Copart, Inc.

CEO : Mr. A. Jayson Adair

Quarterly earnings growth(YoY,%)

| Period | Revenue | Operating Income | EPS | Release Date |

|---|---|---|---|---|

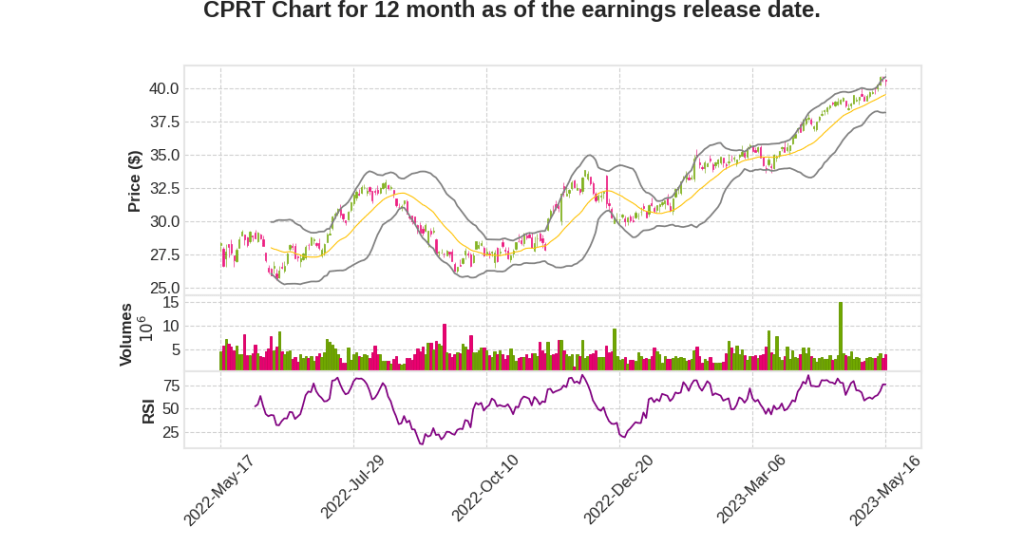

| 2023 Q3 | 8.7% YoY | 12.4% | 23.7% | 2023-05-17 |

Jeff Liaw says,

Key Themes from Advisory Board Meeting

- The insurance industry is experiencing rising combined ratios and increasing total loss frequency trends

- New vehicle prices are a leading indicator for the used vehicle market

- Repairs are becoming more expensive and salvage economics are more attractive

- Insurance volumes remain suppressed compared to historical norms

- Insurance clients are facing hiring and retention challenges

- Interest in engaging with image recognition tools and machine learning algorithms for faster decision making

- Importance of global marketplace in providing superior salvage returns

Non-Insurance Business Growth

- 7% year-over-year growth in the bank, finance, fleet, and rental segments

- Nearly 5% year-over-year growth in dealer volume

Growing Cash Balance

- Capital is prioritized for investing in core business, land, and technology

- Strategic extensions that leverage key capabilities are considered

- Excess cash flow is returned to investors through share buybacks

- Strength of balance sheet empowers and differentiates Copart

- Resources can be deployed to prioritize long-term prosperity and client satisfaction

Leah Stearns says,

Global Unit Sales

- Global unit sales declined 21% in the quarter.

- The decline was primarily due to a decrease in purchased units.

- Internationally, unit growth came from a mix of fee and purchased units, which increased over 11% and 14% respectively.

- U.S. Insurance business grew 6% relative to its one-year comp and 25% relative to its two-year comp.

Auction Returns and Insurance Business

- Copart’s auctions provide insurance customers with best-in-class liquidity and returns.

- Investment in growing the global buyer base has led to strong auction returns.

- Continued recovery in driving activity, increasing accident frequency and severity, total loss frequency, and share gain contributed to the growth in the U.S. Insurance business.

Financial Results

- Global revenue increased $82 million or nearly 9%, including a 1% or $11 million headwind due to currency.

- Global service revenue increased $81 million or nearly 11%, primarily due to higher average revenue per unit and increased volumes.

- U.S. and international service revenue grew nearly 11% and 9% respectively.

- Average sale prices (ASPs) were down slightly year-over-year, with U.S. ASPs down about 1%.

- Purchase vehicle sales for the third quarter increased $1 million or nearly 1%, with U.S. purchased vehicle revenue down 27% and international up 49%.

Gross Profit and Margin

- Global gross profit increased by about $47 million or 11%, with a gross profit margin percentage of 47.3%.

- U.S. margins increased to 52.2% and international margin decreased to 25.5%.

- The margin increase on a consolidated basis was driven by vehicle mix shifts in the U.S. towards higher margin consignment units and partially offset by inflationary impacts and lower margin purchase units internationally.

Cost Management and Efficiency

- Inflationary pressures on labor and transportation costs have been observed, but there has been some attenuation in these expenses, particularly around transportation due to reductions in the cost of diesel.

- The company is constantly seeking to optimize operational processes through technology and automation to drive efficiency and mitigate longer-term cost pressures.

- Labor costs have increased over the last 12 months, viewed as a direct investment in employees and best-in-class service for customers.

Q & A sessions,

Organic Growth Prospects and Investments

- The company believes that its organic growth prospects are compelling and will require investments in technology and other areas.

- They are investing organically to enhance their capabilities in serving financial institutions, which have nuanced products and approaches compared to insurance clients.

- If the right acquisition opportunity presents itself at a compelling valuation and accelerates their growth, they would consider it.

Expanding Buyer Base and International Operations

- The company’s liquidity has grown over time, making it a more compelling platform for members and buyers.

- The expansion into the international arena has been a decade-long endeavor, driven by the rising total loss frequency and pursuit of cars from non-insurance sellers.

- There is still significant growth potential in the fastest-growing economies, as the demand for mobility and vehicles increases.

Economic Opportunity for Insurance Companies

- Insurance companies pay significant amounts of money for towing, repairs, and other interventions for vehicles that could have been directly towed to Copart for sale.

- The company sees a massive economic opportunity for insurance companies to reduce waste in their business processes and improve total loss economics.

- There is a shift in the industry mindset towards repairing cars when possible, but the view is evolving as policyholders’ attachment to their vehicles diminishes over time.