Zimmer Biomet Holdings, Inc.

CEO : Mr. Bryan C. Hanson

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

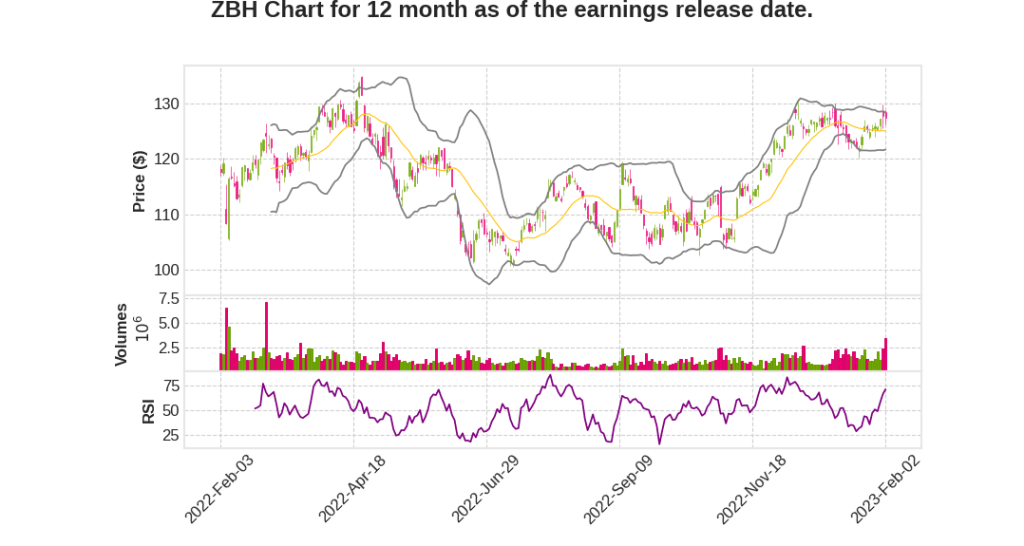

| 2022 Q4 | -10.4% YoY | 110.9% | 55.0% | 2023-02-03 |

Suketu Upadhyay says,

Fourth Quarter Results

- Net sales in Q4 2022 increased by 2.7% on a reported basis and 8.3% on a constant currency basis.

- International sales grew by 11.1%, driven by strong procedure volumes across most markets in EMEA and APAC with EMEA performance driven by recovery in developed markets and continued strength in emerging markets.

- Global knees grew by 10.2%, and global hips grew by 8.4%, with strong performance driven by knee and hip procedure recovery across most regions and easier comp outside the U.S.

- The sports extremity and trauma category grew by 7.6%, impacted by continued strong performance across key focus areas of CMFT, sports medicine, and upper extremities.

- GAAP diluted loss per share was $0.62, compared to GAAP diluted loss per share of $0.40 in Q4 2021, and adjusted diluted earnings per share increased to $1.88 from $1.79 in Q4 2021.

2023 Financial Outlook

- Reported revenue growth projected to be in the range of 1.5% to 3.5% versus 2022, with foreign currency exchange headwind of approximately 150 basis points resulting in revenue growth of 3% to 5% on a constant currency basis.

- Expected adjusted diluted EPS in the range of $6.95 to $7.15, with adjusted operating profit margins to be flat to slightly up compared to 2022 levels.

- Free cash flow expected to be in the range of $925 million to $1.025 billion.

- Choppiness by quarter expected, with Q1 projected to be the highest growth quarter due to easier comps, followed by Q4 driven by improved supply and innovation building throughout the year.

- Supply chain headwinds expected to continue throughout the year but with improvement in H2 2023.

Long Term Financial Priorities

- ZB has made significant progress in strengthening the balance sheet through improved financial performance and ongoing reductions in debt.

- ZB will remain committed to their investment-grade rating and will continue to look at ways to accelerate profitable growth with a focus on achieving their mission.

- Transforming the portfolio with a focus on increasing WAMGR and driving improved long term growth is a priority.

Bryan Hanson says,

ZBH Q4 2022 Earnings Call Highlights:

- ZB had a solid Q4 with better than expected growth driven by continued procedure recovery, strong execution, and a solid momentum with their new innovation.

- The overall global hip and knee business grew more than 8% and 10% on an ex-FX basis in Q4.

- ZB launched a new cementless knee form factor in Q4, which is a real growth driver for their knee franchise.

- ZB has launched more than 50 new products from 2018 through 2022, with the majority of these launches in markets growing in the mid single digits or better.

- ZB expects to launch another 40-plus products between now and the end of 2025, with the majority of those launches in 4%-plus growth markets.

- ZB’s momentum, new product pipeline, and strengthening balance sheet focused on accelerating their portfolio transformation positions them well for the future.

2023 Guidance and Expectations:

- More details on Q4 and 2023 guidance and expectations will be provided by Suke.

Q & A sessions,

Factors impacting growth

- Backlog consumption did not impact outsized growth; easier comps and better pricing were major factors

- Innovation adoption in orthopedics promising, can drive share of wallet and benefit

M&A strategy

- Portfolio transformation focus on faster growth markets through revenue generation, active portfolio management, and investment in commercial channel

- Looking for acquisition targets in robotics, data, ASC setting, sports, and other areas that enhance position in recon, diversify orthopedic area, or help diversify business away from elective procedures

Supply challenges and innovation building

- Supply challenges due to material shortages, labor shortages, and sterilization capacity, expected to improve as year progresses

- Analysis shows sizeable backlog in orthopedics, but capacity constraints at provider level will limit impact to overall market growth

- Innovation investment in faster growth markets to drive revenue growth and sustainability

Company confidence and margin expansion

- Team confidence high, able to deal with supply chain challenges due to muscle memory of dealing with adversity over last five years

- Margin expansion due to good performance versus market in large joints, both hip and knee

Phase 3 of company transformation

- Portfolio transformation through innovation, investment in commercial channel, and active portfolio management to shift mix of revenue to high growth markets

- Better balance sheet increases strategic flexibility to pursue targets that can increase weighted average market growth rate, sustain growth rate, and EPS