Zoetis Inc.

CEO : Ms. Kristin C. Peck

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

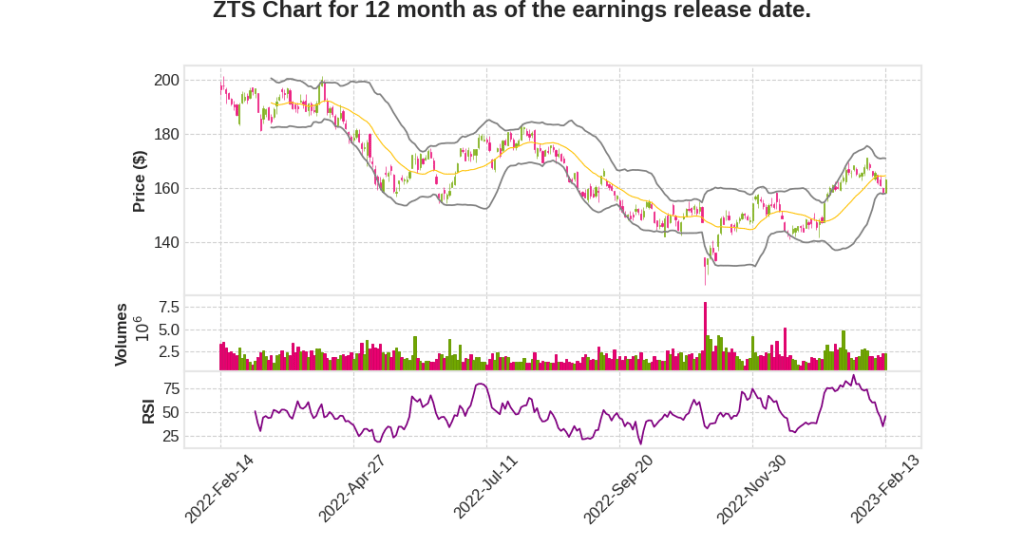

| 2022 Q4 | 3.7% YoY | 16.8% | 12.6% | 2023-02-14 |

Wetteny Joseph says,

Revenue and Growth

- ZTS had a strong year in 2022 with revenue of $8.1 billion and adjusted net income of $2.3 billion.

- Full year revenue grew 4% on a reported basis and 8% operationally with adjusted net income increasing 3% on a reported basis and 11% operationally.

- Companion animal portfolio grew 14% operationally and now makes up 64% of the global revenues.

- Simparica Trio generated $744 million in sales, growing 58% operationally, and reached $1 billion in global revenue for the first time in 2022.

- Key dermatology products generated $1.3 billion in sales posting strong growth of 17% operationally with double-digit growth in both international and the U.S.

- Revenue growth was broad-based with positive operational growth in each of the top 13 markets which make up 85% of total revenues.

Q4 Financial Results

- Q4 revenue increased 4% on a reported basis and 9% on an operational basis.

- Adjusted net income of $539 million increased by 14% on a reported basis and 27% operationally.

- Companion animal products grew 15% operationally while our livestock portfolio was flat in the quarter.

- Simparica Trio was the largest contributor to growth in the quarter, with global revenue of $171 million, representing operational growth of 39% for the quarter.

- Key dermatology product sales in the U.S. were $239 million for the quarter, growing 11% with Apoquel and Cytopoint, each growing double-digits.

Guidance for 2023

- ZTS projects revenue between $8.575 billion and $8.725 billion, representing a range of 6% to 8% operational growth with companion animal expected to be the primary growth driver.

- Despite the decline in vet planning visits last year, industry fundamentals remain strong with business remaining above pre-COVID levels and clinic revenue is at an all-time high.

- Modest livestock declines are expected in 2023, driven by the generic impact on DRAXXIN sales, particularly in the first half, as well as unfavorable market conditions in U.S. cattle.

- Foreign exchange is expected to have a minimal impact versus the prior year, with the full year impact neutral at revenue and slightly accretive at adjusted net income.

- We assume a triple combination product will launch in the U.S. in the first half of 2023 to compete against Simparica Trio.

Kristin Peck says,

Strong Full Year Results

- The operational revenue growth for full year 2022 was 8%, in line with the high-end of guidance in November.

- The innovative companion animal portfolio grew 14% operationally, while livestock portfolio declined 2% operationally, primarily due to generic competition and market challenges.

- Operational growth was generated across U.S. and international segments, which grew 7% and 9% respectively.

Increased Investment Plans for R&D and Manufacturing

- Zoetis is guiding to a range of 6% to 8% operational growth for revenue in 2023 and adjusted net income growth in the range of 7% to 9% operationally.

- Increased investment plans for R&D and manufacturing to support growth.

Five Key Growth Catalysts

- In dermatology, there are excellent growth opportunities even after nearly a decade of game-changing innovation.

- In pet parasiticides, Zoetis continues to gain share and has improved supply in 2023.

- In the area of pain, Zoetis is seeing positive early reactions to both products in their large markets and expanding geographies and supply.

- In diagnostics, Zoetis continues to generate solid above-market growth in international markets.

- Zoetis sees major opportunities in fast-growing emerging markets outside the U.S., where its portfolio is well suited to meet those evolving needs.

Q & A sessions,

Expected Trio Growth

- Expect Trio to grow significantly in 2023, though not at the 58% rate seen in 2022 due to competition and variability in quarter-to-quarter growth.

- Anticipate total year significant growth for Trio.

R&D Investment

- R&D spend is determined by pipeline demand, and the company is pleased with the level of investment required.

- Expect faster growth at ANI in revenue based on guide of 6% to 8% of revenue and 7% to 9% at adjusted net income.

Gross Margin Expansion

- Expect gross margin expansion on the year for 2023, with about 40 basis point expansion due to timing of price increases and favorable product mix.

- Net price contribution was around 3% in 2022, with companion animal products above that. Expect a higher price contribution in 2023, with DRAXXIN impact being less than in 2022.

Supply Chain Investments

- Capital investments being made across the network to support monoclonal antibodies, solid dose products, and vector vaccine manufacturing.

- Short-term investments being made in inventory and demand planning processes and tools.

Visits and Revenue

- Vet visits down about 4% in Q4 2022, but revenue per visit up 10% and total revenue up 6% on the quarter.

- Expect visits business to be flat to up in 2023, with an increase in vet visits seen in January 2023.