ANSYS, Inc.

CEO : Dr. Ajei S. Gopal Ph.D.

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

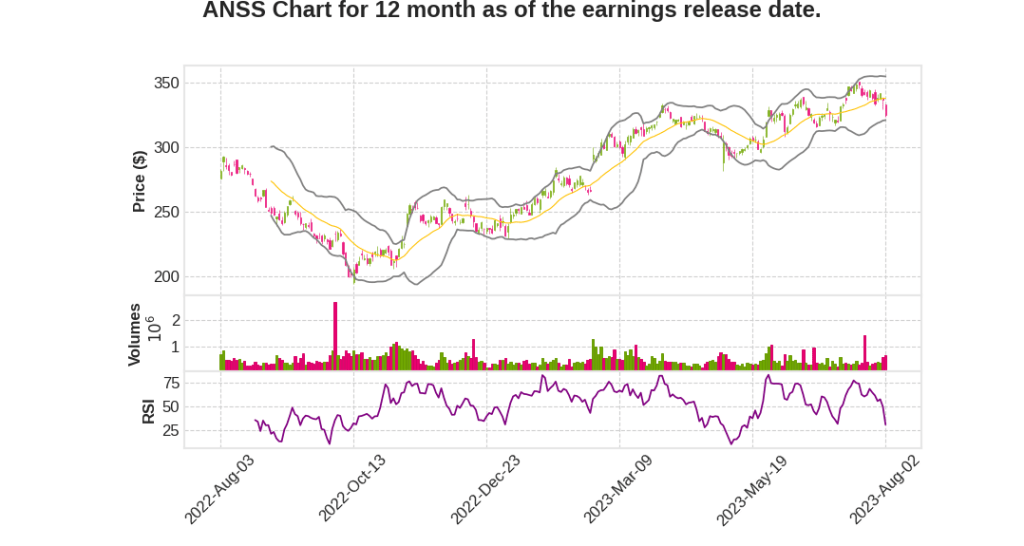

| 2023 Q2 | 4.8% YoY | -25.3% | -29.8% | 2023-08-03 |

Ajei Gopal says,

Strong Q2 Performance and Raised Guidance

- ANSYS beat its guidance across all key metrics in Q2 2023.

- Double-digit growth in ACV and revenue for the first half of 2023.

- Broad-based growth across industries, geographies, and customer types.

- Full year guidance for ACV and revenue has been raised.

Key Contributors and Contracts

- Top three contributors by industry in Q2 were high-tech and semiconductors, aerospace and defense, and automotive and ground transportation.

- A four-year 8-figure agreement with a multinational industrial company based in Japan was one of the largest contracts of the quarter.

- A nearly $57 million multiyear agreement with a global aerospace and defense company based in the United States reflects significant growth.

- A key contract in Q2 was with a Space 2.0 leader, leveraging the full ANSYS portfolio.

ANYSYS Solutions Driving Sustainability in Aerospace

- ANSYS solutions are helping aerospace companies drive sustainability and achieve net 0 carbon emissions by 2050.

- Simulation is playing a key role in the industry transformation of commercial aircraft.

- Customers are using ANSYS solutions to explore alternative fuels, boost aircraft efficiency, and design biomimetic coatings.

- Automation technology and AI-based software are being integrated to optimize the development of autonomous air mobility systems.

Simulation in the Space Sector

- Simulation is critical for space-related companies due to the unforgiving environment and the inability to perform physical testing.

- Micro satellites are being used for certain missions, and ANSYS customers are leveraging simulation to optimize their designs.

- An agreement was reached with a long-time Space 2.0 customer for synthetic aperture radar coverage through small satellite constellations.

- ANSYS technology is being used to design and operate lunar landers for space exploration.

Partnership Activities

- Intel Foundry Services has certified ANSYS semiconductor solutions for power integrity sign-off verification.

- The partnership with Samsung Foundry has been expanded, with ANSYS solutions certified for heterogeneous multi-die packaging technologies and Samsung’s 2-nanometer silicon process technology.

- The partnership with Synopsys includes a new reference flow for Samsung’s 14 LPU technology.

- The collaboration with PTC focuses on integrated materials management and sustainability workflows.

ESG Initiatives and Recognition

- ANSYS has been named to USA TODAY’s inaugural list of America’s climate leaders for achieving the greatest reduction in core emissions intensity.

- ANSYS has been named to Newsweek’s list of most loved global workplaces, ranking 27th globally.

Nicole Anasenes says,

ACV and Revenue

- ACV for Q2 was $488.3 million, growing 6% YoY or 7% in constant currency.

- ACV from recurring sources grew 13% or 17% in constant currency on a trailing 12-month basis, representing 82% of the total.

- Q2 total revenue was $496.6 million, growing 4% or 5% in constant currency.

- Year-to-date, ACV and revenue both grew double digits in constant currency at 12% and 13% respectively.

Operating Margin and EPS

- Q2 operating margin was 36.4%, exceeding guidance, driven by outperformance on revenue and the mix of license types sold.

- Q2 EPS was $1.60, better than guidance, also benefiting from strong revenue results and timing of expenses.

Guidance for 2023

- ACV outlook raised to a range of $2.275 billion to $2.340 billion, representing growth of 12% to 15.2% or 11.4% to 14.6% in constant currency.

- Revenue outlook raised to a range of $2.257 billion to $2.327 billion, representing growth of 8.9% to 12.3% or 8.5% to 11.9% in constant currency.

- EPS expected to be in the range of $8.39 to $8.88.

Unlevered Operating Cash Flow

- Q2 unlevered operating cash flow was $72.1 million, in line with expectations.

- Full year 2023 guidance for unlevered operating cash flow is a range of $699 million to $749 million.

Q3 Guidance

- Q3 ACV expected in the range of $460.5 million to $480.5 million, with 13% constant currency growth.

- Q3 revenue expected in the range of $453.7 million to $473.7 million.

- Q3 operating margin expected in the range of 29.6% to 31.3%.

- Q3 EPS expected in the range of $1.18 to $1.31.

Q & A sessions,

AI investments

- Investing in AI to improve products and user experience of ANSYS tools

- Continued focus on AI and making simulation easier to use

- Recent introduction of ANSYS GPT virtual support technology based on AI

- Example of AI capabilities reducing simulation time by 1,000x for a European automaker

Aerospace market

- Aerospace industry going through a transition with discussions on different takeoff modalities and propulsion

- Many small companies in the aerospace supply chain are designing technology and potentially ANSYS customers

- ANSYS has technologies like mission engineering to support aerospace companies’ transformation

Impact of AI on end markets

- High-tech and semiconductor industry leading the way in adopting AI techniques

- ANSYS technologies help customers in high-tech market with physical design limits and mixed signal power integrity

- Other industries like aerospace and automotive have longer design cycles but will eventually incorporate more AI techniques, driving simulation intensity

Simulation in advanced chip designs

- Simulation necessary for sign off at advanced process nodes, providing a tailwind for ANSYS

- Next-generation silicon designs like 3D ICs introduce multiscale and multiphysics challenges

- ANSYS technologies can handle challenges of multiscale and multiphysics in chip design

Role of ANSYS in semiconductor industry

- Historically strong portfolio in power integrity and thermal effects

- Excited about product capabilities and certifications at advanced process nodes