Amcor plc

CEO : Mr. Ronald Stephen Delia B.Sc., MBA

Quarterly earnings growth(YoY,%)

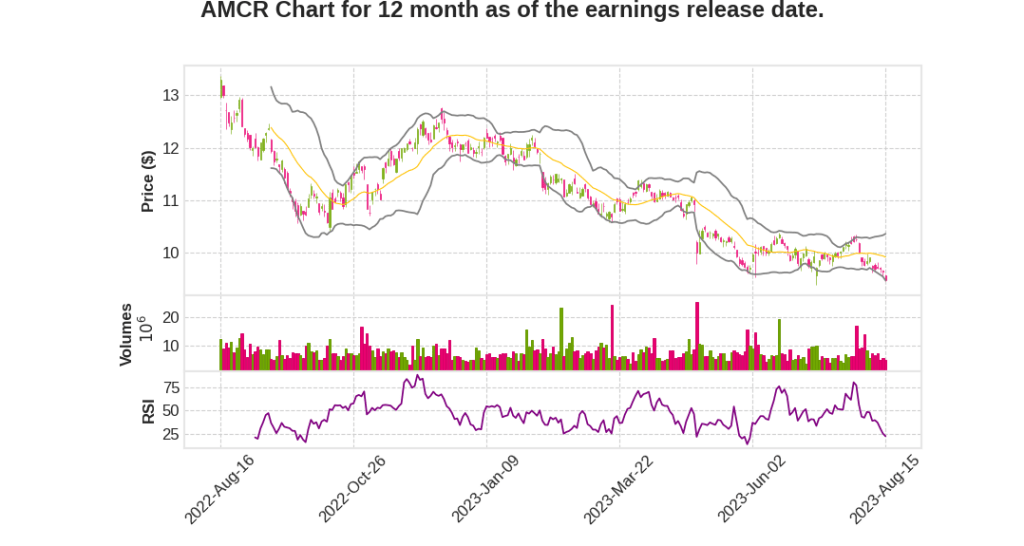

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

| 2023 Q3 | -1.1% YoY | -23.6% | -33.3% | 2023-08-16 |

Ron Delia says,

Safety

- Amcor has made strong progress in continuous safety improvement, with 69% of sites remaining injury-free for at least 12 months and a 31% reduction in injuries globally.

- The company conducted a detailed investigation into a tragic incident in which a contractor’s employee lost his life in India and is deploying the learnings across all sites to eliminate the risk of similar accidents in the future.

Operating Performance

- Amcor delivered solid operating performance in fiscal 2023, with adjusted EBIT up 1%.

- The company returned $1.2 billion to shareholders through share repurchases and dividends.

- Despite ongoing inflation, softening consumer demand, and customer destocking, Amcor was able to modestly grow adjusted EBIT through proactive pricing and cost reduction efforts.

Earnings Growth Outlook

- Amcor expects to return to solid mid-single-digit earnings growth in the second half of fiscal 2024 and continue to grow at high-single-digit rates thereafter.

- The company is confident that the benefits from cost reduction and productivity initiatives, as well as cycling weaker volume comparatives, will have a sustainable positive impact on earnings.

- Known benefits, such as cost savings from plant closures and lower interest expense, are largely within Amcor’s control and support the expectation of a return to solid earnings growth without relying on significant changes in the demand environment.

Financial Results

- Reported net sales for fiscal 2023 were up 1%, with organic sales flat on a constant currency basis.

- Full-year adjusted EBIT was $1.6 billion, up 1% on a constant currency basis.

- Adjusted EPS was $0.733 per share, down 2% on a constant currency basis.

- In the June quarter, sales were down 5%, and adjusted EBIT was 7% lower than the prior year due to weaker volumes.

Capital Allocation and Financial Profile

- Amcor returned approximately $1.2 billion of cash to shareholders through dividends and share repurchases.

- The company has repurchased approximately 11% of outstanding shares since 2020, and the dividend currently yields around 5%.

- Return on average funds employed is at 15.4%.

Michael Casamento says,

Capital Allocation and Share Buyback

- The company has bought back over $1 billion of shares in the last couple of years.

- In 2023, they plan to complete a $70 million share buyback, which will close out the buyback program.

- The priority of capital allocation is to invest back in the business through CapEx for organic growth.

- They have increased their CapEx over the years and will continue to do so in 2024, considering the demand environment.

- They have $300 million to $400 million left for M&A or additional buybacks.

Mergers and Acquisitions (M&A)

- The company has done three deals in 2023 and recently announced another deal.

- Their focus has shifted towards making acquisitions after completing the share buyback program.

Cash Flow and Outlook

- The company will continue to monitor cash flow throughout the year and make adjustments if necessary.

- The outlook for 2024 includes a $70 million budget for M&A.

- They expect to invest in organic growth through increased CapEx, considering the demand environment.

- Dividend payments are also planned for the next year.

Q & A sessions,

Protein Category and Growth Opportunities

- The protein category, including packaging solutions for processed and fresh meat, has historically grown globally at attractive rates.

- Amcor has a comprehensive product portfolio for processed and fresh meat applications, and their unique product offerings have enabled them to grow their participation in the meat category.

- Amcor is well-positioned to drive growth in the high-value protein market with their strong capabilities, significant investments in innovation and sustainability, and technical service.

- They have a strong presence in North America, and their global scale and reach allow them to leverage their R&D network and installed capacity for global growth opportunities.

- The recent acquisition of Moda positions Amcor well to provide a turnkey equipment solution in some parts of the world where equipment purchases drive subsequent sales of packaging films and technical services.

Sustainability Efforts

- Amcor continues to make progress in supporting the development of circular systems through their responsible packaging strategy, focusing on package design, waste management infrastructure, and consumer participation.

- They have made advancements in developing more sustainable packaging solutions and increasing their use of recycled materials.

- Amcor collaborates with other industry leaders to support the development of the infrastructure required for a circular economy, such as the strategic partnership formed with Delterra, P&G, and Mars to reduce plastic waste in the Global South.

- They are also partnering with Licella and Mondelēz to bring on stream one of Australia’s first chemical recycling facilities, promoting a circular economy and providing local access to food-grade recycled material.

Destocking and Market Conditions

- Amcor has experienced destocking in various categories, including the meat space, premium coffee space, medical packaging space, and North American beverage part of their Rigid Packaging business.

- They anticipate that the destocking will largely be behind them by the end of the calendar year and will have a less meaningful impact in 2024.

- About two-thirds of the volume decline in the fourth quarter can be attributed to destocking.

Acquisition of Moda and Competitive Landscape

- The acquisition of Moda allows Amcor to offer a full system solution in the protein packaging market, including primary packaging equipment, technical services, and parts.

- Amcor believes their industry-leading film technology and full solution offering give them a competitive advantage in the protein space.

- While every segment is competitive, Amcor is optimistic about their ability to compete and earn business in the protein market.

- Amcor expects to continue executing smaller deals, but they remain open to medium and larger-sized deals as well.

Cost Optimization and Inflation

- Amcor has optimized their business through plant closures in the past, but there may still be opportunities for further cost optimization if demand remains depressed.

- They believe the demand challenges they are experiencing are temporary and inflation-induced, and they expect volumes to return to normal.

- Inflation rates for different cost buckets are moderating, and Amcor has been successful in pricing to recover inflation costs.

- They continue to reset prices with new contracts, allowing them to reflect current inflation conditions and dynamics.

Note: This summary is based on the given text and does not include additional information that may be relevant to the stock’s movement.