Royal Caribbean Cruises Ltd.

CEO : Mr. Jason T. Liberty

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

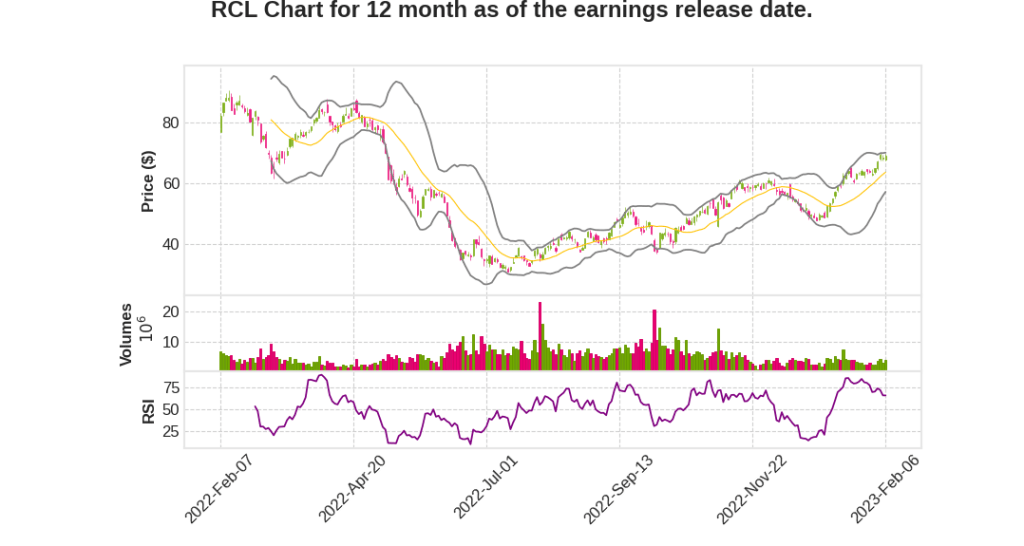

| 2022 Q4 | 165.1% YoY | -101.5% | -63.2% | 2023-02-07 |

Jason Liberty says,

Strong Book Position with Higher Rates

- Expected to have a lower load factor until spring, but still in a strong book position

- Rates are considerably higher than in 2019

Expectations for Exceeding EBITDA from 2019

- Forecast is achievable and based on strong visibility on revenue and cost management

- Expect to exceed EBITDA generated in 2019

Positive Outlook for 2023

- Thoughtful guidance and considerations for different markets and products

- Strong belief for 2023 and potential for better outcomes for the year

- Acceleration towards Trifecta seen as a positive trend

Michael Bayley says,

New Ships Driving Demand and Pricing

- Icon of the Seas has been the best-selling product in the history of Royal Caribbean’s business.

- Remarkable stats coming out of Icon, with the ultimate family townhouse already 55% sold for 2024 at an average price of $75,000 a week

- Icon is driving a great ’24 with healthy demand and pricing.

- The new ship class is the first time Royal Caribbean International has had a new class of ship in nine years, and the performance so far is delightful.

Q & A sessions,

Strong Demand Trends and Increased Bookings

- Strong WAVE trends across all brands, with elevated demand from North America and Europe

- Short close-in products and 3, 4, and 5-night products have seen acceleration

- Booking window is now within a couple of weeks of normal

- Demand for European consumers to go on a vacation experience is high despite impact of conflict and energy prices

Increased Capacity and Demand for CocoCay and Perfect Day

- CocoCay has been a huge success and has seen a significant increase in overall capacity

- Hideaway Beach will allow an additional 3,000 people to Perfect Day, bringing the capacity to approximately 13,000 people a day

- There is an appetite for other similar ventures in the future

Positive Outlook on Ticket and Onboard Revenue

- Ticket yields expected to continue and average revenue per day (APD) to increase

- Booking earlier is the main force behind the increase in onboard activity

- Frictionless acquisition experience through e-commerce is allowing customers to get the vacation they desire

Impact of Energy Prices and Conflicts

- The conflict in Ukraine and Russia has a deployment impact and limits deployment to the Baltics

- Impact of energy prices has been felt more by European consumers, but their desire to go on a vacation experience remains high

Continued Growth in China

- CocoCay and Perfect Day experiences have seen great demand and resilience as prices go up

- Hideaway Beach will accommodate additional 3,000 people and there is an appetite for more such ventures in the future