Baker Hughes Company

CEO : Mr. Lorenzo Simonelli

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

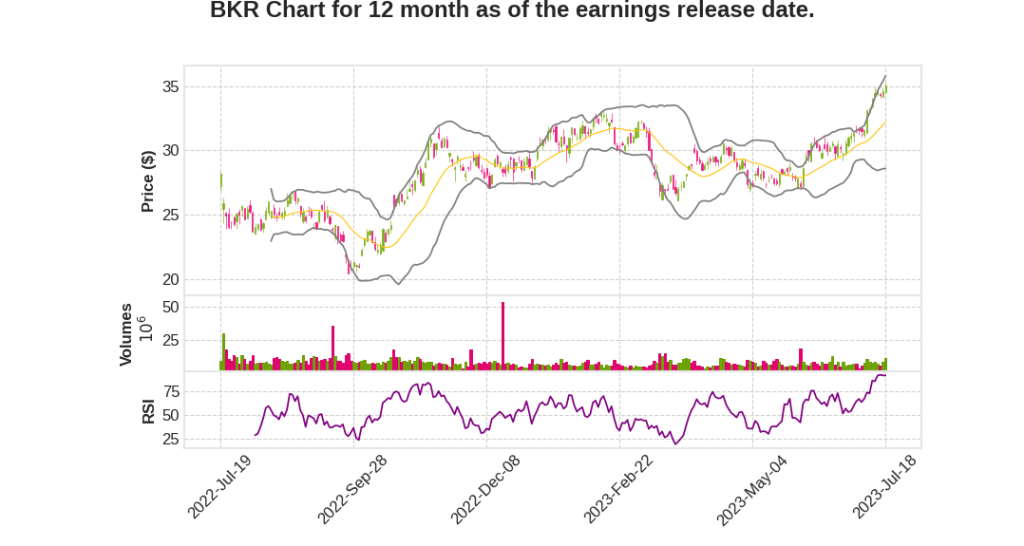

| 2023 Q2 | 25.1% YoY | -445.5% | -148.8% | 2023-07-19 |

Lorenzo Simonelli says,

Order Momentum and Operating Results

- Maintained order momentum in IET and SSPS

- Delivered strong operating results at the higher end of guidance in both business segments

- Booked almost $150 million of New Energy orders

- Generated approximately $620 million of free cash flow

Global Upstream Spending Outlook

- Expect global upstream spending in 2023 to be more durable and less sensitive to commodity price swings

- Market softness in North America expected to be offset by strength in international and offshore markets

- Strong balance sheets and disciplined capital spending driving spending cycle

- Steady activity increases from NOCs and IOCs in international and offshore markets

LNG Outlook

- Solid demand growth in LNG, led by Europe and Asia

- Contracted long-term offtake agreements slightly above previous levels

- Key driver of momentum in industry FIDs

- Expect market to exceed 65 MTPA of FIDs this year and similar activity in 2024

- Expanding pipeline of LNG opportunities tied to growing recognition of role in energy transition

Optimizing Corporate Structure and Cost Reductions

- Driving actions to optimize corporate structure and increase margins and returns

- Completed actions to achieve first $150 million of cost-out target by end of 2023

- Additional opportunities for further cost reductions in 2024 and beyond

- Goal to exceed 20% EBITDA levels for each business segment in next few years

Growth Opportunities and Energy Transition

- Well positioned to capitalize on multiple growth vectors in IET and OFSE

- Excited about new opportunities in New Energy applications leveraging unique portfolio

- Believe combination of growth opportunities and business transformation objectives will drive higher margins and returns

Nancy Buese says,

Strong Second Quarter Results

- Exceeded high-end of adjusted EBITDA guidance range

- Strong orders in both business segments

- Exceeded expectations on free cash flow

Orders and Revenue

- Total company orders of $7.5 billion, up 28% YoY

- RPO at record levels, providing volume and earnings visibility

- Revenue of $6.3 billion, up 25% YoY

Margin Improvement

- Adjusted operating income rate up 100 basis points sequentially and 250 basis points YoY

- Adjusted EBITDA margin rate of 14.4%, up 70 basis points sequentially and 150 basis points YoY

Free Cash Flow and Debt

- Generated strong free cash flow of $623 million, up $426 million sequentially

- Expect free cash flow conversion from adjusted EBITDA for the full year to be in the range of 45% to 50%

- Total debt of $6.6 billion, net debt of $3.8 billion

Cost Optimization and Margin Improvement

- Achieved $150 million cost-out target by end of 2023

- Identified additional opportunities for cost reduction in 2024 and beyond

- Objective to drive EBITDA margins for each business segment above 20%

Outlook

- Third quarter revenue expected to be between $6.4 billion and $6.6 billion

- Full-year revenue expected to be between $24.8 billion and $26 billion

- Expect sequential improvement in OFSE revenue and EBITDA in the third quarter

Q & A sessions,

Raised Guidance for IET Orders

- Guidance for IET orders raised by $1 billion

- Large pipeline of opportunities for IET

- Visibility improving for this year and next few years

Robust LNG Outlook

- LNG projects coming to FID through rest of this year and into next year

- Customer discussions for LNG projects are robust

- Natural gas and LNG playing a key role as a base load for energy mix

Strength in Offshore Activity

- Strength in offshore activity, particularly in FPSO sites

- Opportunities in offshore production

New Energy Orders

- Met full-year guidance in the second quarter for new energy orders

- Seeing opportunities in the back half of the year

Optimistic Outlook

- Optimistic outlook for 2023

- Maintaining order momentum in IET and SSPS

- Strong operating results and free cash flow