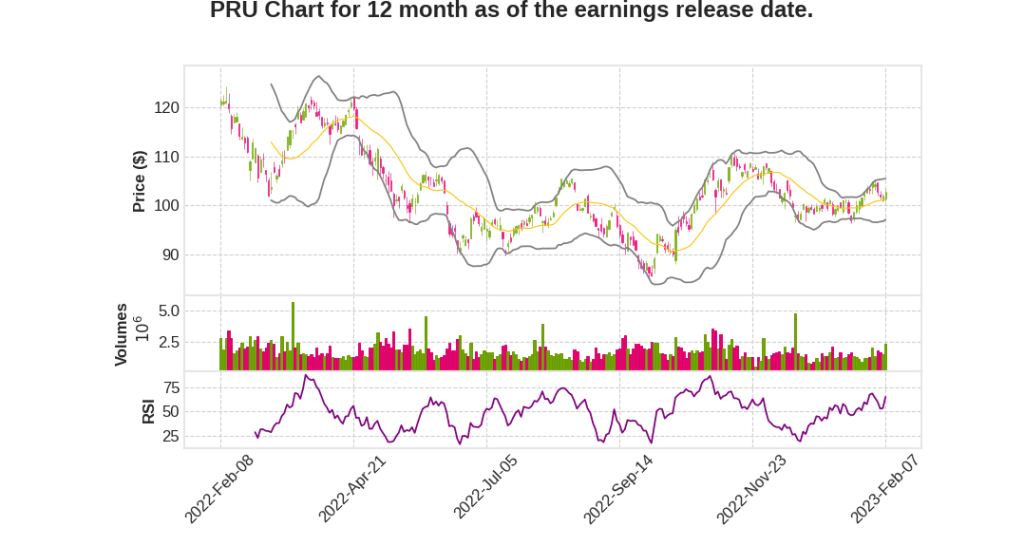

| 2022 Q4 | -18.8% YoY | -98.7% | -179.5% | 2023-02-08 |

Charlie Lowrey says,

Business Transformation

- The business reduced overall market sensitivity by completing the sales of the full-service retirement business and the pay lock block as well as the run off of traditional variable annuities.

- Investments made in the long-term sustainable growth of the business through programmatic acquisitions, and partnerships in emerging markets. For example, in Africa, a minority interest was acquired in Alex Forbes, a leading provider of financial advice, retirement, investment, and wealth management in South Africa.

- Completed the second largest pension risk transfer transaction in US market history with IBM, and several major longevity risk transactions, including the $8 billion transaction we completed in the fourth quarter with the Barclays Bank, UK retirement fund.

- Introduced FlexGuard Life, an indexed variable universal life product, and expanded private loan capabilities through PGIM private capital.

- Invested in enhanced customer experiences that blend human touch with advanced technology, such as the expansion of the digital sales application to expedite same-day policy delivery and processing with greater automation in Brazil.

Cost Savings

- Achieved $820 million of annual run rate cost savings, exceeding the target of $750 million one year ahead of schedule.

- Streamlined and automated the way in which the business operates, while improving the customer and employee experience through new systems and technologies.

- Implemented a hybrid work model for employees that reduced the U.S. real estate footprint by 50%, equating to approximately $50 million in annual run rate savings.

- Adopted a continuous improvement mindset that helps proactively identify and execute on cost savings opportunities that enhanced customer and employee experiences, and continue to improve competitiveness going forward.

Financial Strength

- Rock solid balance sheet and disciplined approach to capital deployment helped Prudential navigate financial and macro economic challenges for nearly 150 years.

- Financial strength, including AA ratings, is supported by $4.5 billion in highly liquid assets at the end of the fourth quarter, as well as a high quality, well-diversified investment portfolio.

- Returned more than $800 million to shareholders through dividends and share repurchases during the fourth quarter, for a total of over $7.5 billion since the beginning of 2021.

- Board has authorized up to $1 billion in share repurchases, as well as a 4% dividend increase beginning in the first quarter of 2023.

Andy Sullivan says,

Positive impact from COVID pandemic challenges subsiding

- The pandemic challenges that resulted in headwinds from a sales perspective have subsided quite a bit.

Steady increase in market share in Japanese businesses

- Prudential has steadily increased its market share and consistently ranked in the top three for new business face amounts every year of the last decade.

- This has generated significant earnings and cash flows for Prudential.

Threefold strategy to grow business

- First, Prudential is focused on continuing to strengthen and expand both its captive and third-party distribution.

- Second, they will continue to innovate and expand on the solutions they deliver to customers.

- Finally, they are laser-focused on delivering an outstanding customer experience with a particular emphasis on their digital capabilities.

Outstanding customer experience and digital capabilities

- Prudential is consistently ranked in the top three and often number one in policy issuance, policy service, and claims by J.D. Power.

Growing position in the low-single digits over time

- The market remains highly attractive to Prudential, and they intend to grow their position in the low-single digits over time.

Q & A sessions,

Transformation and Focus on Financial Performance

- The company has made significant progress in its transformation, but still has more work to do to become a higher growth and less market-sensitive company.

- The company will focus on financial performance, advancing its transformation, including the customer and employee experience, and deploying capital thoughtfully to create long-term sustainable value for all stakeholders.

Goal of Becoming a Global Leader

- The company aims to become a global leader in expanding access to investment, insurance, and retirement security.

- The company will achieve this by investing in growth businesses and markets, delivering industry-leading customer experience, and creating the next generation of financial solutions to serve a broad range of customers.

Confidence in Approach in PGIM

- The company has a high degree of confidence in its approach in PGIM.

- The company focuses on a broad and diversified product portfolio, great long-term investment results, and great distribution to achieve positive flows.

- The company is expanding its product range in vehicles and investing in distribution on both the retail and institutional side.

- The company has a strong long-term investment track record, particularly in fixed income, which benefits from sustained higher rates.