Raytheon Technologies Corporation

CEO : Mr. Gregory J. Hayes

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

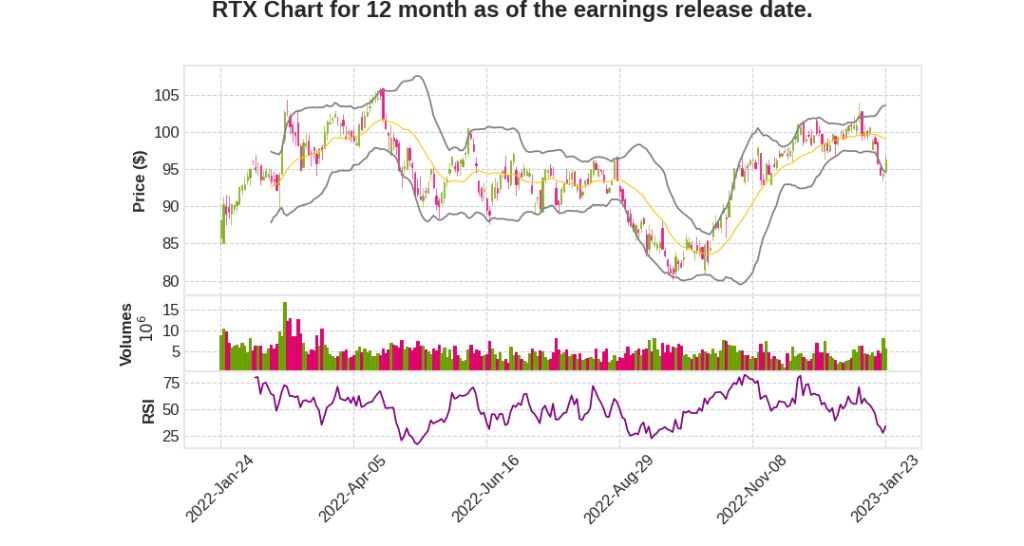

| 2022 Q4 | 6.2% YoY | 13.7% | 86.5% | 2023-01-24 |

Chris Calio says,

Realignment of RTX into Three Business Units

- RTX is realigning into three business units to better coordinate with customers and improve collaboration across businesses

- Realignment will enhance performance, make RTX more competitive, and capture additional revenue synergies

- Roy Azevedo, President of RIS business, plans to retire, and Shawn Mural, CFO of RI&S, is now acting President of RIS

Critical Assumptions for 2023

- Expect global air traffic to fully recover to 2019 levels by the end of 2023 with continued strength in the U.S. and Europe

- Assuming China’s lifting of COVID restrictions continues to be manageable and its traffic levels will remain robust

- Commercial aftermarket revenue growth across aerospace businesses to approach 20% in 2023

- Commercial aircraft volumes to be up around 20% year-over-year

- Backlog expected to continue to grow on the defense side due to the heightened and increasingly complex threat environment

Key Actions to Position for Success

- Grow production capacity to deliver on backlog

- Address labor availability constraint by reducing attrition and implementing retention and recruiting initiatives

- Restore health within the supply chain

- Offset $2 billion of labor and material inflation in 2023 through higher pricing and aggressive cost reduction actions across all RTX

Financial Outlook for 2023

- Expecting commercial aftermarket revenue growth across aerospace businesses to approach 20% in 2023

- Expecting commercial aircraft volumes will be up around 20% year-over-year

- Assuming a recovery in the supply chain as we move into the back half of the year

- Expecting roughly $2 billion of labor and material inflation in 2023 and targeting to more than offset this headwind through higher pricing and aggressive cost reduction actions across all RTX

Greg Hayes says,

RTX Q4 2022 Earnings Highlights

- Delivered $67.1 billion in sales for the full year, which was up 6% organically and adjusted EPS of $4.78, which was up 12% year-over-year.

- Returned almost $6 billion of capital to shareholders, which included $2.8 billion of share repurchases.

- Generated $4.9 billion in free cash flow, which exceeded expectations.

- Captured $86 billion in new bookings, resulting in backlog growth of 12%, a book-to-bill of 1.28 and a near-record backlog at the end of the year of $175 billion.

- Invested $9 billion in R&D and CapEx, allowing the company to bring new technologies to market and drive further automation and digitization through each phase of the product lifecycle from design through development, manufacturing, and product sustainment.

Transformation Plan

- RTX plans to streamline its structure to a customer-centric organization with three focus segments: Collins Aerospace, Raytheon, and Pratt & Whitney. This will better align with customers’ needs and allow for better collaboration on next-generation technology.

- There is still a lot of work to be done to make this happen.

Commercial and Defense End Markets

- RTX saw continued advancements on its path towards leading the future of sustainable aviation with the start of development flight testing of the GTF Advantage engine.

- The company completed the first engine test run for its regional hybrid electric flight demonstrator. This new engine will reduce fuel burn and CO2 emissions by 30% compared to today’s most advanced regional turboprop aircraft.

- RTX’s products and technologies have been instrumental in helping the people of Ukraine defend itself.

Patents and Employee Engagement

- RTX was granted over 2,600 patents last year, placing the company in the top 10 of companies in the United States for the second consecutive year.

- RTX outperformed among all companies in the Russell 1000 for local U.S. job creation in 2022.

- RTX leads the industry in employee giving and volunteering, which is a testament to the impact the workforce has in the communities where they work and live.

Q & A sessions,

RTX Priorities for 2023

- Strong demand in all end markets, $175 billion backlog

- Continued focus on supply chain, labor, and inflation challenges

- Investing in digital solutions and leveraging automation to unlock efficiencies

- Disciplined capital allocation, generating strong free cash flow to return significant value to shareholders

- Confident in achieving 2025 targets, will provide update at upcoming Investor Day

Impact of R&D Amortization on Free Cash Flow

- R&D amortization not eliminated, cost RTX $1.6 billion last year and expected to be $1.4 billion this year

- Drag will still be around $1 billion by 2025, impacting free cash flow

- Realistically expect $9 billion in free cash flow in 2025 instead of $10 billion due to R&D drag

Inflation Challenges and Cost Reduction Plans

- $2 billion inflation challenges, with $800 million being people cost

- Plans in place for cost reduction in supply chain, factories, and back office

- Transformation activity and realignment of businesses will also present opportunities for cost reduction

Reorganization and Portfolio Realignment

- Reorganization not just about recreating the old legacy Raytheon Company

- Looking to move pieces where they are most appropriately aligned from a technology and customer standpoint

- By end of Q1 2023, expect to have a good understanding of new organization

- Portfolio overall is strong, book-to-bill will improve in some legacy RI&S businesses

Outlook for RMD and Collins Aerospace

- Expect more growth potential at RMD and Collins than any other business outside of Collins due to strong backlog

- Might see pieces related to JADC2 moving into Collins business

- Expect growth in 2024 when supply chain returns to pre-pandemic levels