Rollins, Inc.

CEO : Mr. Jerry E. Gahlhoff Jr.

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

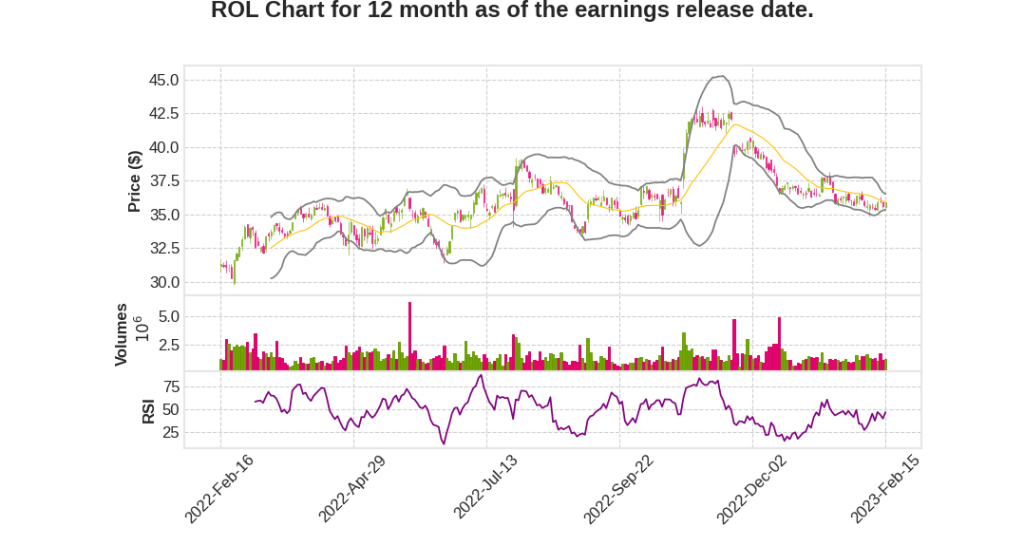

| 2022 Q4 | 10.2% YoY | 36.9% | 30.8% | 2023-02-16 |

Kenneth Krause says,

Revenue Growth

- Total revenue grew approximately 10% in the quarter and 11% for the full year

- Acquisitions drove 3% of revenue growth in the quarter and for the year

Profitability

- Quarterly adjusted EBITDA margins were a healthy 22.1%, up approximately 180 basis points versus the same period a year ago

- Quarterly gross profit was 50.5% of revenue, up 10 basis points from the same quarter a year ago

- People costs, most notably medical costs, were up about $7 million for the year

- SG&A expense in the quarter was just under 29% of revenues, up $3 million from the prior year, but improving 230 basis points when stated as a percentage of revenue

- If you recall, we adjusted the prior year quarterly EBITDA margin by the impact of the non-recurring SEC matter.

- On an as-reported basis, we generated incremental adjusted EBITDA margins that we’re approaching 40%.

Cash Flow and Balance Sheet

- Quarterly free cash flow generated $116 million, increasing by over 20% in the quarter and up a very healthy 16% for the entire year

- Cash flow conversion, the percent of income that was turned into cash was well above 100% for the quarter and the full year

- Debt remains negligible and debt-to-EBITDA is well below 1x on a gross level

- We were in a net cash position to finish the year

- We are actively evaluating options to refinance our credit facilities that are set to expire in April of 2024

Jerry Gahlhoff says,

Revenue Growth and Organic Growth

- Total revenue grew over 10% in the fourth quarter and over 11% for the full year.

- Organic growth was 6.9% compared with 7.8% for the full year.

- The company realized slower growth in the residential sector, but started 2023 with strong residential revenue performance in January.

Focus on Safety

- Rollins has a long-standing company-wide focus on personal safety.

- New initiatives are being implemented to empower employees and enable an accountable, safety-driven culture.

- A new employee-level program will incentivize the highest levels of safe-driving behaviors, which is planned to be piloted later this year.

Acquisitions and Efficiency

- Rollins successfully completed 31 acquisitions representing a total of $119 million invested in 2022.

- The company is very optimistic about leveraging strategic acquisitions in 2023 as a focus of their growth strategy.

- Rollins is committed to investing in their business to drive efficiency.

- New applications and technology are being added to their portfolio of brands to improve efficiency, such as routing and scheduling technology initiatives at Clark and HomeTeam.

Pricing and Inflation

- During 2022, Rollins brought forward their annual price increase program to earlier in the year due to inflationary challenges.

- Price increases will be initiated beginning in early March and some were already implemented in January.

- All Rollins brands are increasing their rate cards and focusing on pricing the value of their services.

- The company expects the inflationary environment to persist into 2023 and is focused on managing the price/cost equation.

Commercial and Ancillary Growth

- Rolins saw strong growth in their commercial line with 10.3% growth over the prior year.

- The company continues to succeed in their other service lines, particularly within their termite and ancillary, which grew 15.4% year-over-year.

- Rollins remains focused on driving revenue growth from cross-selling activities across their large and growing customer base.

Q & A sessions,

Costs Breakdown

- People, materials, and fleet are the three major cost categories in the business.

- Fleet costs have gradually improved throughout the year due to lower oil prices.

- Materials and supplies costs have improved as a percentage of sales towards the end of the year.

- People costs are being managed closely, and the company is focusing on hiring and retaining the best workforce.

Inflation Management

- The company is managing the inflationary pressures by pulling forward pricing and passing along the value of services to customers.