Broadridge Financial Solutions, Inc.

CEO : Mr. Timothy C. Gokey

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

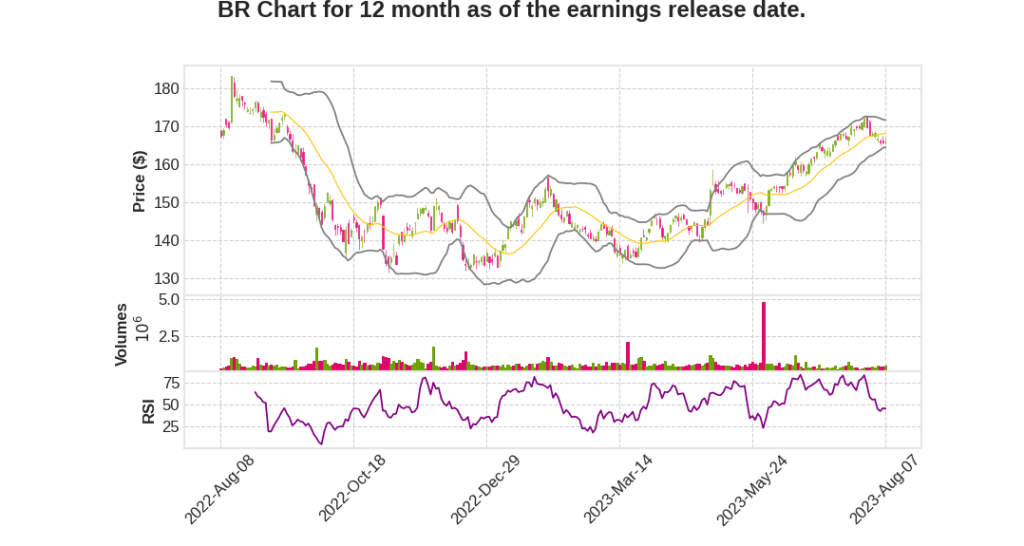

| 2023 Q4 | 6.7% YoY | 73.8% | 29.7% | 2023-08-08 |

Edmund Reese says,

Key Milestones Achieved in Fiscal 2023

- Completed investment in wealth management platform

- Reduced client platform spend and going live with anchor client in July

- Improved free cash flow conversion to 90%

- Paid down debt and reached leverage objective

- Positioned to return more capital to shareholders through higher dividend and share repurchases in fiscal 2024

Financial Summary

- Full year recurring revenue growth was at the higher end of guidance

- Adjusted EPS grew 9% to $7.01

- Recurring revenue rose to approximately $4 billion, up 9% YoY on a constant currency basis

Recurring Revenue Growth

- Q4 recurring revenue grew 8% to $1.3 billion, all organic

- Full year recurring revenue growth was 9%, exceeding organic growth objective of 5% to 7%

- Acquisition of BTCS contributed 2.6 points of growth to three-year recurring revenue CAGR

Segment Growth

- ICS recurring revenue grew 7% in Q4, driven by growth across all product lines

- GTO recurring revenue grew 9% in Q4, driven by higher licensed revenue and fixed income trading volume

Volume Trends

- Equity position growth was 6% in Q4 and 9% for the full year

- Mutual fund position growth was 8% in Q4 and for the full year

Revenue Drivers

- Recurring revenue growth of 8% in Q4 was balanced between net new business and internal growth

- Revenue from closed sales and high retention rate from existing customers provided four points of growth

- Foreign exchange impacted recurring revenue by one point

Timothy Gokey says,

Financial Performance

- Recurring revenue grew 8% in Q4 2023, with strong growth across all segments

- Earnings rose 21% in Q4 2023, driven by strong revenue growth and disciplined expense management

- Recurring revenue and adjusted EPS both rose 9% in fiscal 2023

- Free cash flow conversion improved to 90% in fiscal 2023

Guidance for Fiscal 2024

- Guidance calls for 6-9% recurring revenue growth, all organic

- Guidance calls for 8-12% adjusted EPS growth

- Expected free cash flow conversion of approximately 100%

Dividends and Capital Allocation

- Announcement of a 10% increase in annual dividend

- Expectation to resume share repurchases in fiscal 2024

- Flexibility to fund tuck-in M&A if the right opportunity arises

Governance Franchise

- ICS business delivered 9% recurring revenue growth in fiscal 2023

- Growth driven by new sales, increased investor participation, and higher interest income

- Strong growth in digital and print wins in customer communications business

- Innovations in digitization and shareholder engagement, such as omni-channel wealth and focused product

Capital Markets Franchise

- Capital Markets revenues rose 11% in fiscal 2023

- Growth driven by BTCS business and onboarding of new global post-trade clients

- Meeting demand for simplified operating models and global multi-asset solutions

- Delivering leading-edge solutions like distributed ledger repo and AI applications

Wealth and Investment Management

- Wealth and investment management revenues rose 4% in fiscal 2023

- Growth driven by revenues from new sales and demand for modular solutions

- Suite of solutions driving advisor productivity, enhancing client experience, and reducing cost and risk

- Finalized rollout plan with UBS and focused on $20-30 million of annualized wealth platform sales

Closed Sales

- Closed sales of $246 million in fiscal 2023, down 12% from fiscal 2022

- Market uncertainty and longer sales cycles impacted sales, particularly in Europe

- Believe delays are temporary and expect strong sales growth in fiscal 2024

Q & A sessions,

Backlog Conversion and Revenue Cycle

- The company expects to continue converting its backlog to revenue, with a conversion cycle of 12 to 18 months.

- Wealth management revenue is expected to come across earlier in the year from the backlog.

- Continued execution on backlog conversion is anticipated, with no significant changes expected in the revenue cycle.

Position Growth and Recurring Revenue

- The company expects mid-to-high single-digit position growth to continue, supporting its recurring revenue guidance.

- Testing suggests that the outlook for position growth remains in line with previous expectations.

- There is a 6-month window to monitor and react to any potential changes in position growth.

Margin Expansion and Earnings

- The company anticipates continued margin expansion, driven by operating leverage, digital initiatives, and operating efficiencies.

- During the past three years, the company has achieved margin expansion of 77 basis points, with a similar outlook for fiscal 2024.

- Float income and distribution have no impact on earnings but may affect reported margins.

Fiscal 2023 Results

- Full-year recurring revenue grew by 9% on a constant currency basis, exceeding the guidance range of 6% to 9%.

- Adjusted operating income increased by 12% and margin expanded by 110 basis points to 19.8%.

- Adjusted EPS rose by 9% to $7.01, while close sales reached $246 million.

Guidance for Fiscal 2024

- The company expects recurring revenue growth to be in line with its historical three-year financial objectives.

- Strong growth in both the ICS and GTO segments is anticipated.

- Equity and fund position growth is expected to support mid-to-high single-digit recurring revenue growth.