Steel Dynamics, Inc.

CEO : Mr. Mark D. Millett

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

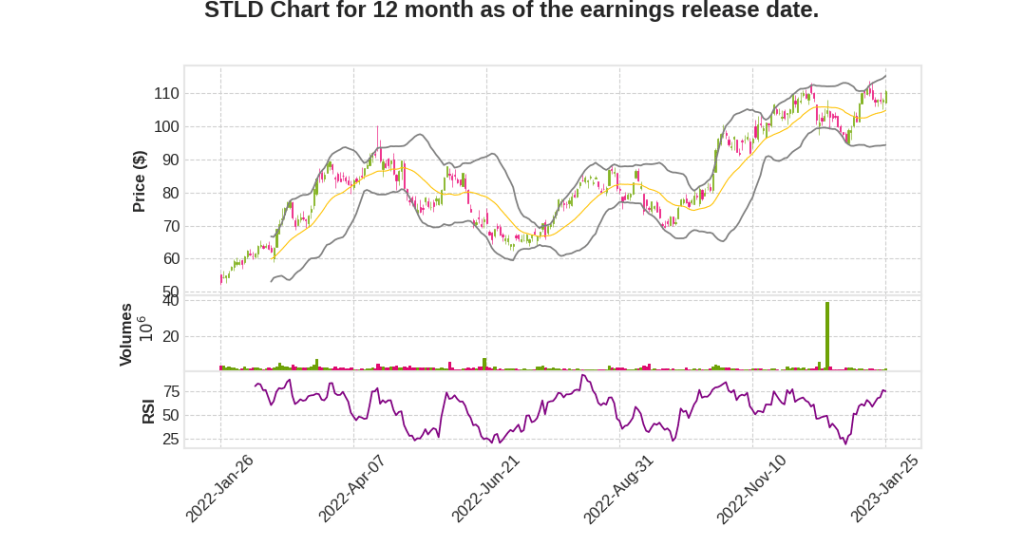

| 2022 Q4 | -9.1% YoY | -46.4% | -34.6% | 2023-01-26 |

Theresa Wagler says,

Record Annual Performance in 2022

- Record revenues of $22.3 billion derived from strong product pricing and volumes across all of our operating platforms

- Record operating income of $5.1 billion and net income of $3.9 million or $2.92 per diluted share

- Record cash flow from operations of $4.5 billion with EBITDA of $5.5 billion

Fourth Quarter 2022 Results

- Net income was $635 million or $3.61 per diluted share, which includes additional performance-based special compensation of $24 million or $0.09 per diluted share awarded to all nonexecutive eligible team members

- Operating income declined 35% sequentially to $759 million due to lower realized selling values and seasonally lower shipments within our steel operations

Impact of High-Cost Pig Iron

- Earnings negatively impacted by about $80 million due to high-cost pig iron purchased earlier in 2022 during the early stages of Russia and Beijing of Ukraine

- Expect to see negative impact continue into the first quarter with likely negative impact of around $60 million

Steel and Metals Recycling Operations

- Operating income from our steel operations was $3.1 billion, representing the second strongest year in our history

- Fourth quarter operating income from our metals recycling operations improved to $14 million based on increased volume and metal spread expansion

- For the full-year 2022, operating income from our mills recycling operations was $130 million

Record Quarterly Operating Income for Steel Fabrication Operations

- Steel fabrication operations achieved record quarterly operating income of $682 million

- Steel fabrication platform also achieved another record year in 2022, with operating income of $2.4 billion eclipsing last year’s record of $365 million

Capital Allocation and Sustainability

- Plan to invest $1.5 billion in capital investments in 2023, with majority relating to aluminum flat-rolled investments and the completion of flat-rolled coating lines

- Free cash flow profile has fundamentally changed over the last five years from an annual average of $580 million between 2011 and 2015 to $2.6 billion today between 2018 and 2022

- Committed to strategic growth with shareholder distributions and preserving investment-grade credit designation

- Newly formed joint venture with Aymium, a leading producer of renewable biocarbon products, could decrease steel Scope 1 greenhouse gas emissions by as much as 35%

Mark Millett says,

Record earnings in New Millennium Building Systems platform

- The New Millennium Building Systems platform generated record steel fabrication earnings in Q4 2022.

Sinton showing significant operating improvement

- Sinton is showing significant operating improvement with a clear path to profitability in Q2 2023.

New aluminum group making progress

- The new aluminum group is making great progress on the aluminum flat-rolled investments.

Exceptional performance in full-year 2022

- Steel Dynamics delivered an exceptional performance in full-year 2022 with record sales, earnings, and cash flow generation.

Focus on team safety

- The company is continually focused on providing the very best for their team’s health, safety, and welfare.

- The team’s safety performance improved significantly in 2022, but there is still more to do to achieve the goal of zero injuries.

Q & A sessions,

Steel Fabrication

- Record quarterly performance and annual operating income of $2.4 billion for the year with record shipments of 856,000 tons

- Non-residential construction markets are expected to remain strong throughout the year

- Steel fabrication order backlog extends through H1 2023 with strong pricing dynamics

Metals Recycling

- The team managed to achieve metal margins that were only $2 per gross ton lower than record 2021 results

- Mexican volumes will enhance Columbus and Sinton positions, and Zimmer and Roka acquisitions are performing very well

- Innovation will provide ample scrap supply in the years ahead, exploring technologies for more effective aluminum scrap separation in anticipation of sourcing material for upcoming aluminum flat-rolled operations

Steel Operations

- Record shipments of 12.2 million tons and operating income of $3.1 billion in 2022

- Higher utilization rates than peers in the industry, supporting strong and growing through-cycle cash generation capability and best-in-class financial metrics

- Current backlog of orders is solid, with a very solid market developing for the rest of the year

Sinton

- Downstream coating lines are running well, but the hot mill is running below full capacity

- Certain supply chain issues related to bearings and roles impacting current utilization, expected to be resolved before the end of Q1

- High-priced pig iron inventory is being drawn down through the quarter, and the raw material input cost expected to normalize for Q2 through the rest of the year

Aluminum Operations

- Market response from both current and new customers across all markets has truly been incredible

- The aluminum flat roll facility will have on-site melt slab capacity of roughly 600,000 metric tons and will be supported by two satellite recycled aluminum slab casting centers

- Start-up of the mill is expected mid-2025, with a firm budget of about $2.5 billion