CDW Corporation

CEO : Ms. Christine A. Leahy

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

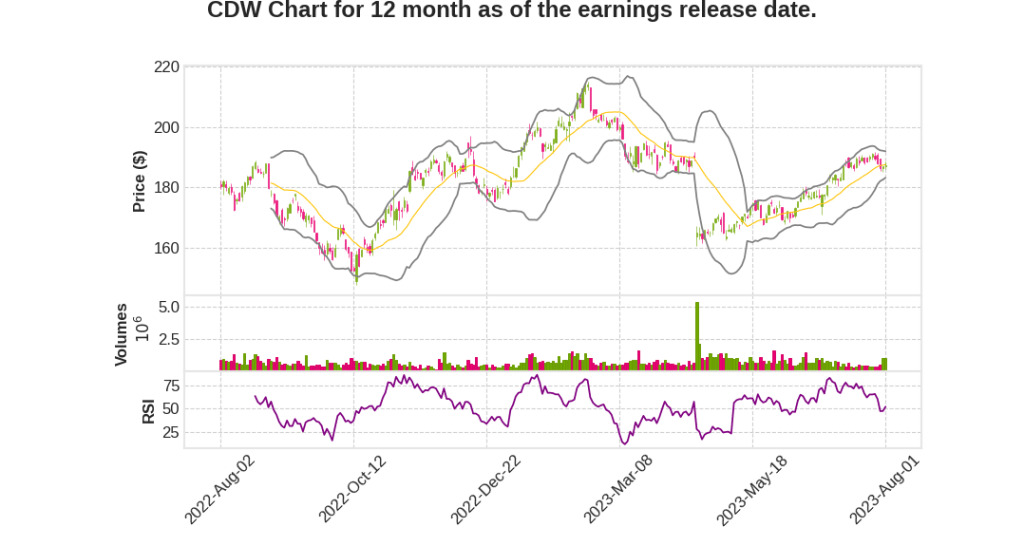

| 2023 Q2 | -8.5% YoY | -5.3% | -5.8% | 2023-08-02 |

Albert Miralles says,

Q2 2023 Net Sales

- Consolidated net sales were $5.6 billion, down 8.5% on a reported and average daily sales basis

- Net sales were up 10.2% versus the first quarter, exceeding expectations

- Public results were driven by strength in solutions performance across channels

- Anticipate remaining backlog to weather out over time

Q2 2023 Gross Profit

- Gross profit was $1.2 billion, a year-over-year increase of 1.1%

- Record second quarter gross margin of 21%, up 200 basis points year-over-year

- Mild impact on margins from increased transactional product volume

- Netted down sales represented 31% of gross profit, up from 28% in prior year Q2

Q2 2023 Expenses

- Non-GAAP SG&A totaled $652 million, flat compared to prior year quarter

- Increased payroll expense offset by management of discretionary expenses

- Coworker count at end of Q2 was approximately 14,900

Q2 2023 Operating Income

- GAAP operating income was $412 million

- Non-GAAP operating income was $530 million, up 2.6% year-over-year

- Non-GAAP operating income margin reached a record second quarter record of 9.4%

Q2 2023 Net Income

- GAAP net income per diluted share was $1.92

- Non-GAAP net income was $349 million, up 2.8% year-over-year

- Non-GAAP net income per diluted share was $2.56, up 3.2%

2023 Outlook

- Expecting IT market contraction at upper end of high single digits

- Baseline view incorporates modest recovery in second half of 2023

- Anticipate outgrowing the market by 200 to 300 basis points

- Continue to expect neutral currency impact for full year

- Full year non-GAAP operating income margin expected to be in range of 9%

- Full year non-GAAP earnings expected to be flat year-over-year in constant currency

Christine Leahy says,

Key Performance Drivers

- Net Sales: Q2 net sales of $5.6 billion, down 9% in U.S. dollars, down 8% in constant currency

- Non-GAAP Operating Income: Q2 non-GAAP operating income of $530 million, up 3%

- Non-GAAP Earnings Per Share: Q2 non-GAAP earnings per share of $2.56, up 3%

- Transactional Business Under Pressure: Transactional business remained under pressure, with the commercial market experiencing ongoing caution and cautious customer behavior

- Solutions Drive Margin Expansion: Increases in solutions contributed to meaningful margin expansion, leading to strong profitability

Commercial Market Performance

- Corporate: Overall sales declined 16%, with mission-critical projects slowly ticking up throughout the quarter

- Small Business: Declined 21% due to ongoing caution by economically sensitive customers, with client device upgrades on hold

Public Market Performance

- Government: Increased 12% and benefited from strategic efforts to target complex services enabled hybrid infrastructure and cloud opportunities

- Healthcare: Performance was relatively flat, with talent needs and data center projects remaining focus areas

- Education: Upturn in performance, contributing to a seasonally higher quarter than the first quarter

Cloud Adoption and Mission-Critical Projects

- Cloud Spend: Both corporate and small business saw double-digit increases in cloud spend, driven by a focus on mission-critical projects

- Client Device Pressure: Ongoing customer focus on mission-critical projects led to declines in client device sales

Q & A sessions,

Impact on Commercial Customers

- Commercial customers are starting to show an uptick in activity and sentiment towards the end of Q2.

- There is cautious optimism regarding a mild-to-moderate recovery in the back end of the year.

- Small businesses are still cautious and holding off on major spending due to economic uncertainties.

Impact on Government and Education Sectors

- The education and government sectors are returning to seasonality and showing signs of stability.

- K-12 is experiencing refresh needs and breakage rates are driving device purchases.

- Public sector projects are tracking normally with a real uptick in refresh needs.

PC Refresh and Win 11 Adoption

- The PC refresh cycle is still uncertain as customers are being cautious and judicious in their spending.

- Customers are exploring the benefits of Win 11 and its higher functionality devices, but the timing of adoption is unclear.

AI Opportunities

- CDW sees AI as a catalyst for internal use cases and an opportunity to help customers evolve.

- Contact center, marketing transformation, and knowledge/customer assistance are key use cases being discussed with customers.

- CDW’s full stack approach allows for advisory services, applications, modeling, and infrastructure required for AI use cases.

Acquisitions

- The acquisitions of Locus and Enquizit expand CDW’s talent orchestration and professional/managed services capabilities.

- Locus has doubled the size of CDW’s talent orchestration business, providing quick access to technical talent in areas like networking, cloud, and security.