The Sherwin-Williams Company

CEO : Mr. John G. Morikis

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

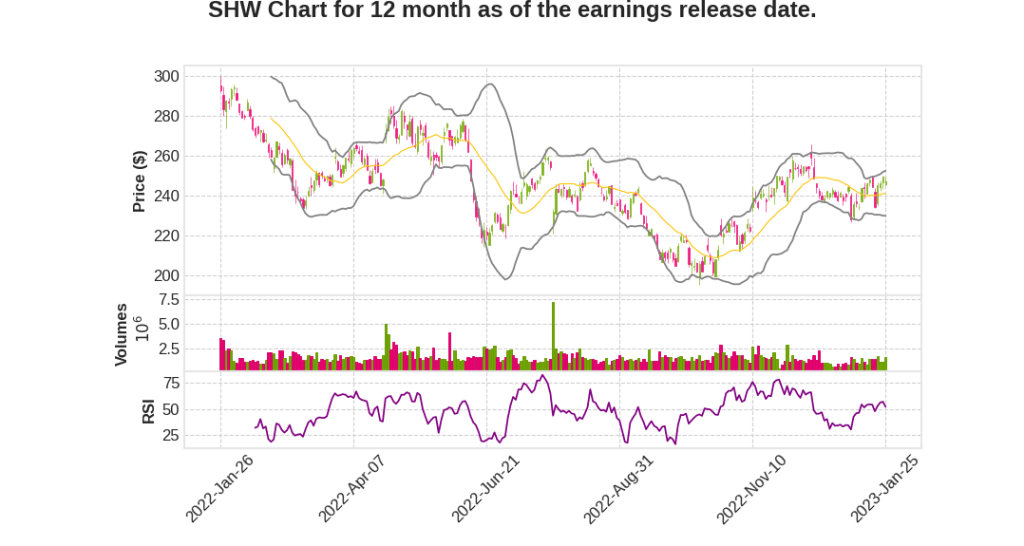

| 2022 Q4 | 9.8% YoY | 53.2% | 28.2% | 2023-01-26 |

John Morikis says,

Record financial performance in 2022

- Generated record sales, adjusted EBITDA, and adjusted diluted net income per share in 2022 despite inflation, raw material availability issues, and COVID lockdowns in China

- Grew full year consolidated sales by 11.1% to a record $22.1 billion

- Returned $1.5 billion to shareholders in the form of dividends and share buybacks in 2022

Challenging demand environment in 2023

- Growth: Expect year-over-year sales and earnings performance to be significantly better in the first half than in the second half

- Guidance: Single-family housing permits and starts have been down year-over-year for consecutive months

- Shock: Expect new residential volume to be down anywhere from 10% to 20% this year

- Expect inflation to continue putting pressure on consumer behavior in the U.S. and Europe

- PMI numbers for manufacturing in the U.S., Europe, China, and Brazil have been negative for multiple months

Outlook for 2023

- New factory: Expect consolidated net sales to be flat to down mid-single digits for the full year 2023

- Expect diluted net income per share for 2023 to be in the range of $6.79 to $7.59 per share

- Expect gross margin expansion, SG&A as a percent of sales to increase, and operating margin to modestly improve year-over-year

- Growth: Expect to open between 80 to 100 new stores in the U.S. and Canada in 2023

Capital allocation priorities

- Continue to invest in growth opportunities

- Control costs tightly in non-customer-facing functions and execute on restructuring initiatives

- Expect to return value to shareholders through dividends and share buybacks

Heidi Petz says,

Americas Group sales and profit

- Sales increased by 15.7% driven by mid-single-digit volume growth and effective pricing.

- Segment profit improved by $126.4 million and segment margin improved by 210 basis points to 17.2%.

- Pro architectural sales grew by high teens percentage led by property management and followed by new residential, commercial and residential repaint, respectively.

Consumer Brands Group sales and margin

- Sales decreased by 2.4%, primarily due to lower volume sales and low single-digit FX headwinds, partially offset by price increases.

- Sales were slightly positive in North America and Europe, but more than offset by significant continued weakness in China due to COVID-related lockdown.

- Adjusted segment margin was 11.3%, up 500 basis points year-over-year.

Performance Coatings Group sales and margin

- Sales increased by 4.2%, driven by mid-teens pricing, partially offset by a low double-digit decrease in volume.

- Adjusted segment margin increased 530 basis points to 14.2% of sales.

- Sales in North America and Latin America increased double digits and mid-single digits, respectively, while sales in Europe and Asia decreased high-single-digits and low teens, respectively.

Restructuring actions

- Both Consumer Brands Group and Performance Coatings Group made good progress in their portion of targeted restructuring actions, resulting in one-time costs of $25.6 million and $22.2 million, respectively, in the quarter.

Store openings

- 40 net new stores were opened in the fourth quarter, and a total of 72 net new stores were opened in 2022.

Q & A sessions,

New Residential Business

- Expect new residential business to be down in the 20% to 30% range, but Sherwin-Williams expects to outperform that and bring in a much better number than that

- Company has strong relationships with new residential contractors and is collaborating and working together to introduce new products and services

- Sherwin-Williams is focusing on driving its TAG business down further into regional builders, where there is terrific opportunity for growth

Residential Repaint Business

- Sherwin-Williams expects to see some deceleration in the annual gains of its residential repaint business due to existing home sales

- The company called out a sequential decrease in its third to fourth quarter, expecting the trend to continue in the first quarter with a flat to slightly up basket

- Key feedstocks like propylene are starting to come down significantly and eventually will find their way into the resins and solvents that Sherwin-Williams buys

Refinish Business

- High demand with a shortage of body texts and parts contributed to a backlog of demand

- Sherwin-Williams is working through the backlog of demand and securing raw materials to increase availability

Packaging Business

- The business had a terrific year and finished the year in the mid-teens, gaining a lot of share

- The company is investing in capacity as fast as it can add it, but the business will grow even faster as more capacity is added

General Industrial Business

- The heavy equipment market is very strong and expected to continue into 2023, particularly in the ag and construction

- The transportation and building products are slowly down a bit

Outlook and Strategy

- Sherwin-Williams expects to outperform the market in each business segment

- The company will be aggressive in pursuing opportunities, particularly in the regional pieces

- Expect architectural volume and TAG specifically to be up low single digits in the first half and then moderate in the back half