Qorvo, Inc.

CEO : Mr. Robert A. Bruggeworth

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

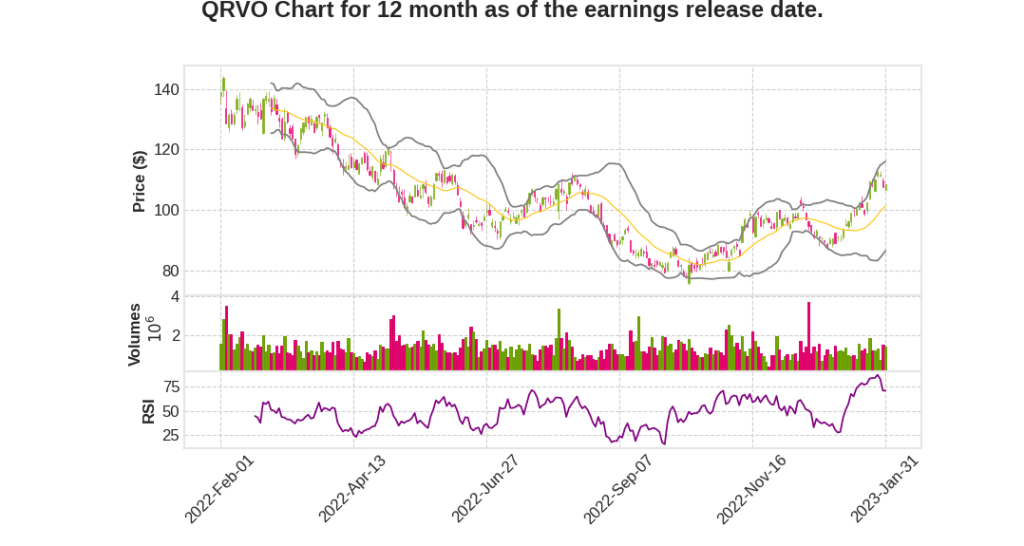

| 2023 Q3 | -33.3% YoY | -94.7% | -108.2% | 2023-02-01 |

Bob Bruggeworth says,

High-Performance Analog Segment

- The power business had a strong quarter with robust design activity for silicon carbide power devices.

- Qorvo began sampling a radar power solution that reduces the size by up to 30% in D&A radar systems while expanding content opportunity.

- Expanded SHIP state-of-the-art RF packaging contract with the U.S. government to develop multichip modules that combine digital optical devices with Qorvo’s mixed-signal RF.

Connectivity & Sensors Group

- The quarter reflected lower end market demand and channel inventory consumption for Wi-Fi products partially offset by strength in the automotive industry.

- Design activity was strong across customers and products, including ultra-wideband, matter, and sensors.

- Volume shipments of MEMS-based sensors, enabling an enhanced HMI experience and true wireless stereo earbuds, were started.

Advanced Cellular

- Design activity continued to be strong across customers and product categories, supporting year-over-year content gains at Qorvo’s largest customers.

- Commenced preproduction shipments of the first integrated PA modules to a Tier 1 European infrastructure OEM for 5G massive-MIMO base stations.

- Selected to supply multiple solutions, including ultra-wideband, antenna tuning, and BAW-based antennaplexing in support of the 2023 smartphone launches of a U.S.-based Android OEM.

Qorvo Outlook

- Qorvo expects growth in BAW-based content as well as other content growth in 2023.

- In 2023, Qorvo expects to grow year-over-year content at its largest two customers.

- Qorvo views HPA’s long-term growth rate as double-digit, and in CSG, Qorvo expects growth in the strong double digits.

- Qorvo is well positioned in investment businesses, securing new designs that extend opportunities in large growth markets.

- The company is working to accelerate revenue related to its Omnia BAW-based biosensors by exploring options for the associated Omnia test hardware.

- Qorvo remains at the forefront of connectivity, sustainability, and electrification, delivering successive improvements in each market’s next-generation products.

Grant Brown says,

Revenue and Segment Performance

- Revenue for Q3 2023 was $743 million, $18 million above the midpoint of guidance.

- HPA revenue of $155 million in the quarter compares to revenue of $182 million in the same quarter last year.

- CSG revenue of $97 million in the quarter compares to revenue of $158 million in the same quarter last year.

- ACG revenue of $491 million compares to revenue of $775 million in the same quarter last year.

Non-GAAP Metrics

- Non-GAAP gross margin in the quarter was 40.9%, falling sequentially due to lower factory utilization and higher inventory-related charges.

- Non-GAAP operating expenses in the quarter were $206 million, $90 million lower than guidance and down $8 million versus last year.

- Non-GAAP operating income in the quarter was $99 million or 13% of sales.

- Non-GAAP net income was $77 million, representing diluted earnings per share of $0.75, at the high end of guidance.

- Free cash flow was $203 million.

Current Quarter Outlook

- Expected quarterly revenue between $600 million and $640 million.

- Non-GAAP gross margin of approximately 41%.

- Non-GAAP diluted earnings per share in the range of $0.10 to $0.15.

- Expect Qorvo’s inventory position will decline in March but remain elevated.

- Project non-GAAP operating expenses in the March quarter will be up approximately $20 million sequentially due to timing of product development spend, seasonal payroll effects and other employee-related expenses.

Operations and Strategic Decisions

- Productivity gains have significantly increased effective BAW capacity, allowing for long-term growth goals.

- Qorvo has decided to sell the Farmers Branch facility and is evaluating strategic alternatives for the biotechnology business to accelerate and maximize its potential value.

Q & A sessions,

Gross Margin

- Under utilization and inventory-related charges account for about 920 basis points of headwind in Q3

- Expected to remain there in the March quarter, hence the flat gross margin guidance

- Inflation across direct costs were approximately 80 basis points in Q3 and again, expected to remain there in Q4

- Supplier quality issue representing approximately 30 basis points of headwind in the Q3 period

- Reduction in channel inventories is a necessary first step

MEMs

- RF MEMs technology costs a little bit more per function but provides a significant improvement in performance

- Pressure sensor MEMs doing extremely well in over 25 different vehicles and other devices

Revenue Trajectory

- September quarter is expected to see a significant ramp due to seasonal drivers and clearing of channel inventories

- December and March quarters have relatively easy comps

- Clearing of channel inventory picture by the end of the calendar year should provide for a restocking or selling into potentially normalized demand levels